NexeArt Leasing

Art Galleries

LEASING WITH PURCHASE OPTION

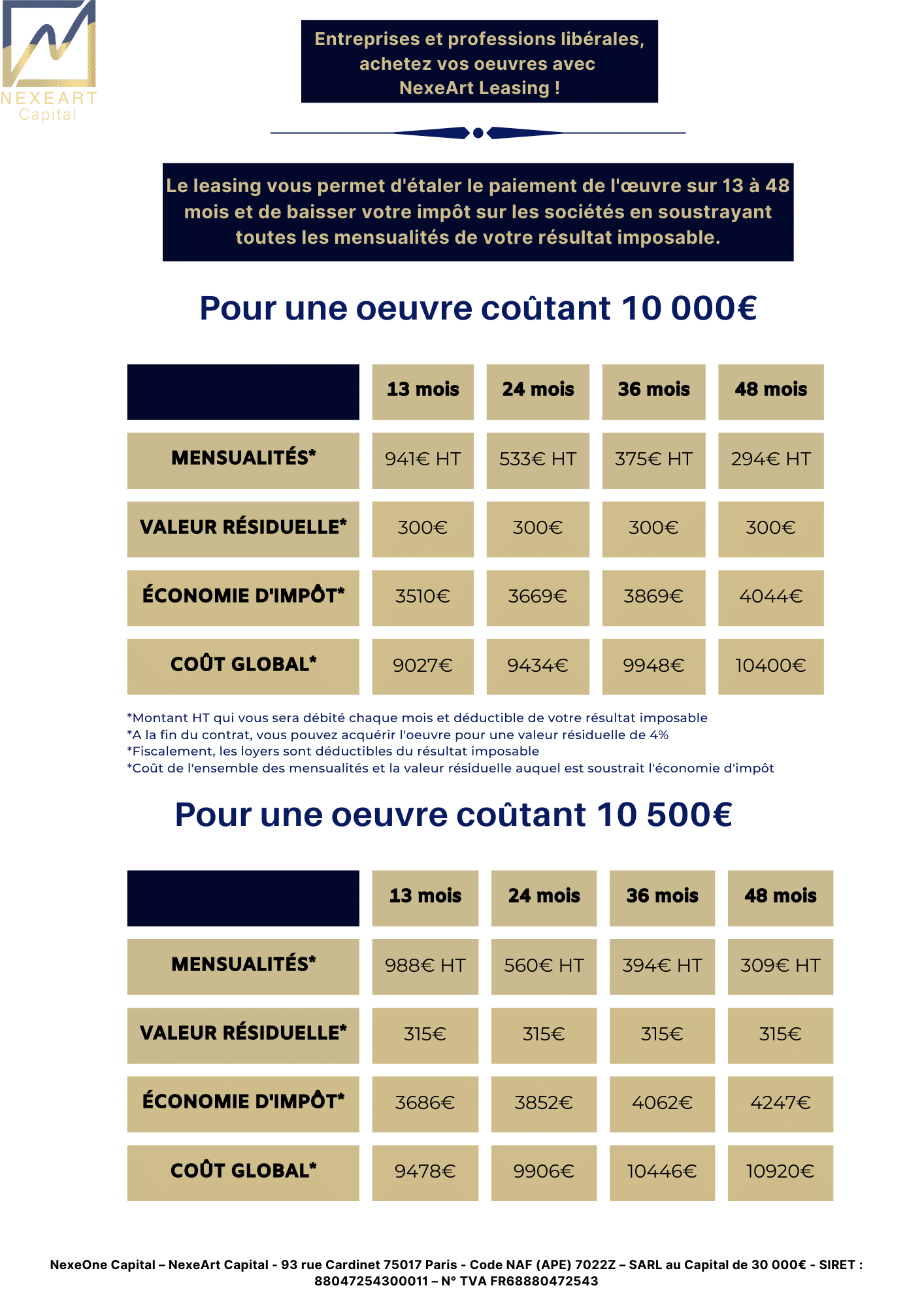

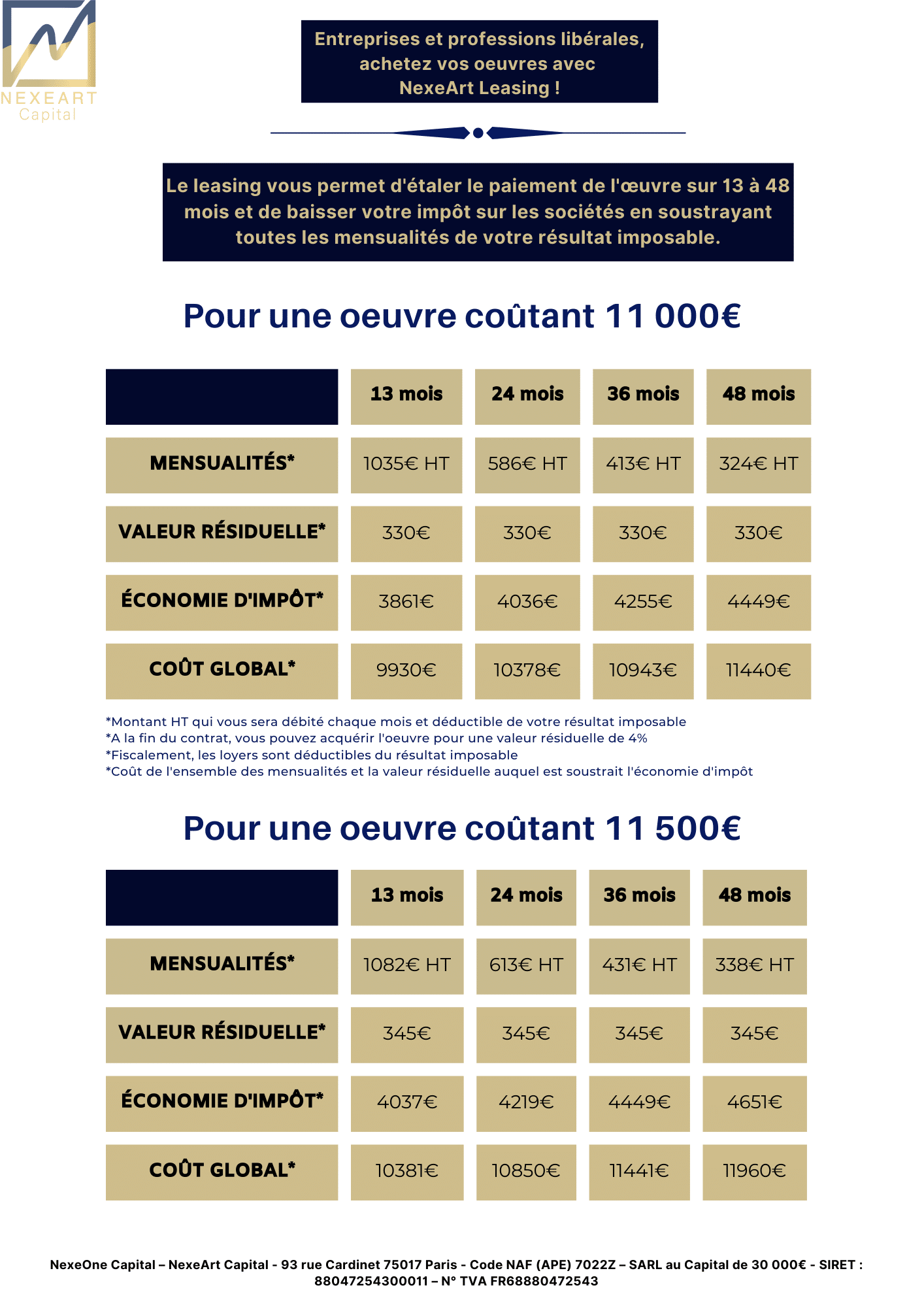

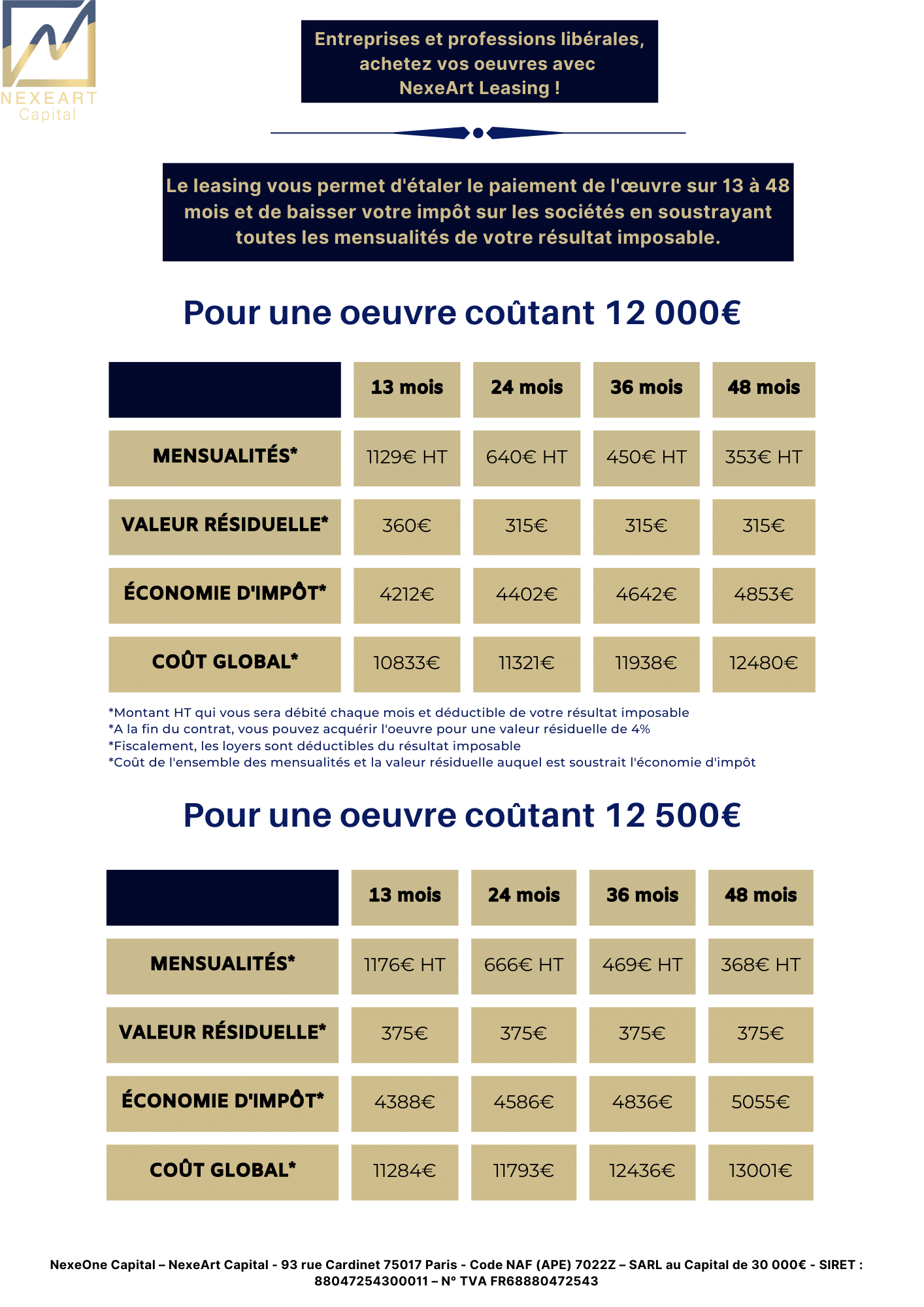

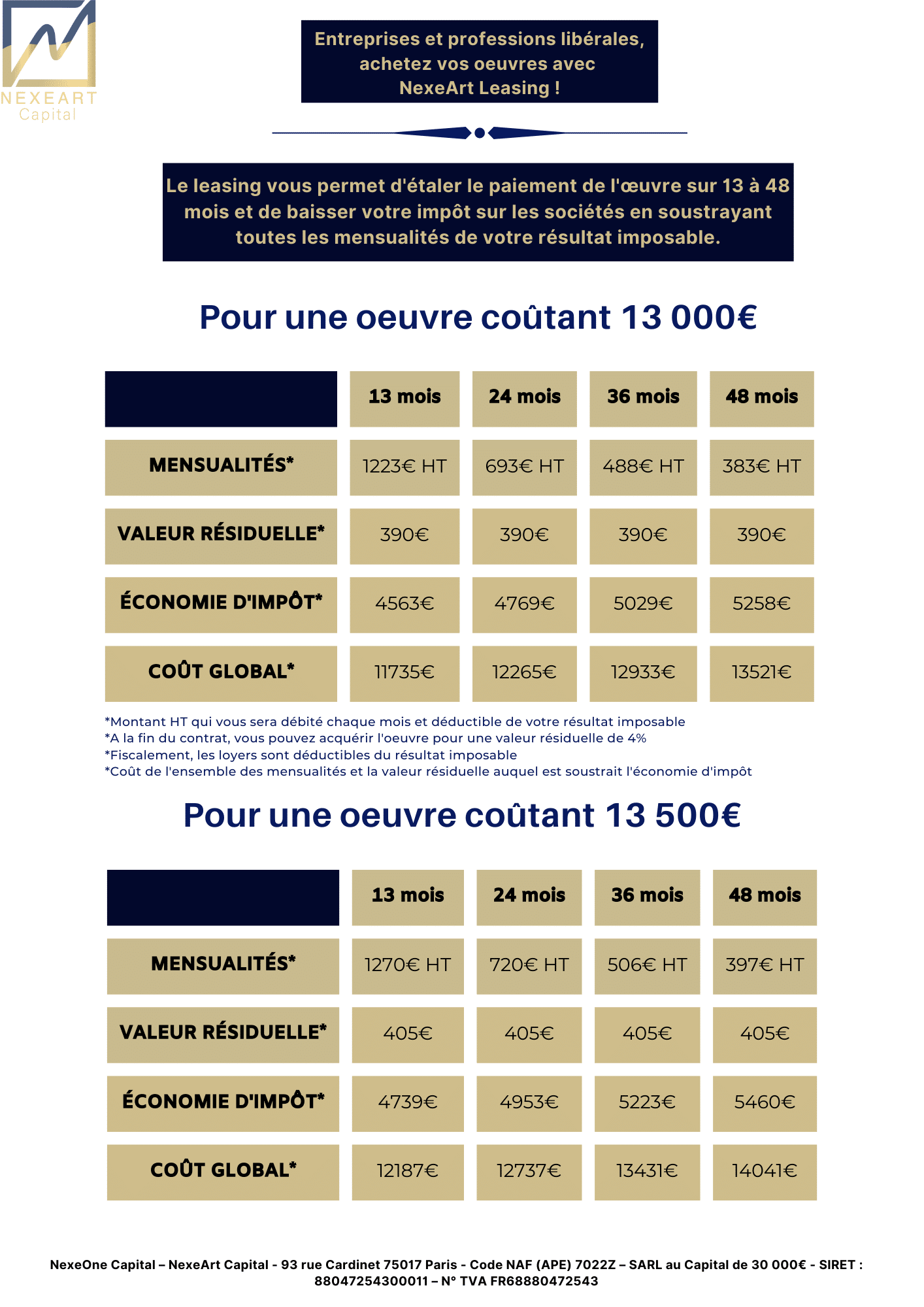

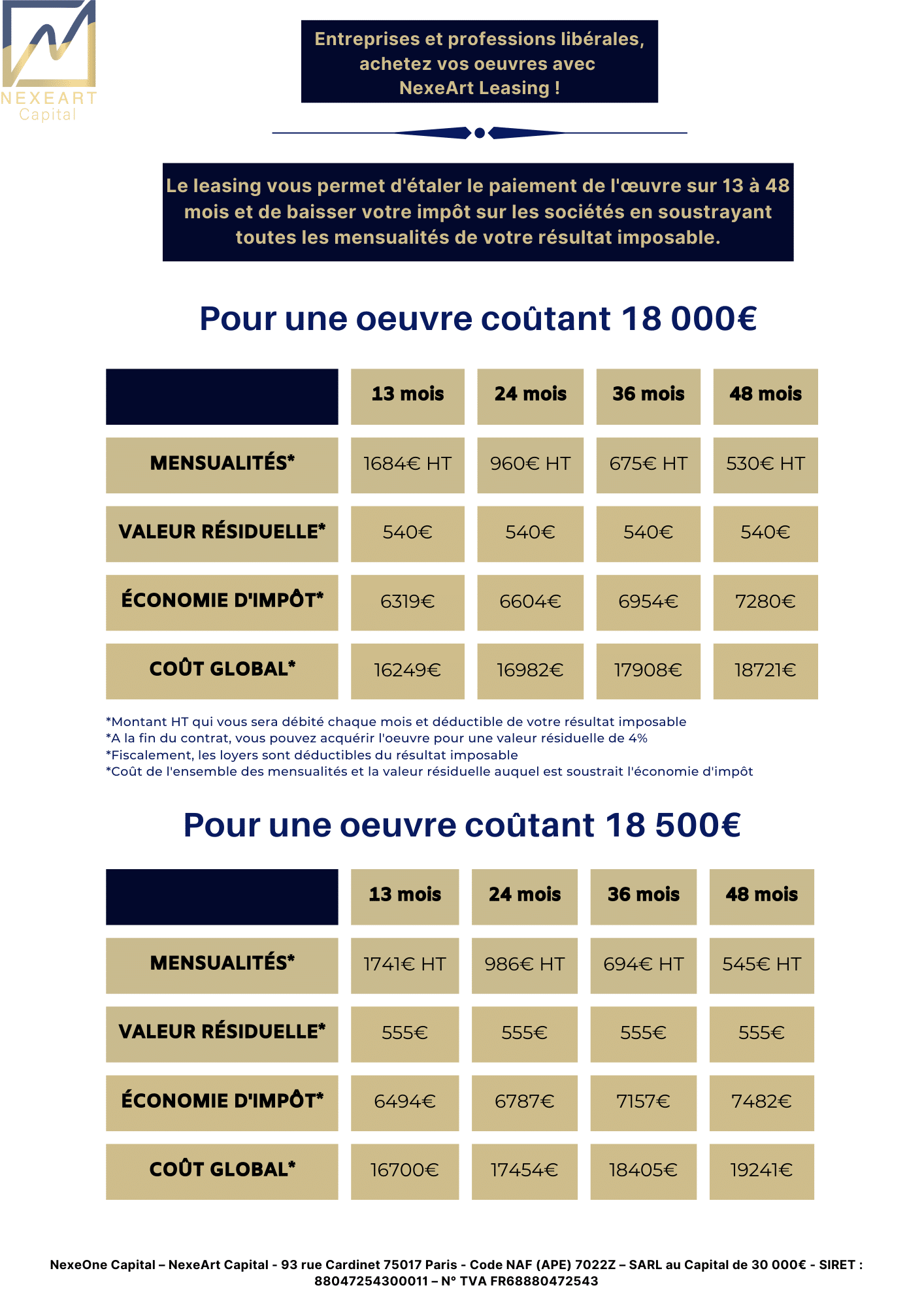

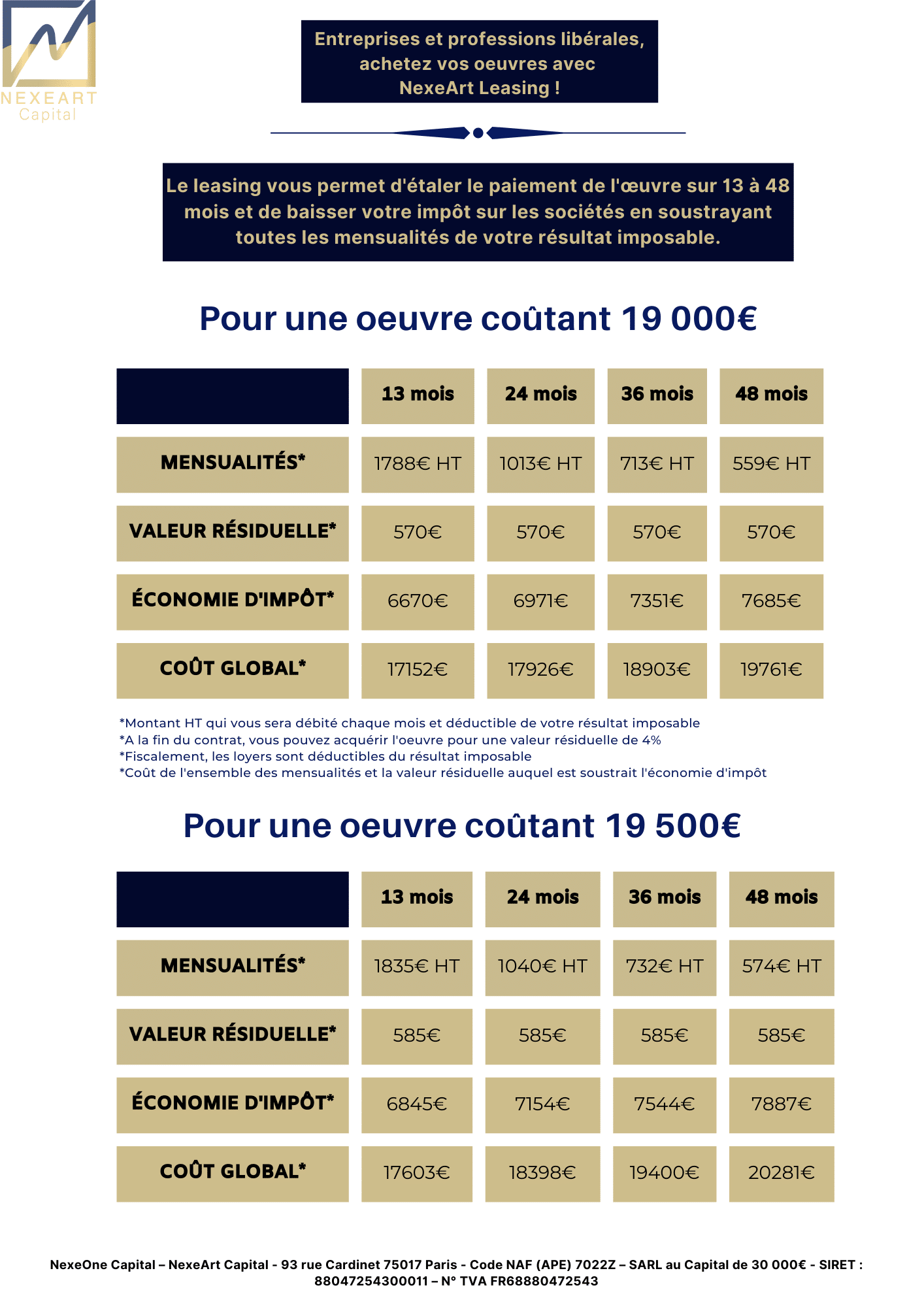

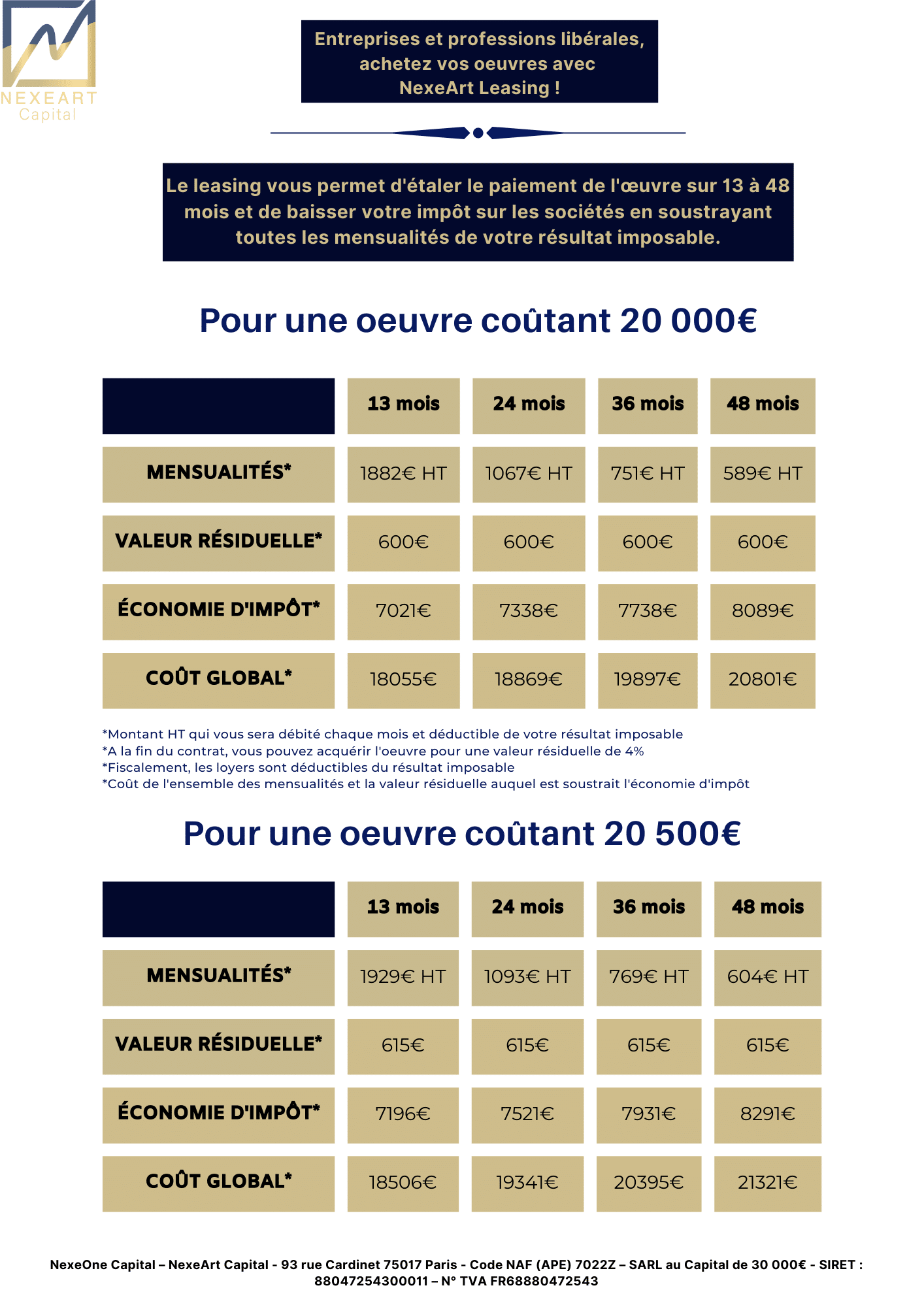

