NexeArt Leasing

Companies & Professions

LEASING WITH PURCHASE OPTION

Art leasing allows you to rent a work of art (painting, sculpture, photograph or art furniture) for a period defined by a leasing contract and, according to the terms of the transaction signed with the lessor, to acquire it at the end of the contract in return for a residual value.

Leasing works of art offers a number of advantages: for companies, liberal professions and medical establishments, it enables the simple and progressive display of works of art designed to enrich and embellish reception halls, offices, workspaces or other professional premises, with a reduction in taxation and, at the end of the lease, the possibility of repurchasing the works on advantageous terms.

Contract duration

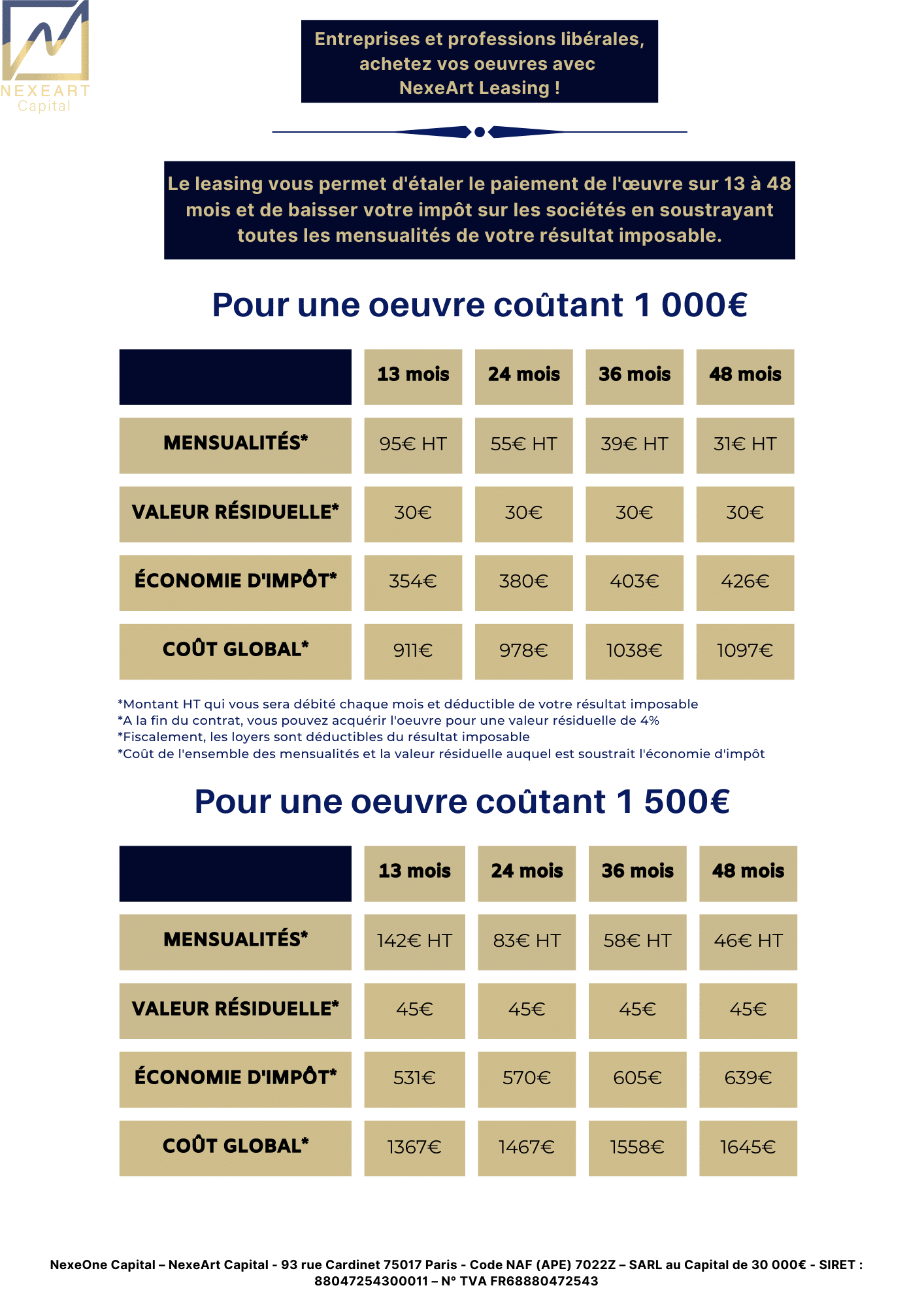

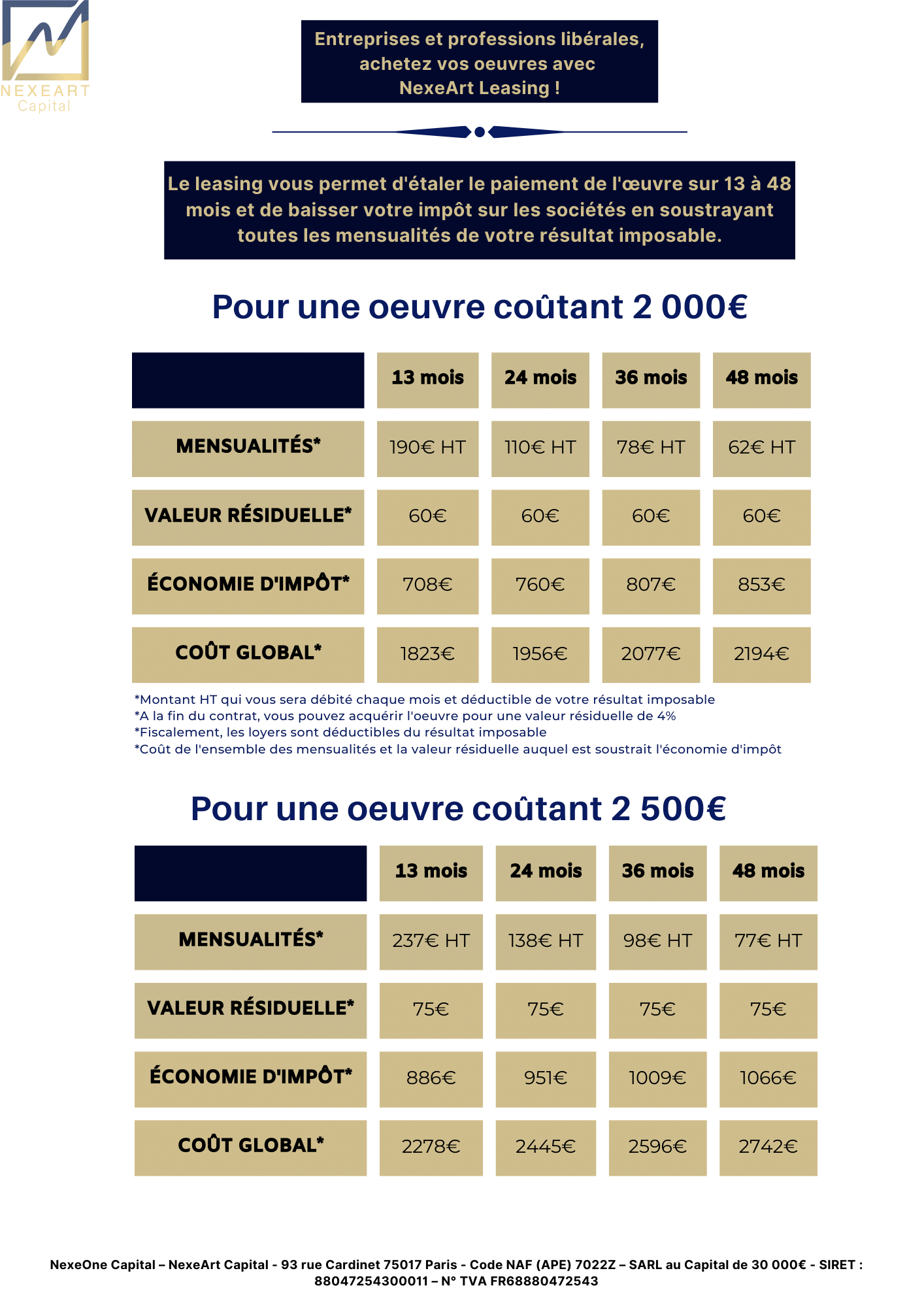