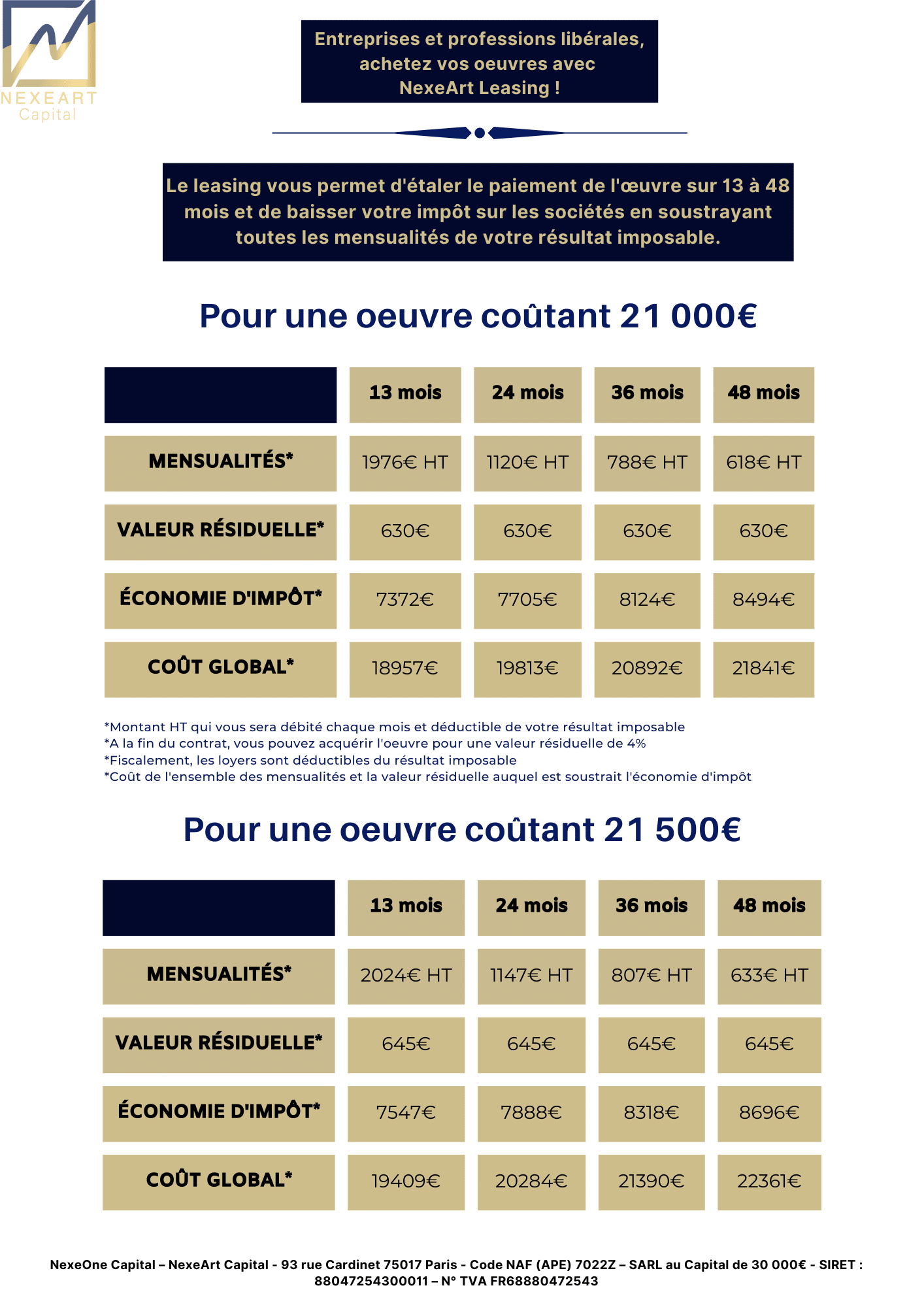

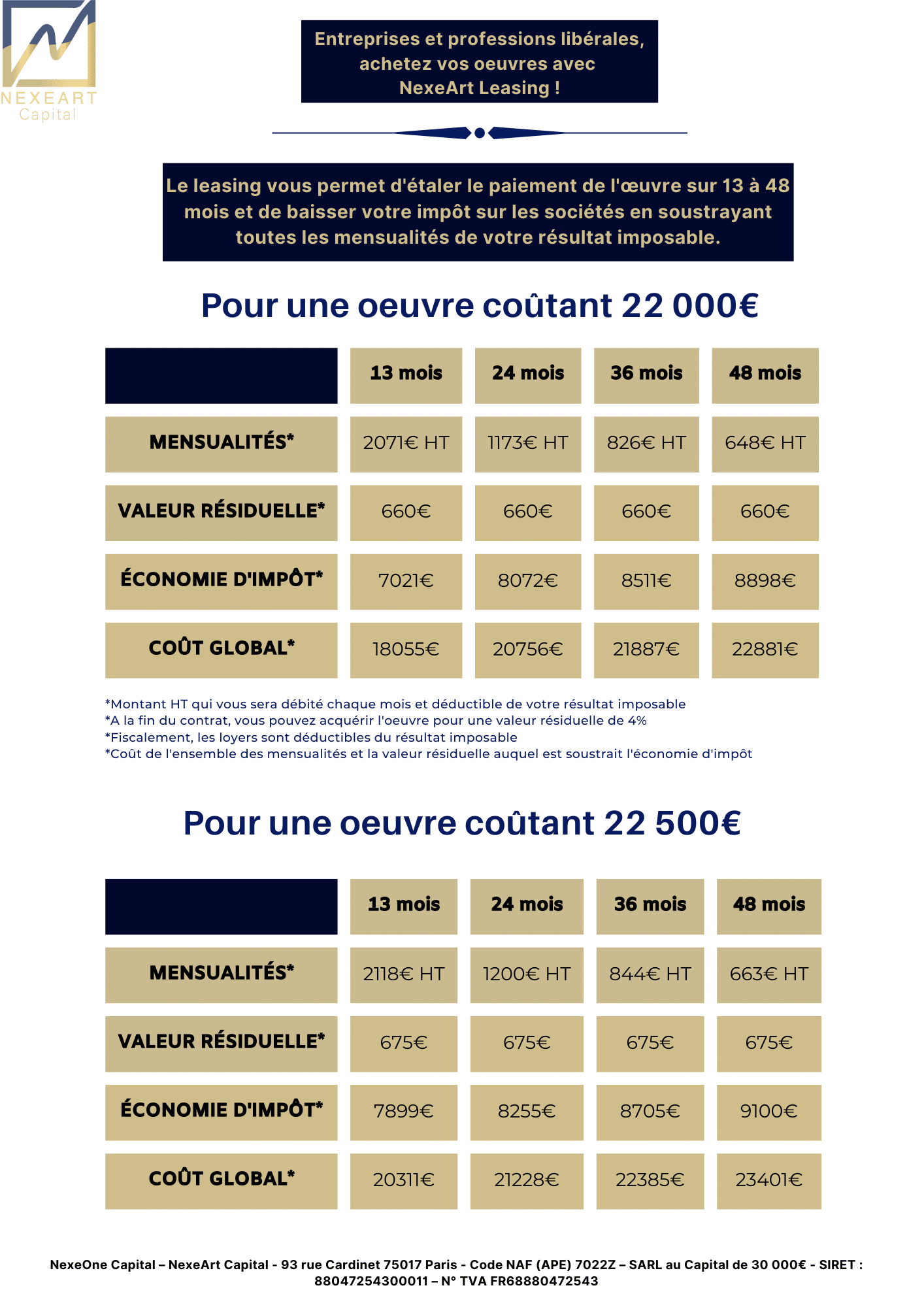

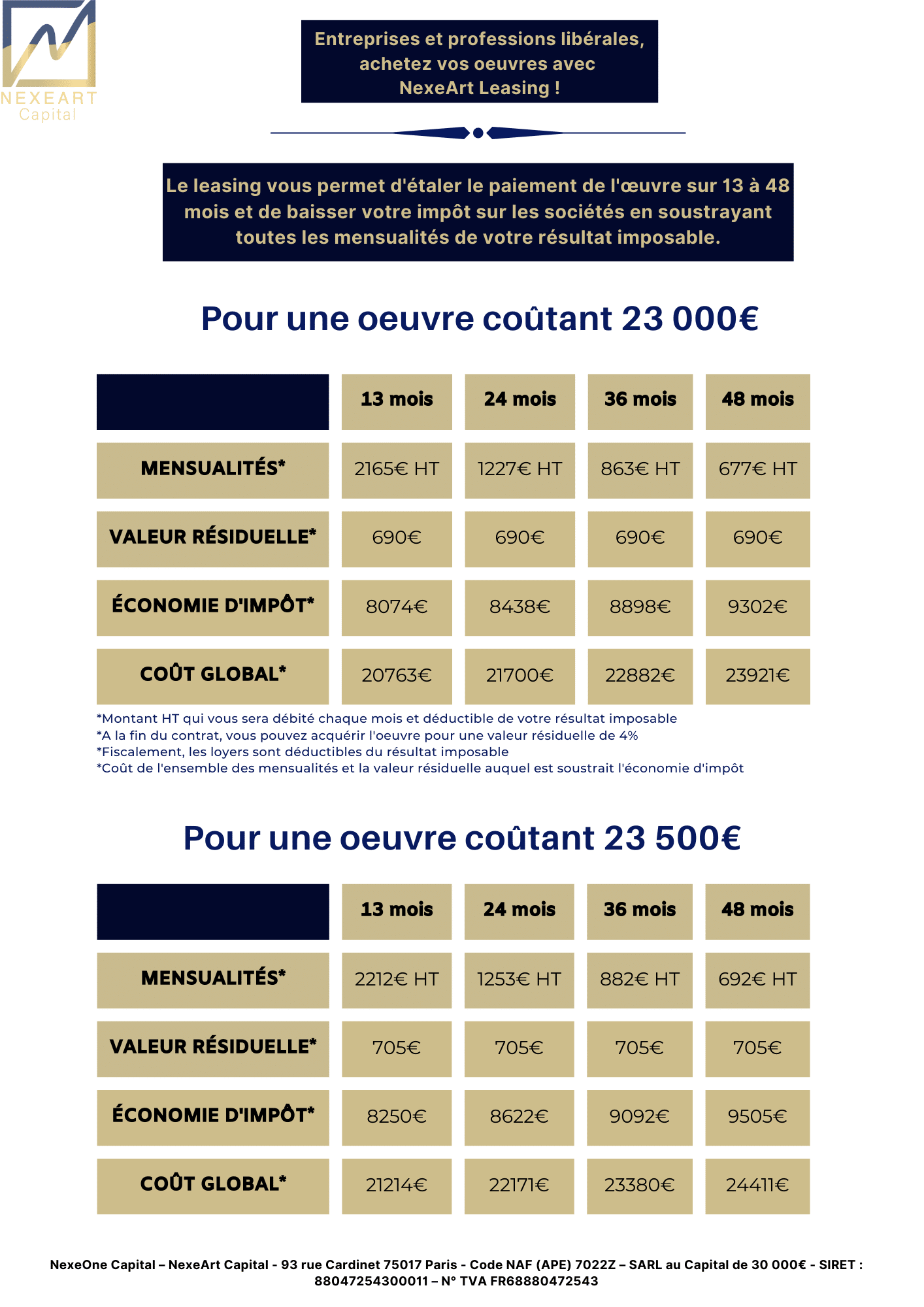

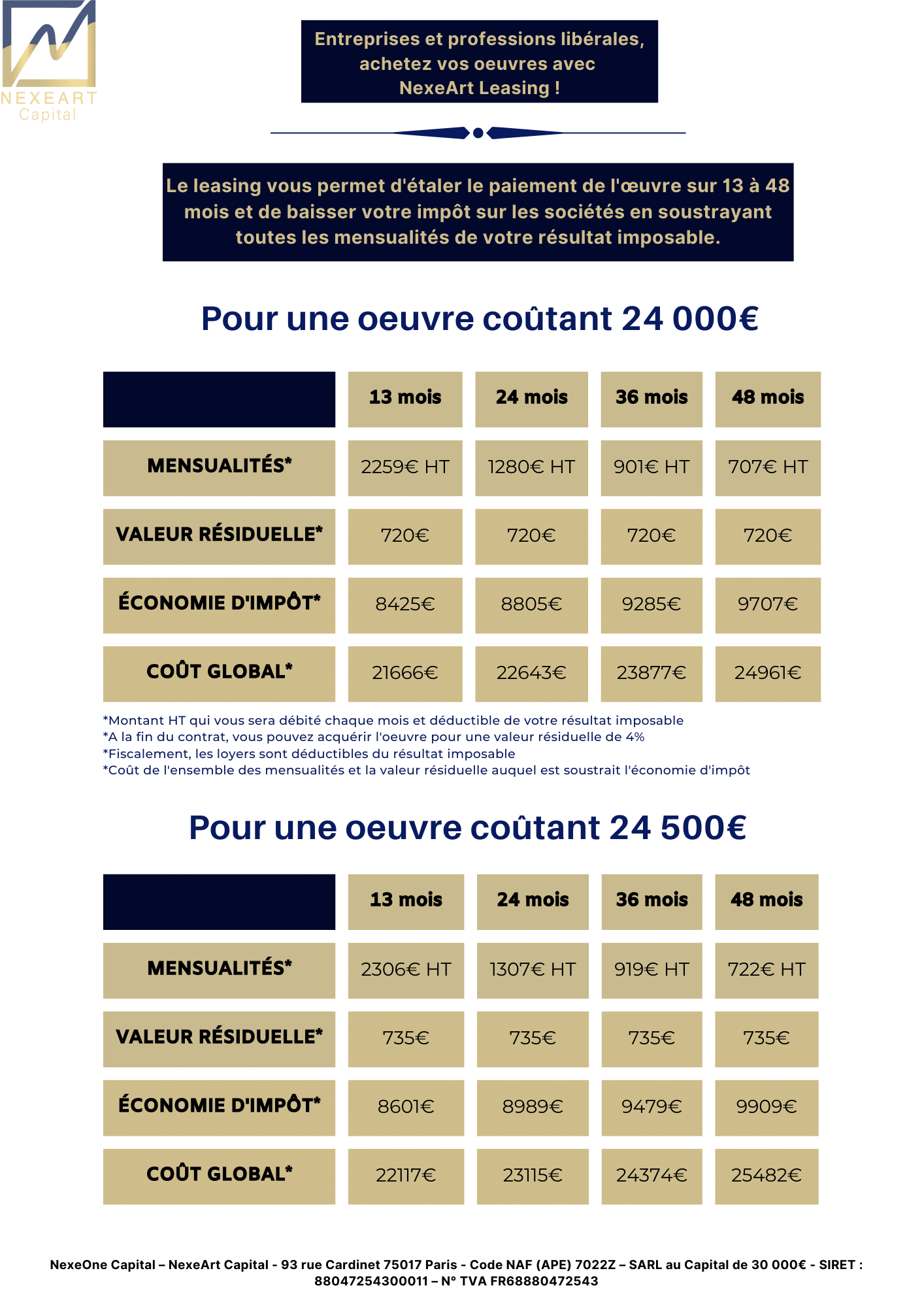

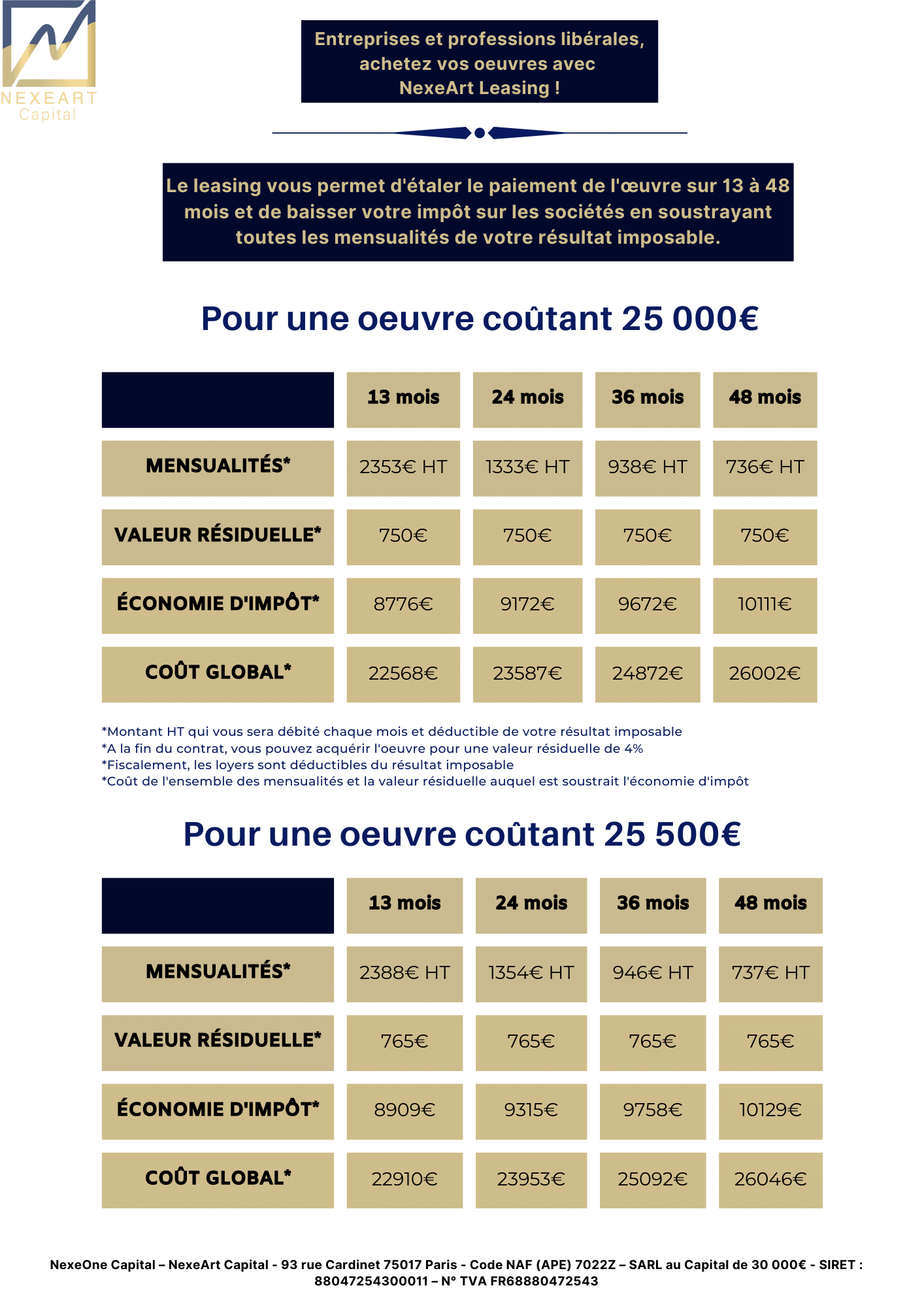

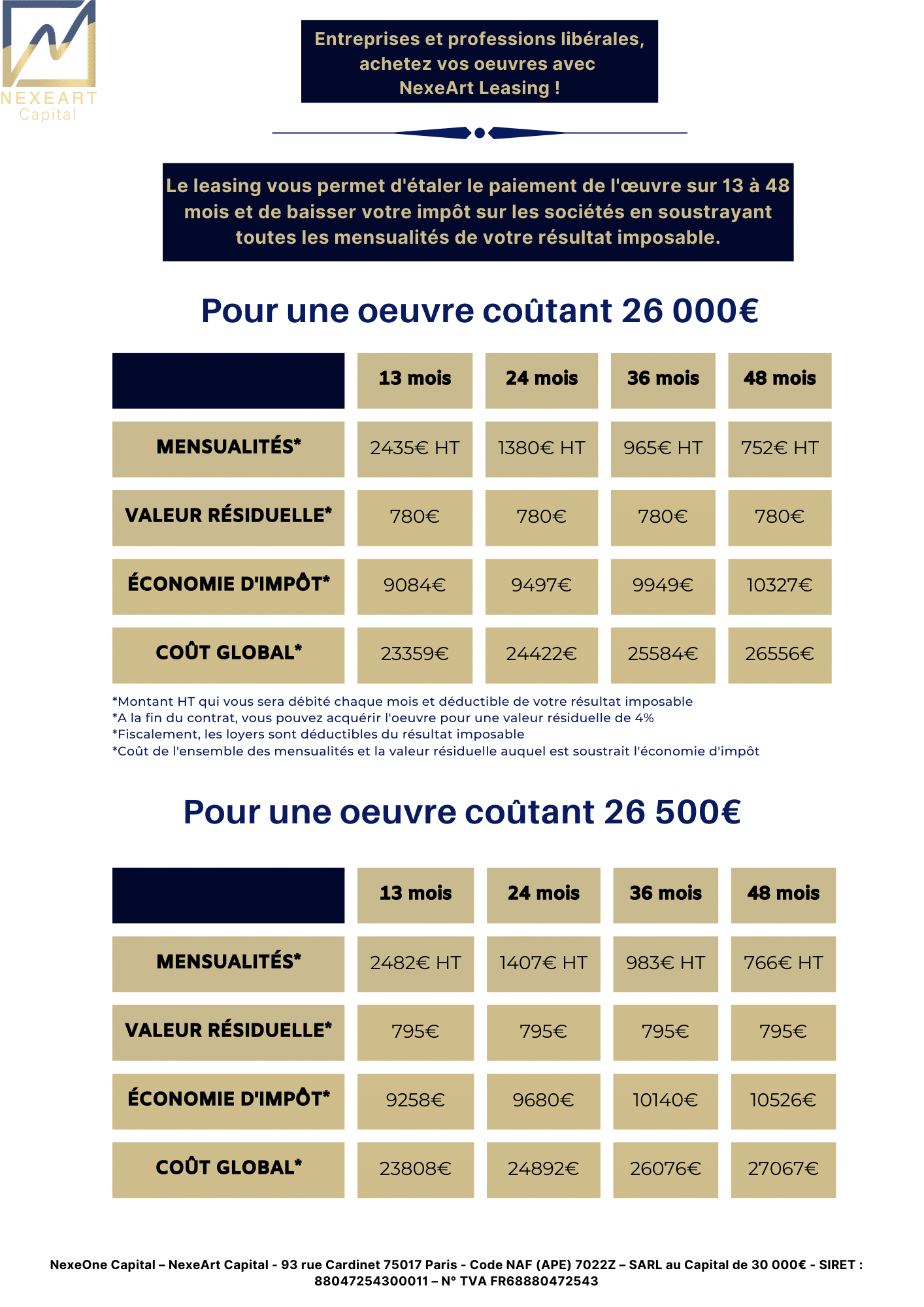

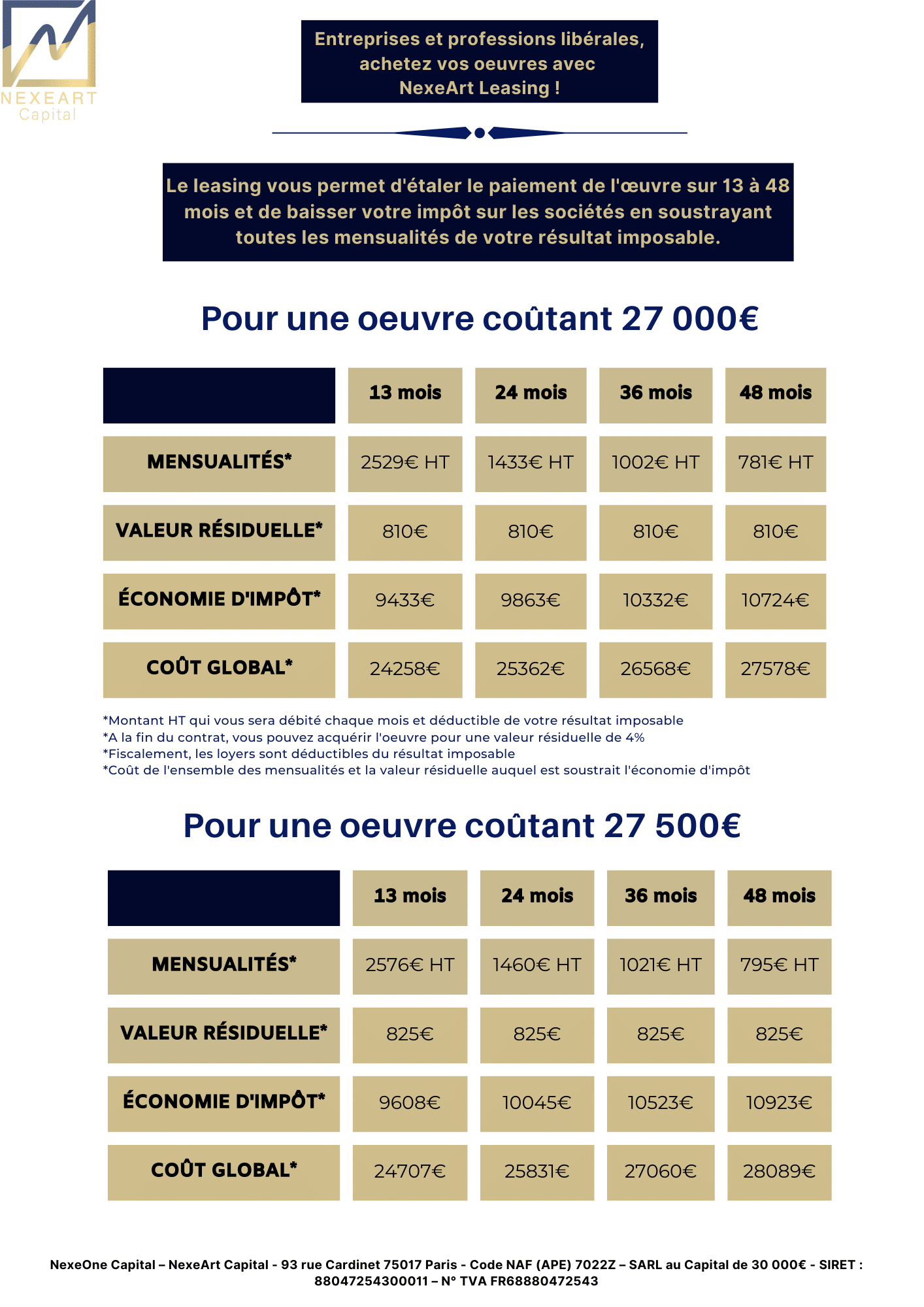

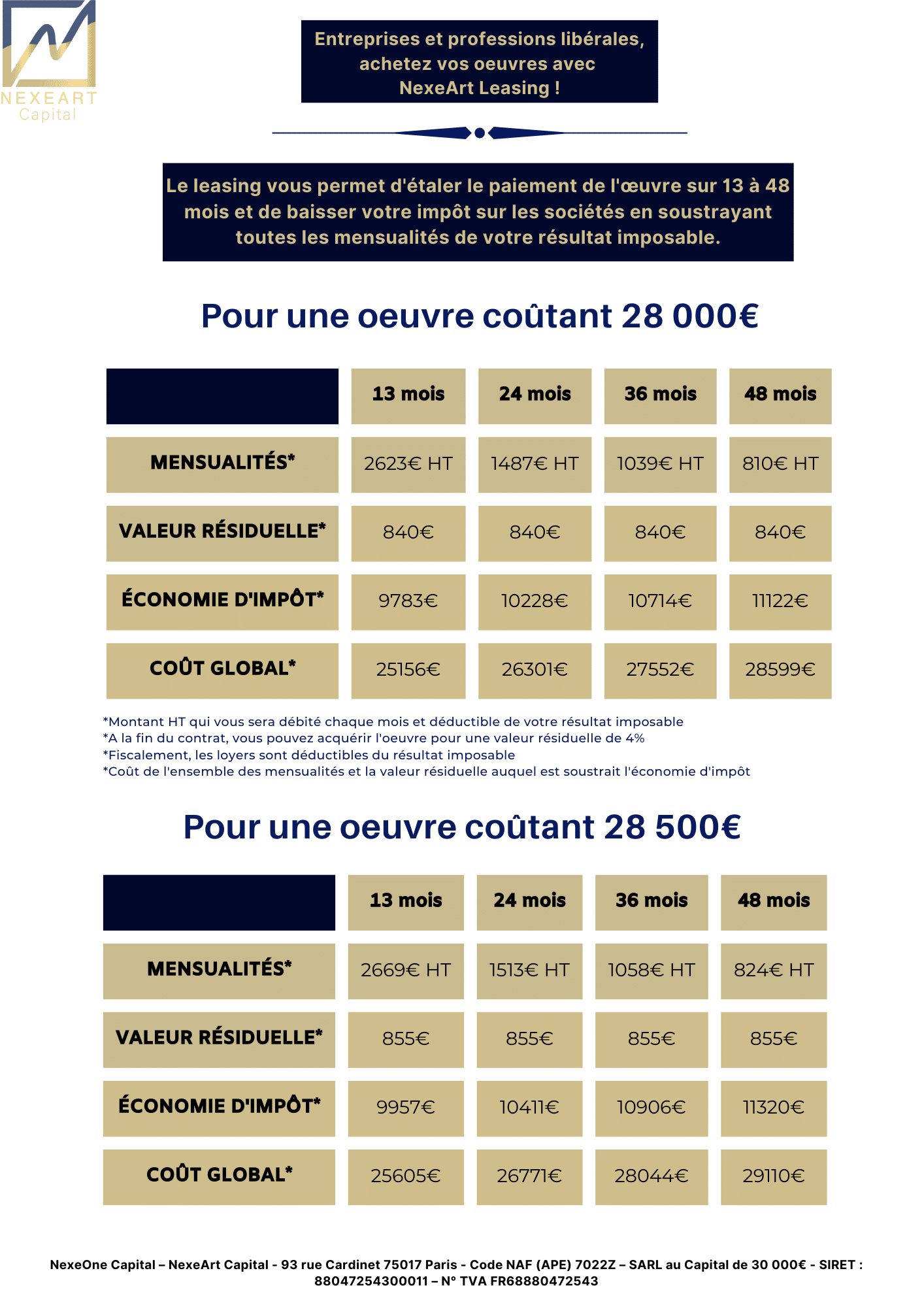

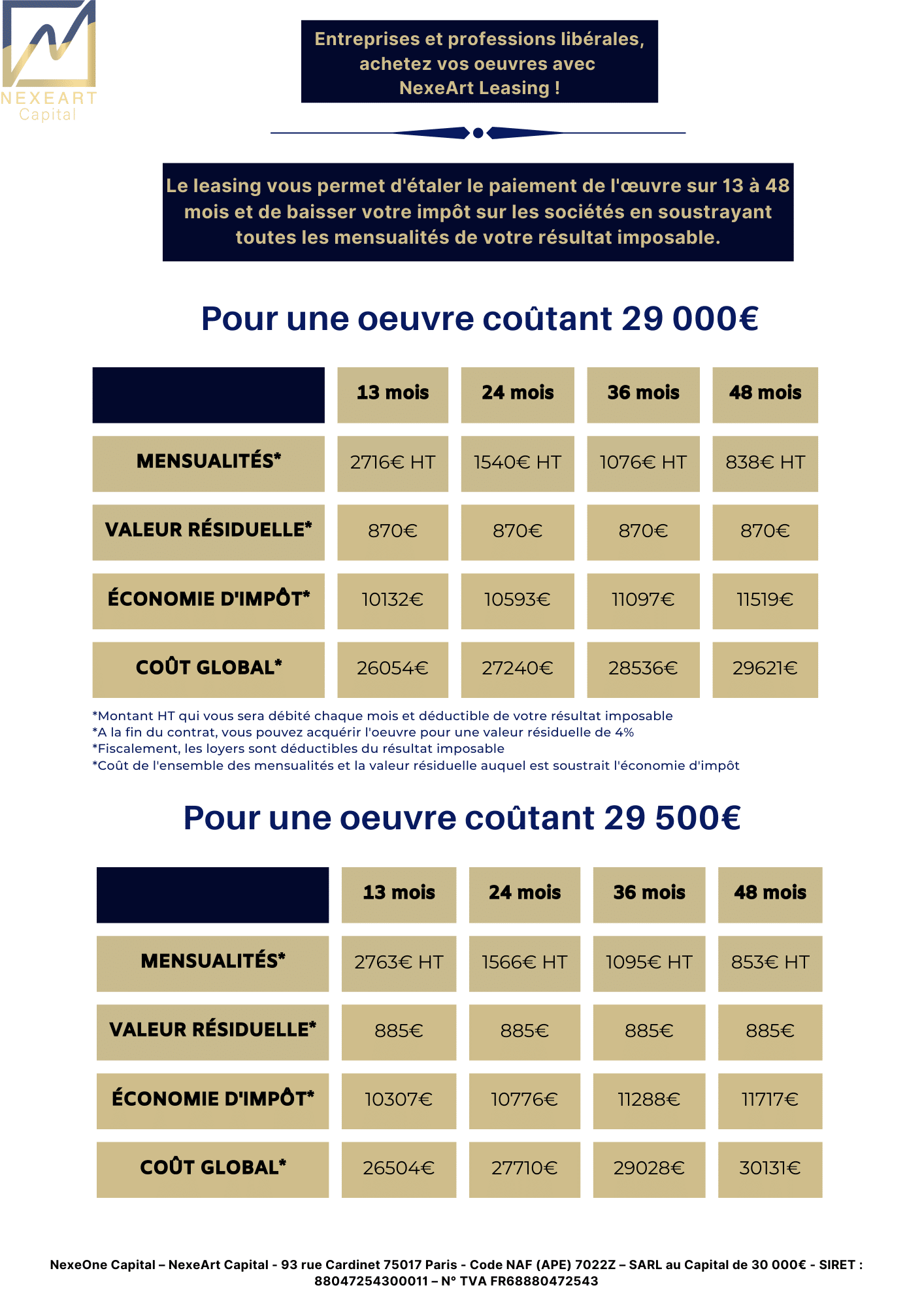

Art leasing allows you to rent a work of art (painting, sculpture, photograph or art furniture) for a period defined by a leasing contract and, according to the terms of the transaction signed with the lessor, to acquire it at the end of the contract in return for a residual value.

Leasing works of art offers a number of advantages: for companies, liberal professions and medical establishments, it enables the simple and progressive display of works of art designed to enrich and embellish reception halls, offices, workspaces or other professional premises, with a reduction in taxation and, at the end of the lease, the possibility of repurchasing the works on advantageous terms.

Contract duration

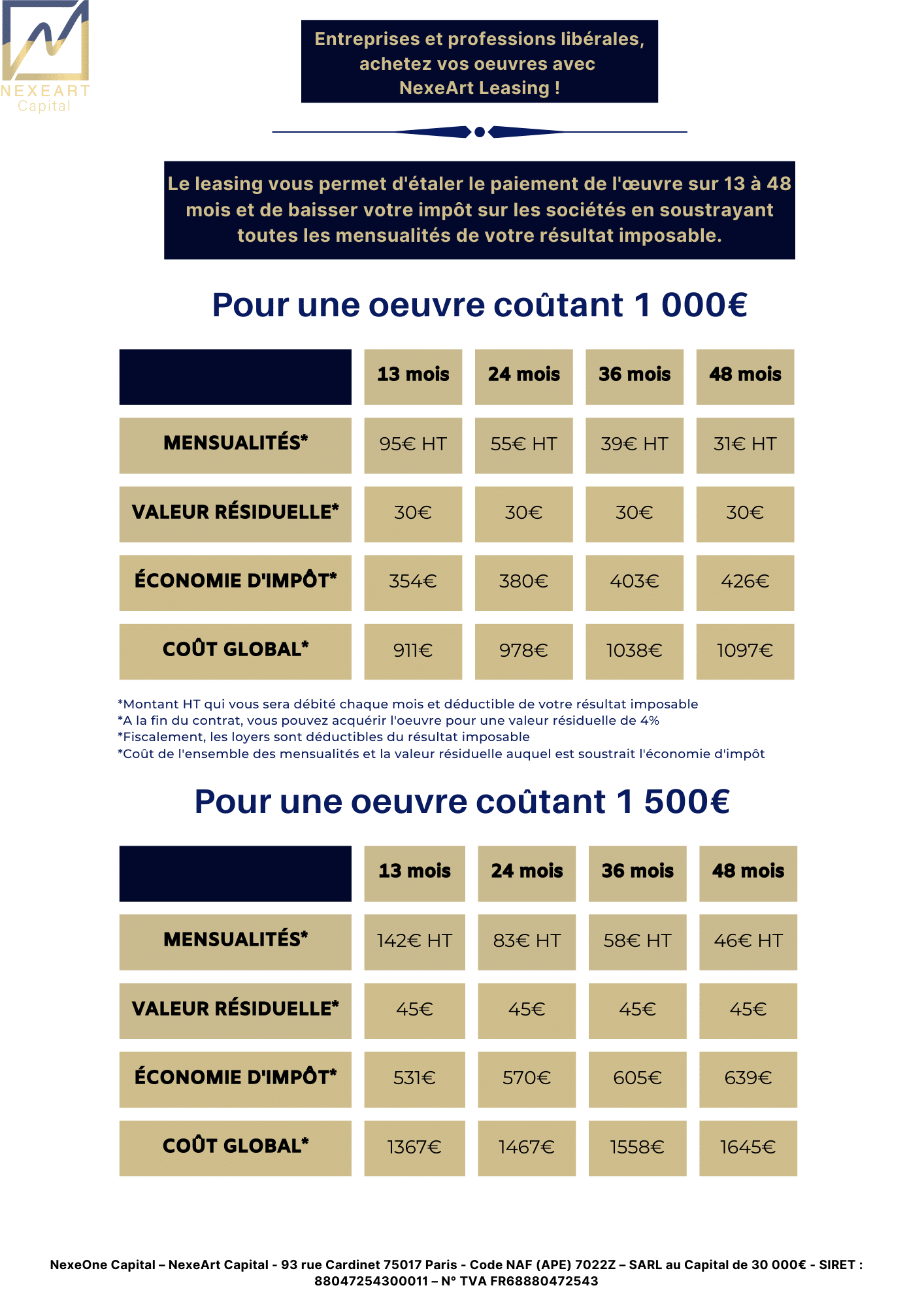

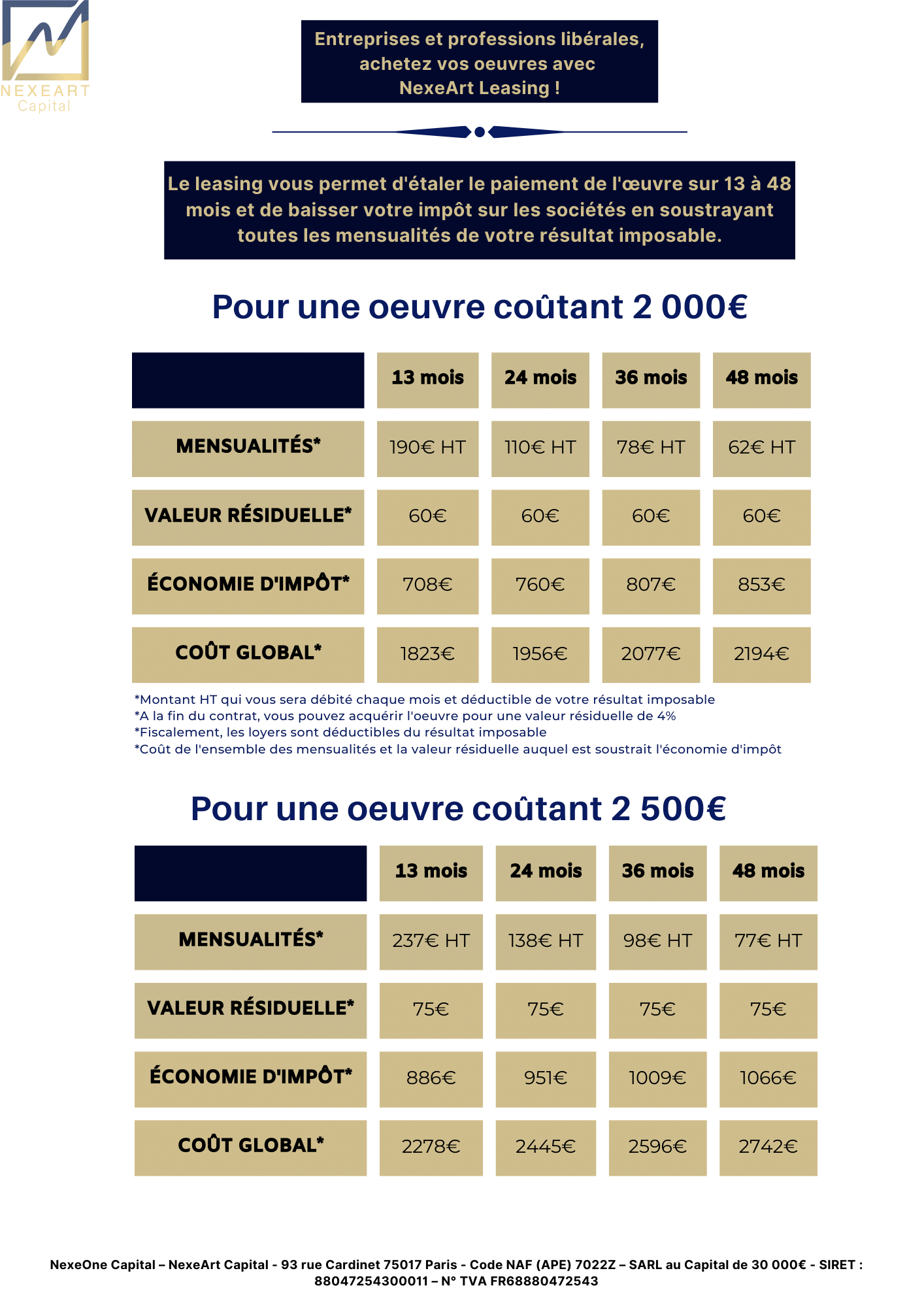

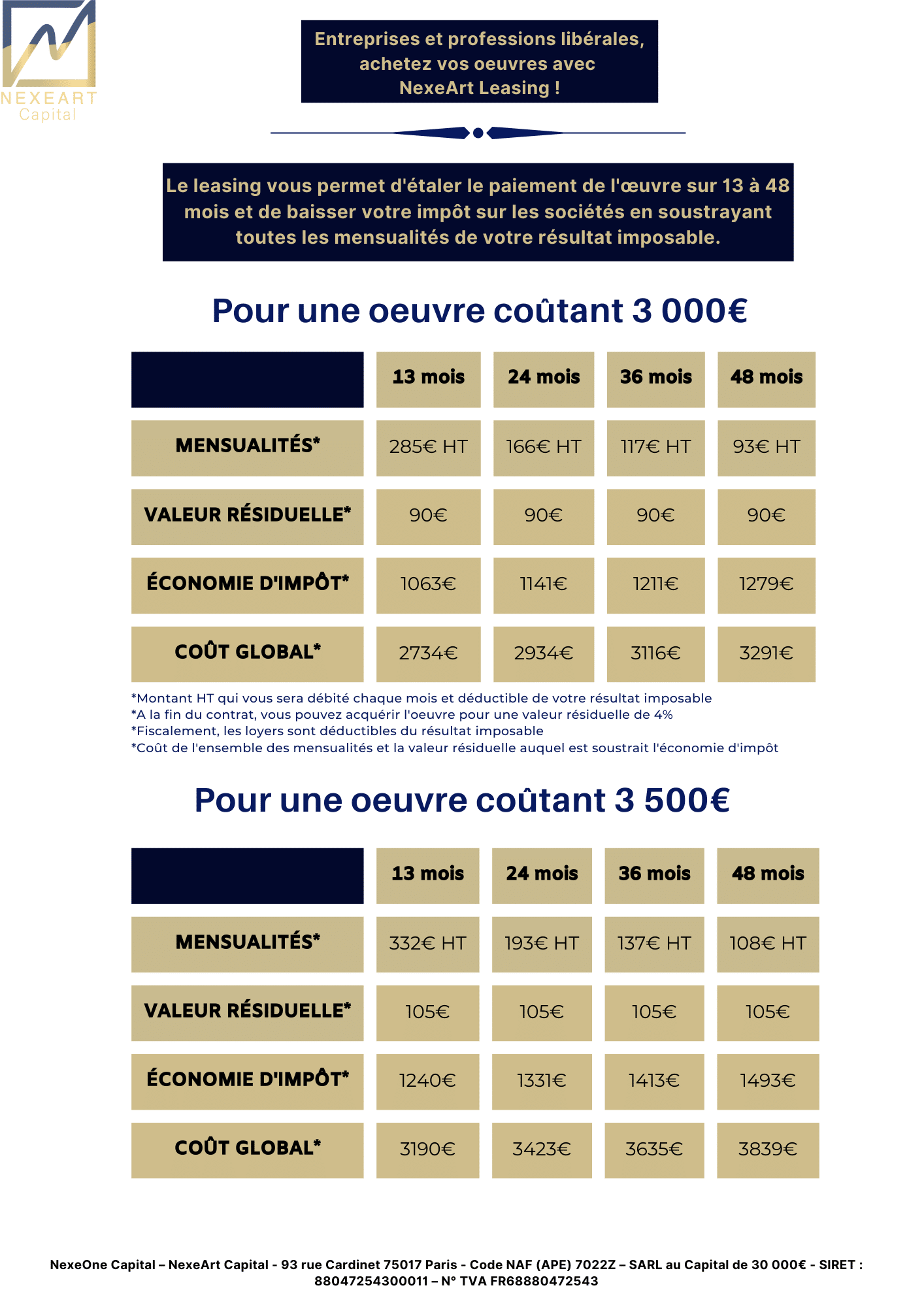

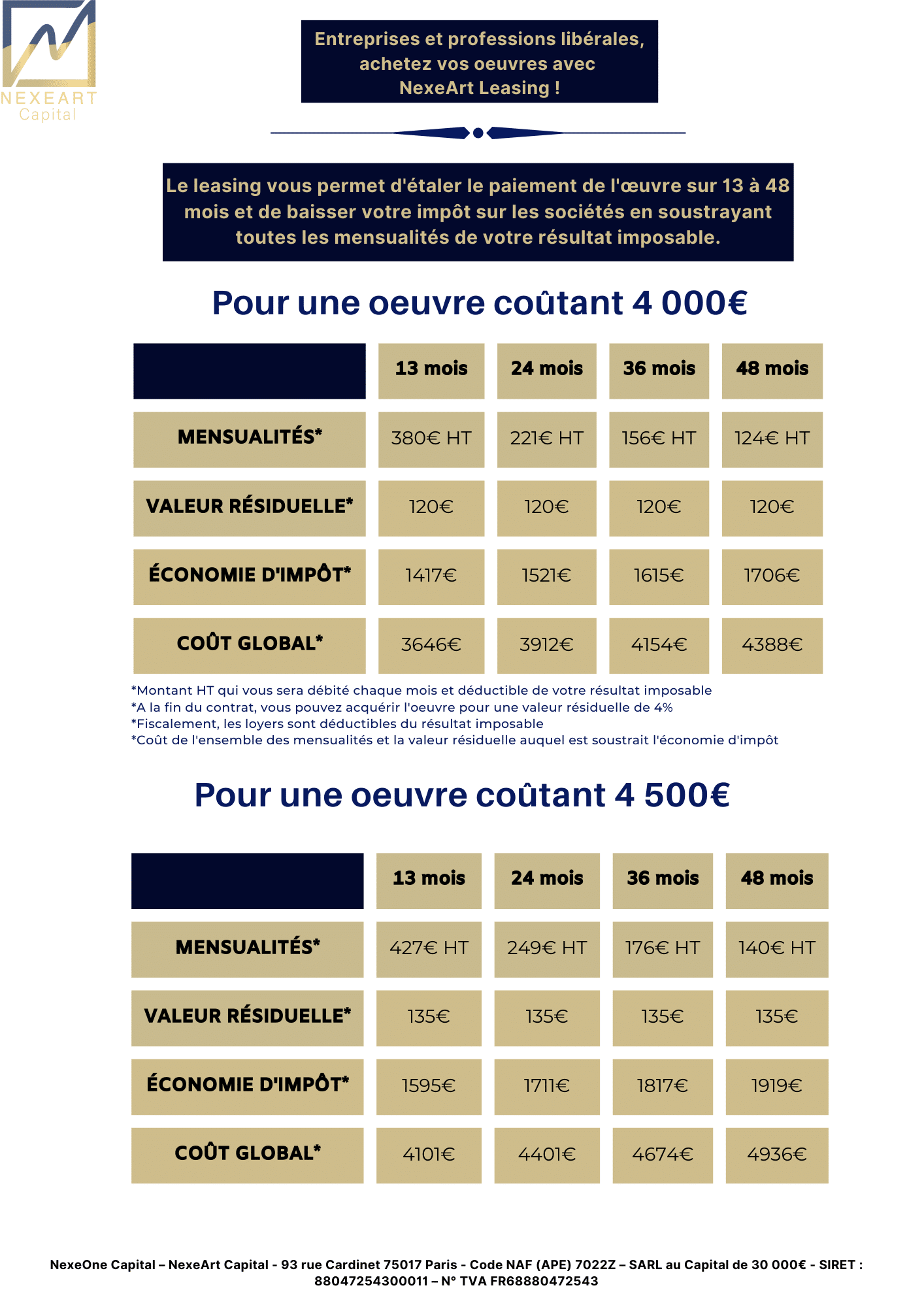

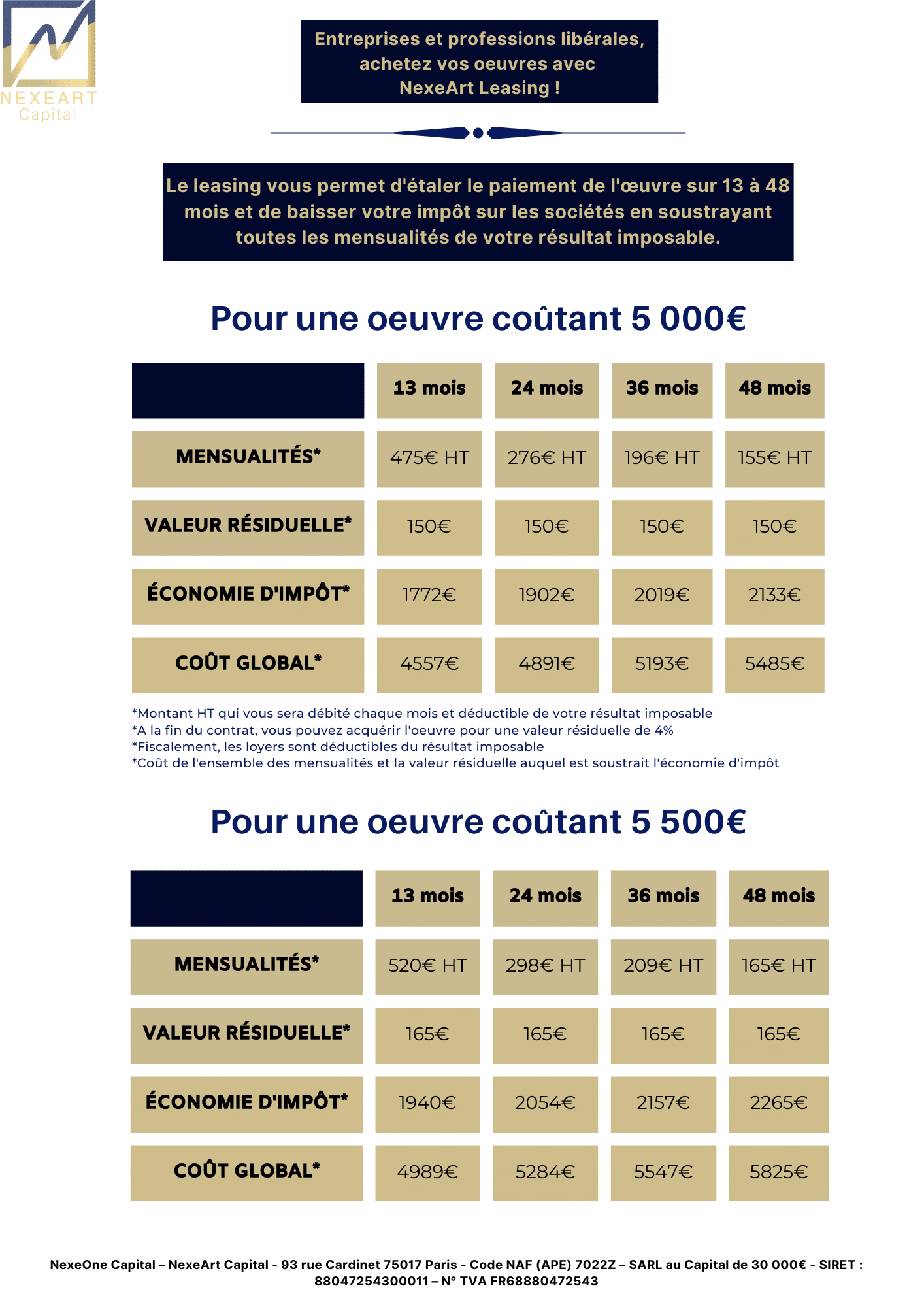

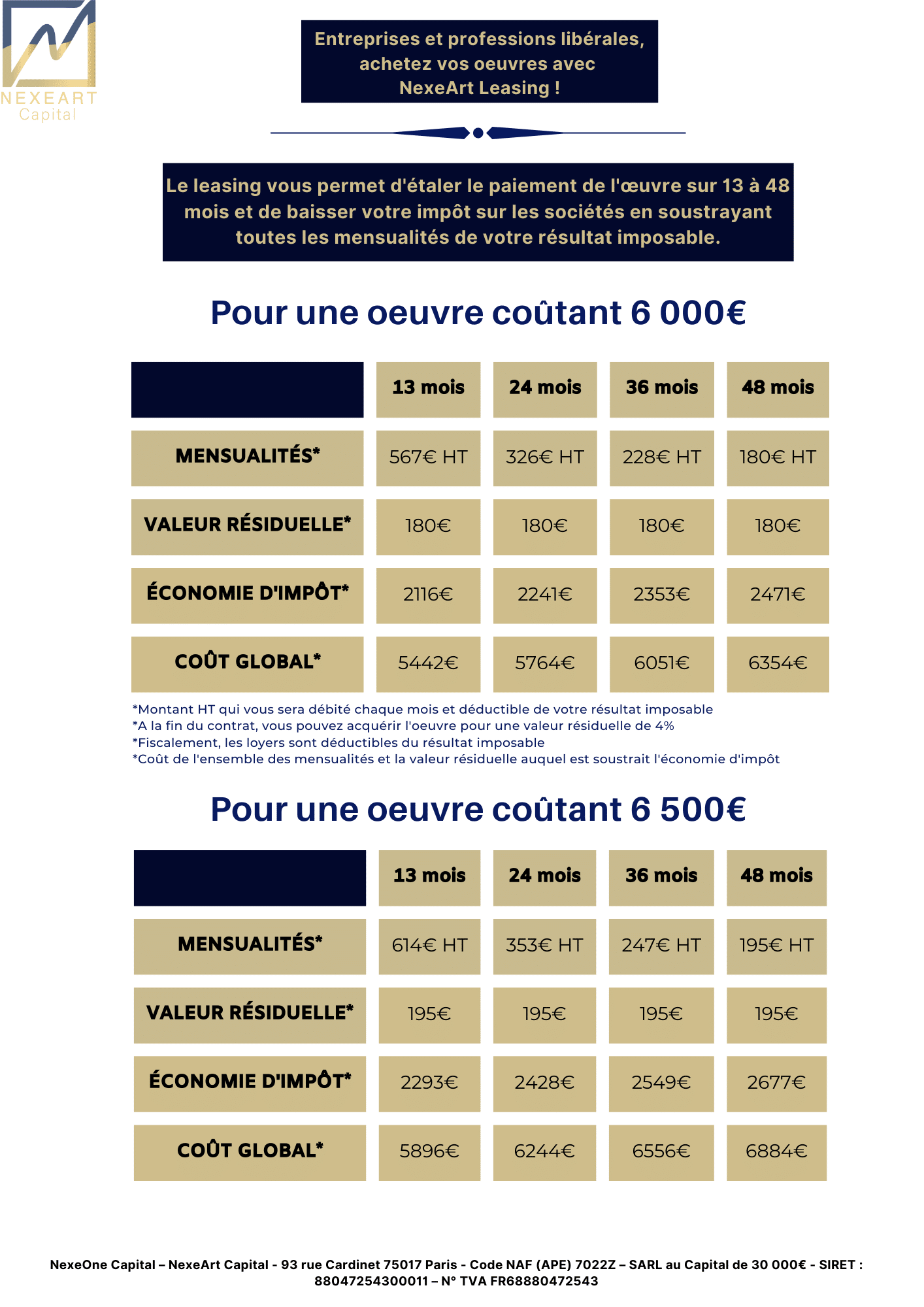

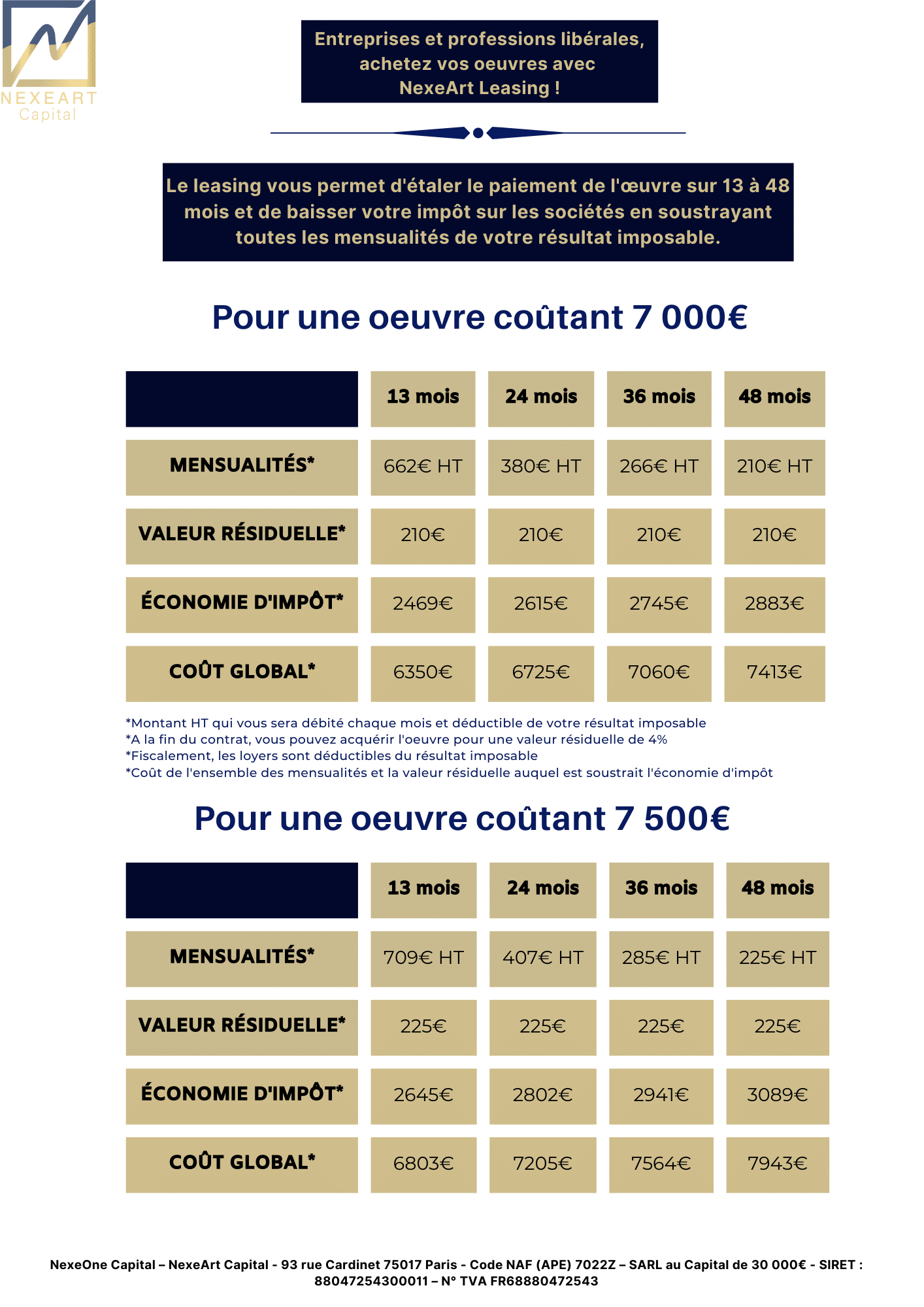

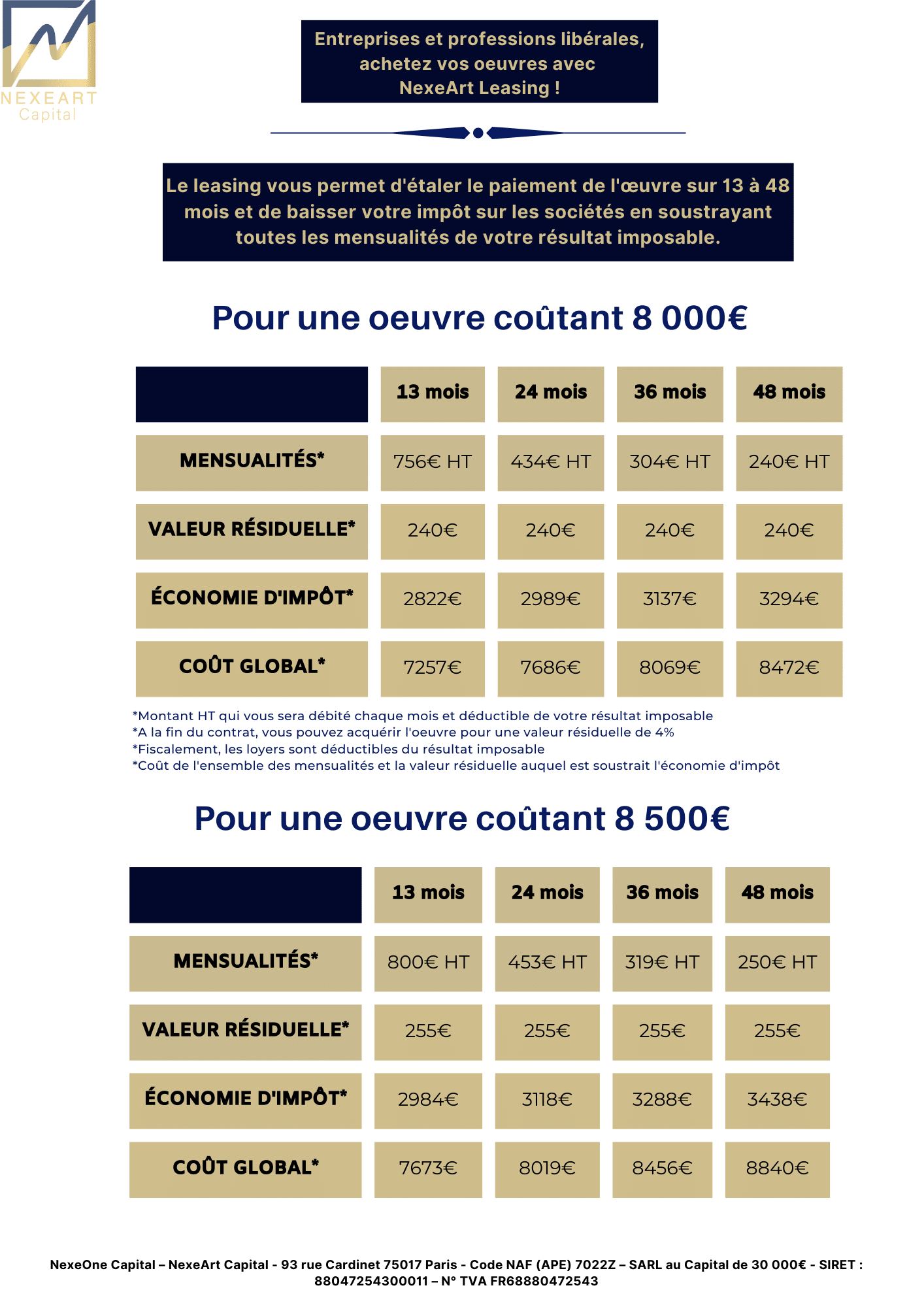

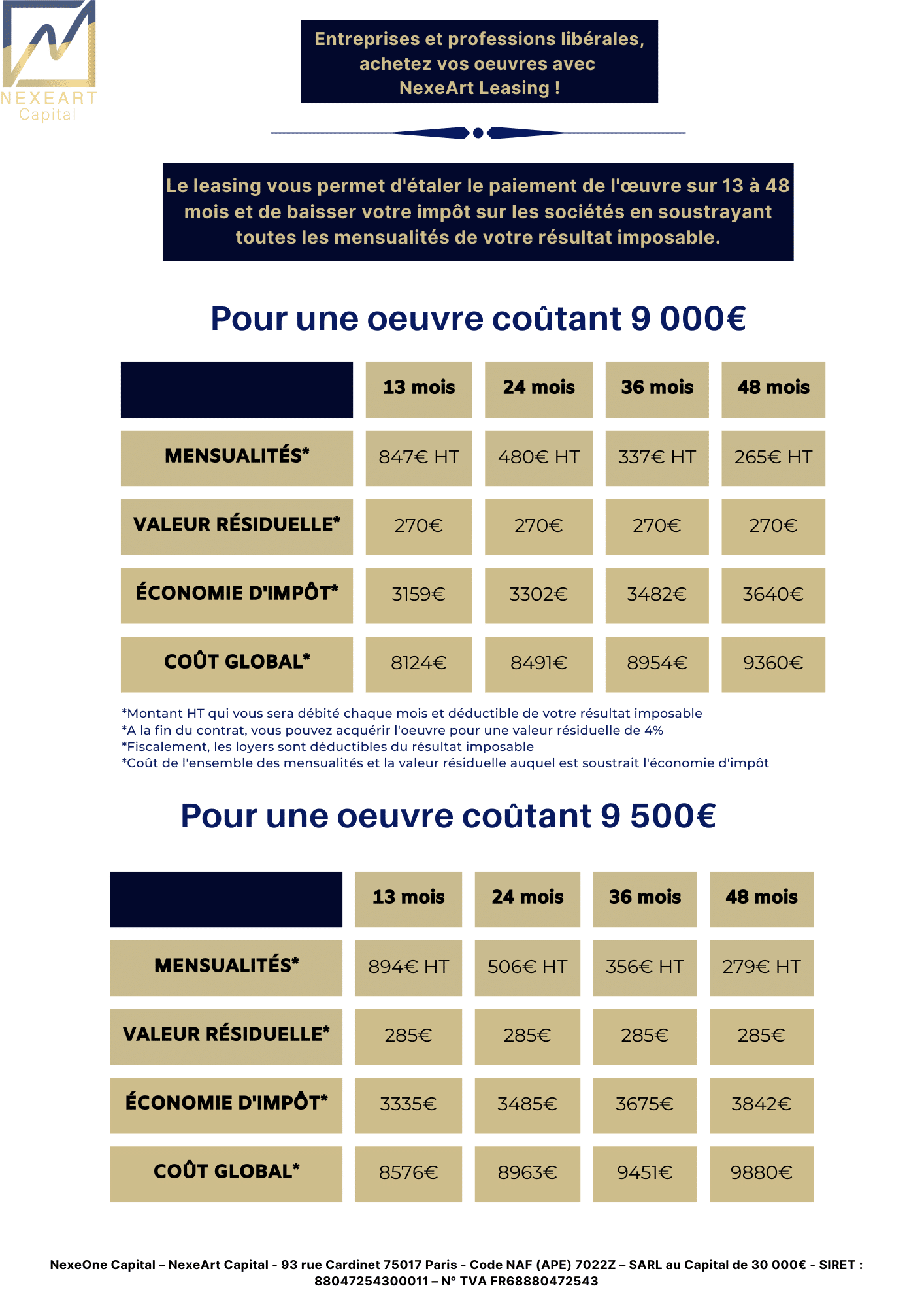

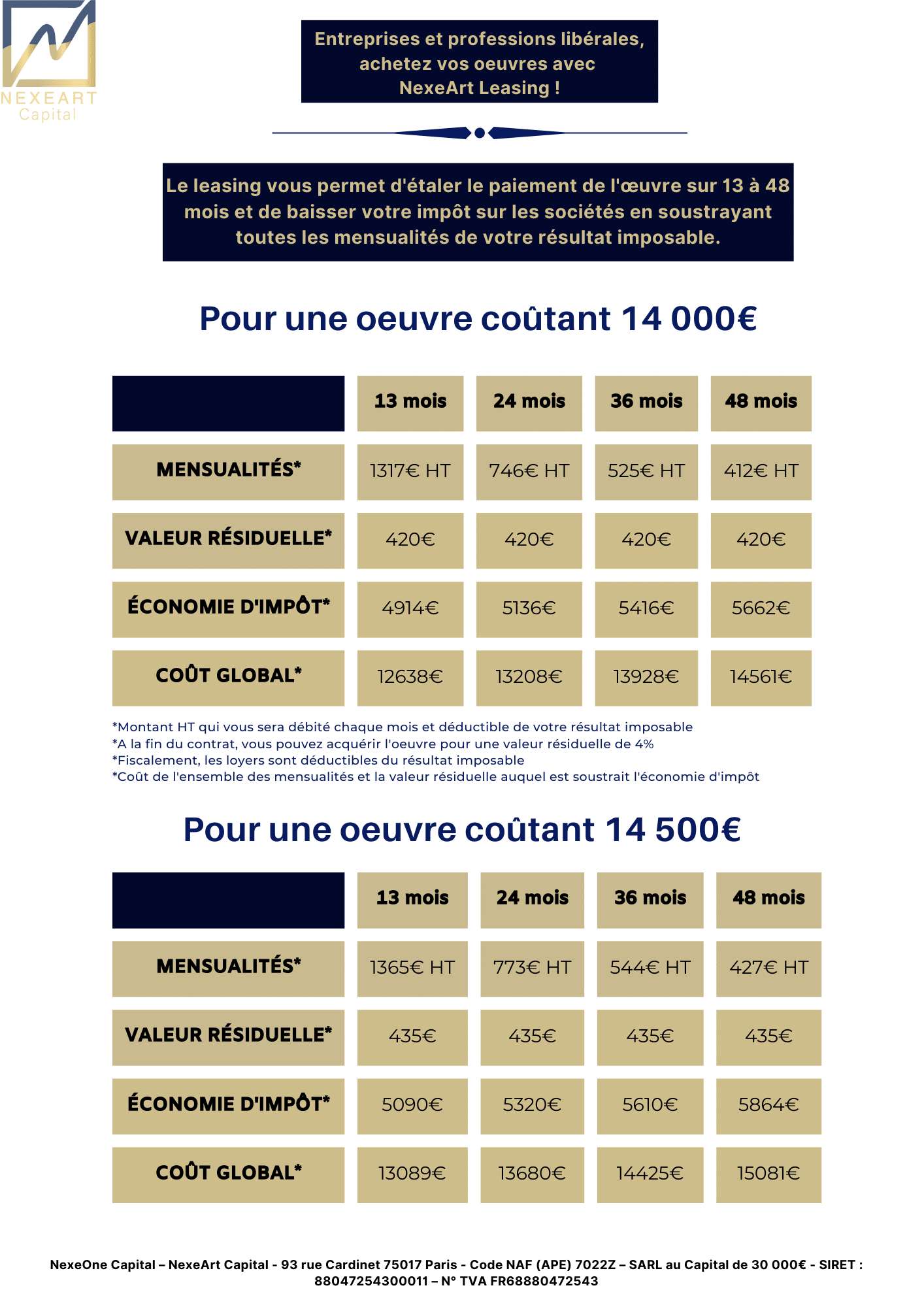

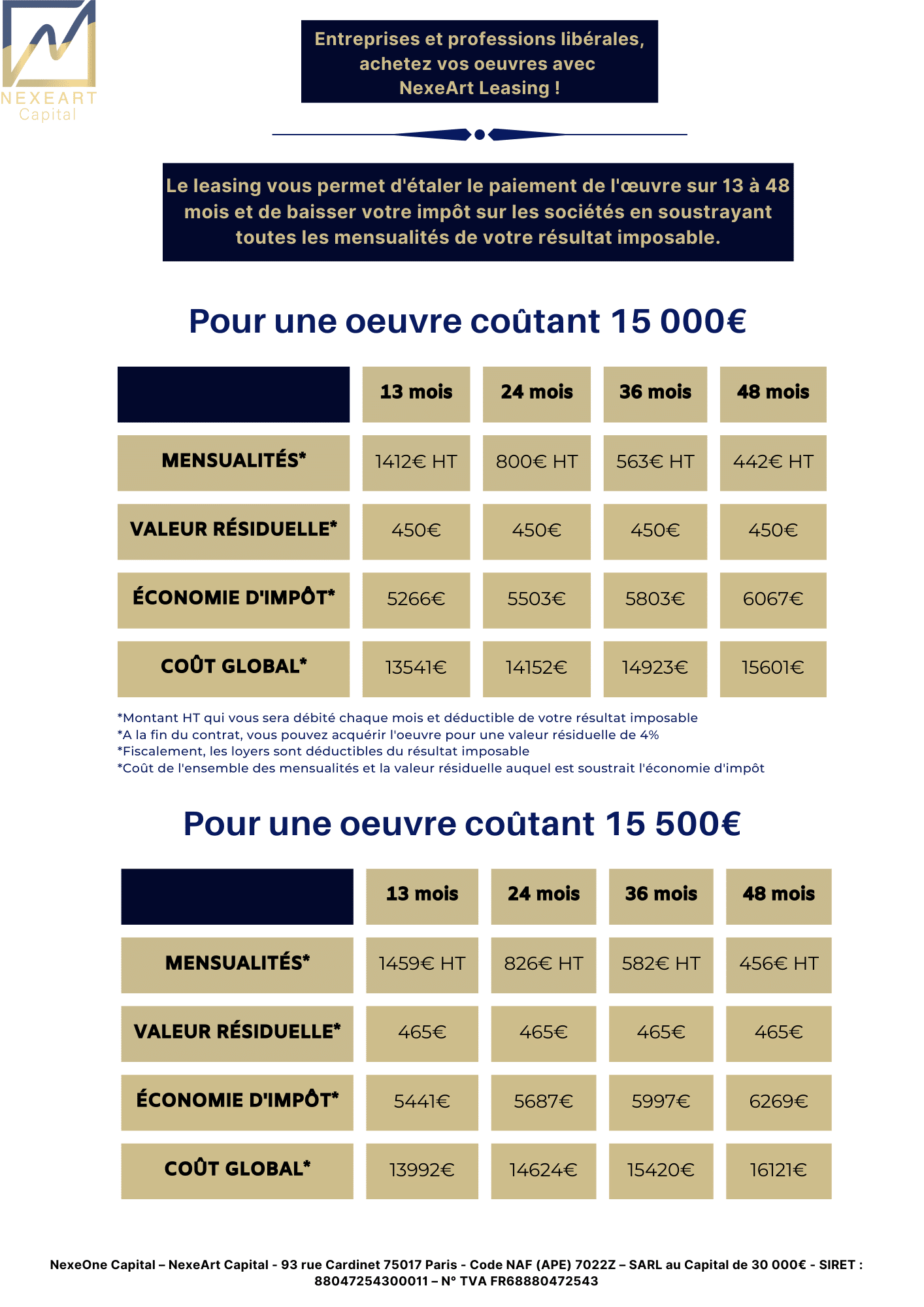

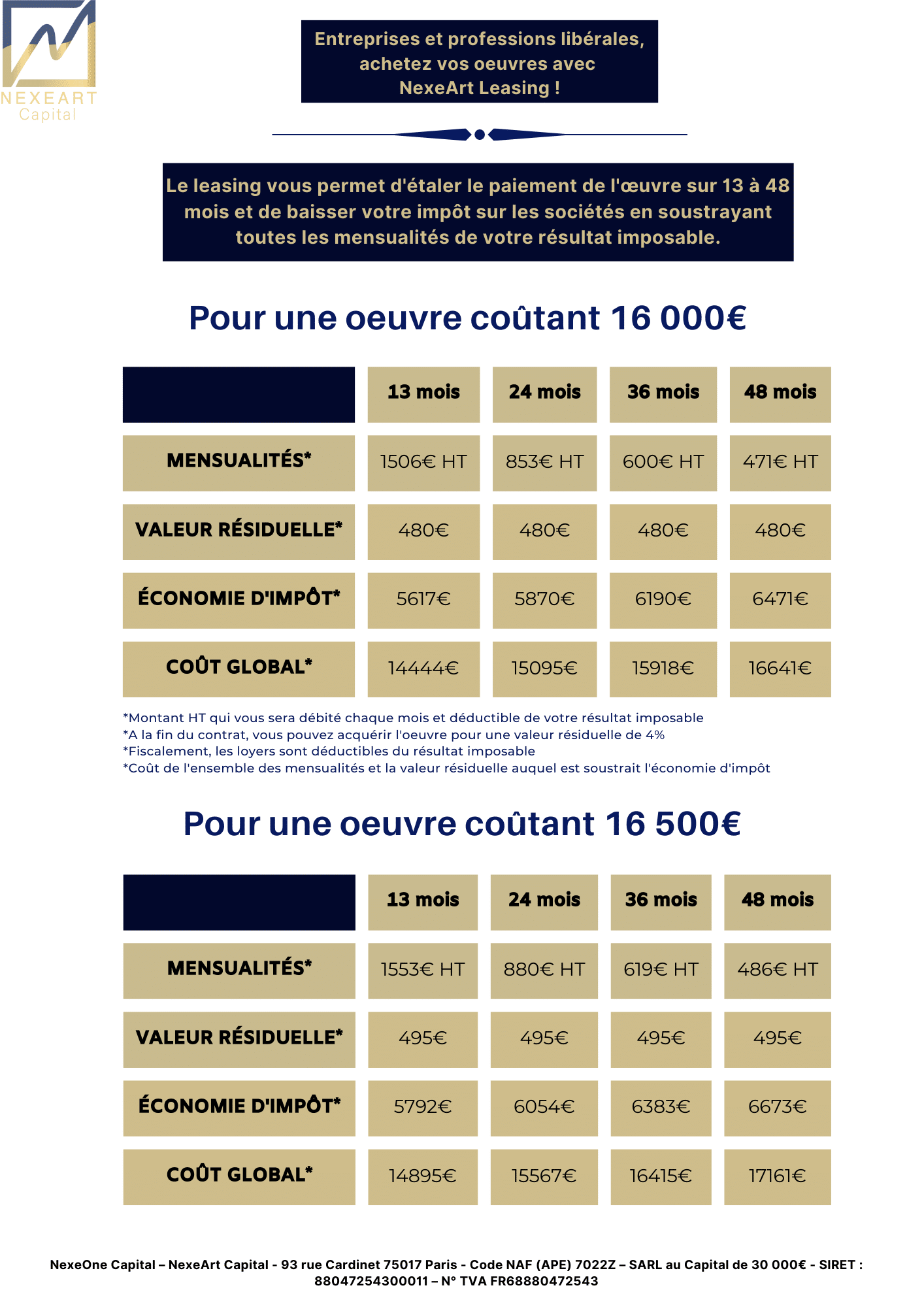

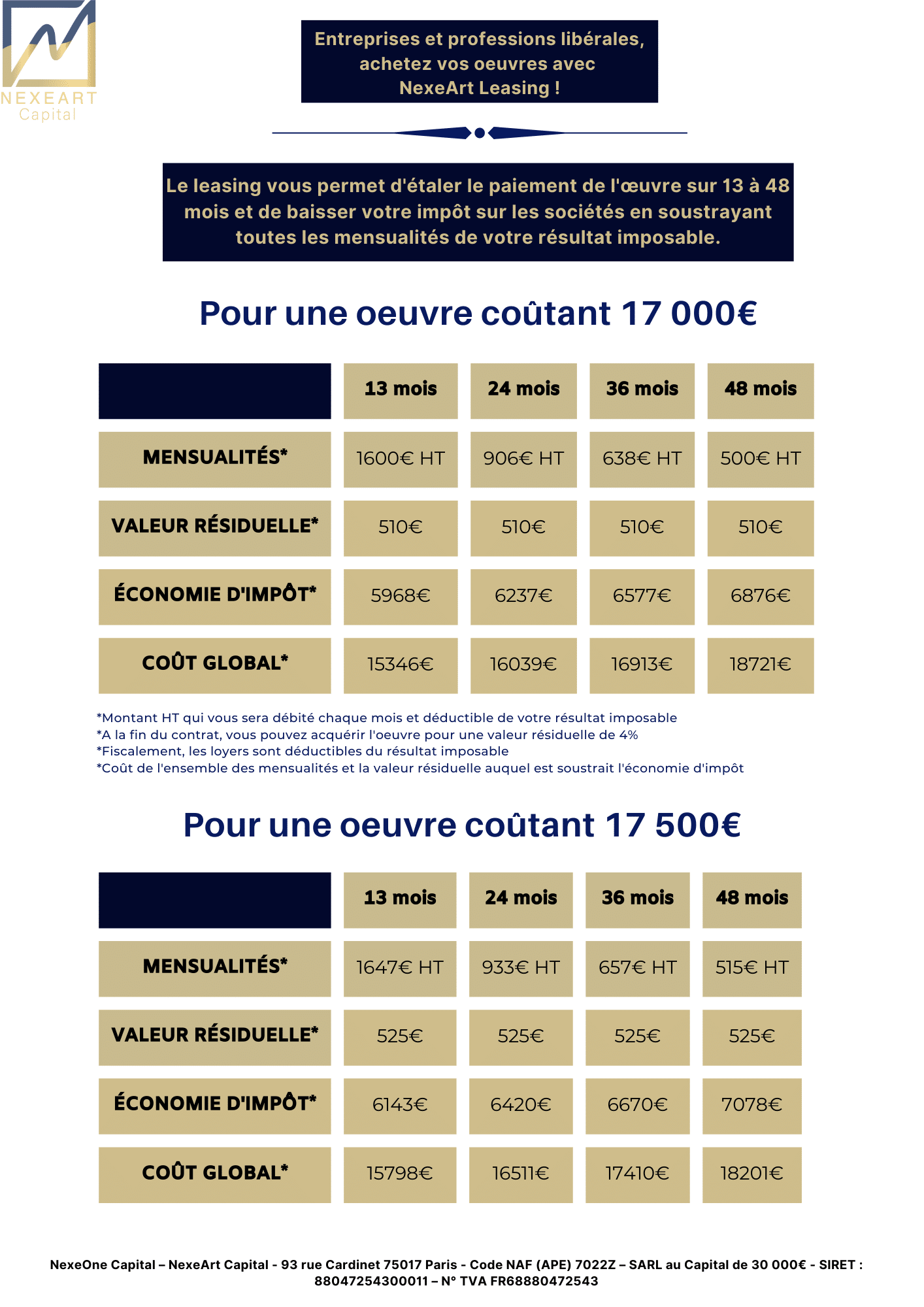

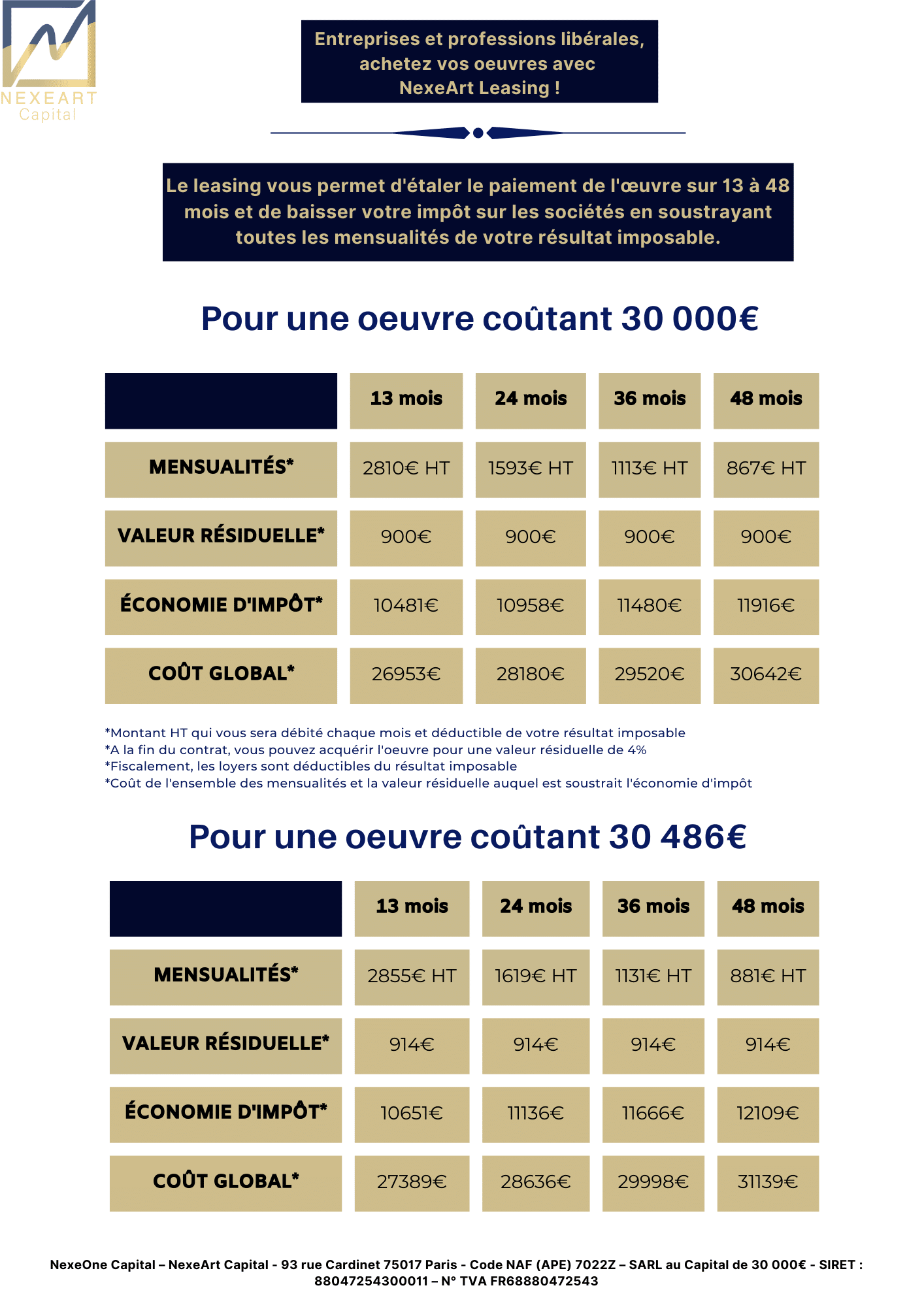

The duration of the contract is variable, ranging from 13 to 48 months.

The work must be visible in a location accessible to employees or customers.

The benefits of NexeArt Capital leasing for companies

For the company, art leasing is a real vector of communication. Displaying works of art in offices and workspaces contributes to :

– embellishing premises and infrastructures

– the development of the organization’s brand image and identity in the eyes of employees, customers and partners;

– employee well-being and the creation of human bonds within the work community,

– access to a diversified culture and the discovery of numerous artists.

While sponsorship imposes conditions on the amounts invested and focuses on living artists, art leasing places no limits or restrictions on the amounts invested.

Tax and art leasing & the law?

The only companies eligible for the art leasing tax deduction scheme must be subject to corporate income tax (SA, EURL, SARL or SAS) or income tax in the industrial and commercial profits

and commercial profits (BIC).

In this way, the cost of leasing works of art is included in office decoration and fitting-out, in account 6068 of the general chart of accounts.

The tax benefits of this arrangement are indisputable, since the leasing is subject to the common law system of expenses deductible from net income (art 39-1 of the CGI), which will reduce income tax contributions.

In addition to this tax reduction (IS or IRPP), among the many other financial and tax advantages of leasing works of art, we can mention:

– the creation of a valuable material asset;

– spreading the cost of purchasing a work over several months or years (13 to 48 months);

– retaining title to the work off-balance sheet;

– smoothing out expenditure and maintaining a high level of cash flow and borrowing capacity.

– Purchase of the work at residual value

Articles 238 bis and 238 bis AB of the French General Tax Code set out the tax exemption conditions available to companies for the acquisition and leasing of original works by living artists.

Setting up a relationship

Simulation

Application

Signature

Disposal

Art Galleries

OFFER YOUR CUSTOMERS DISTINCTIVE AND ORIGINAL SOLUTIONS

Diversify your customer base

• Find an offer that sets you apart from your competitors

• Create a bond with your collectors

• Art as an asset

• A secure solution for your payments

• A customized solution for every purchase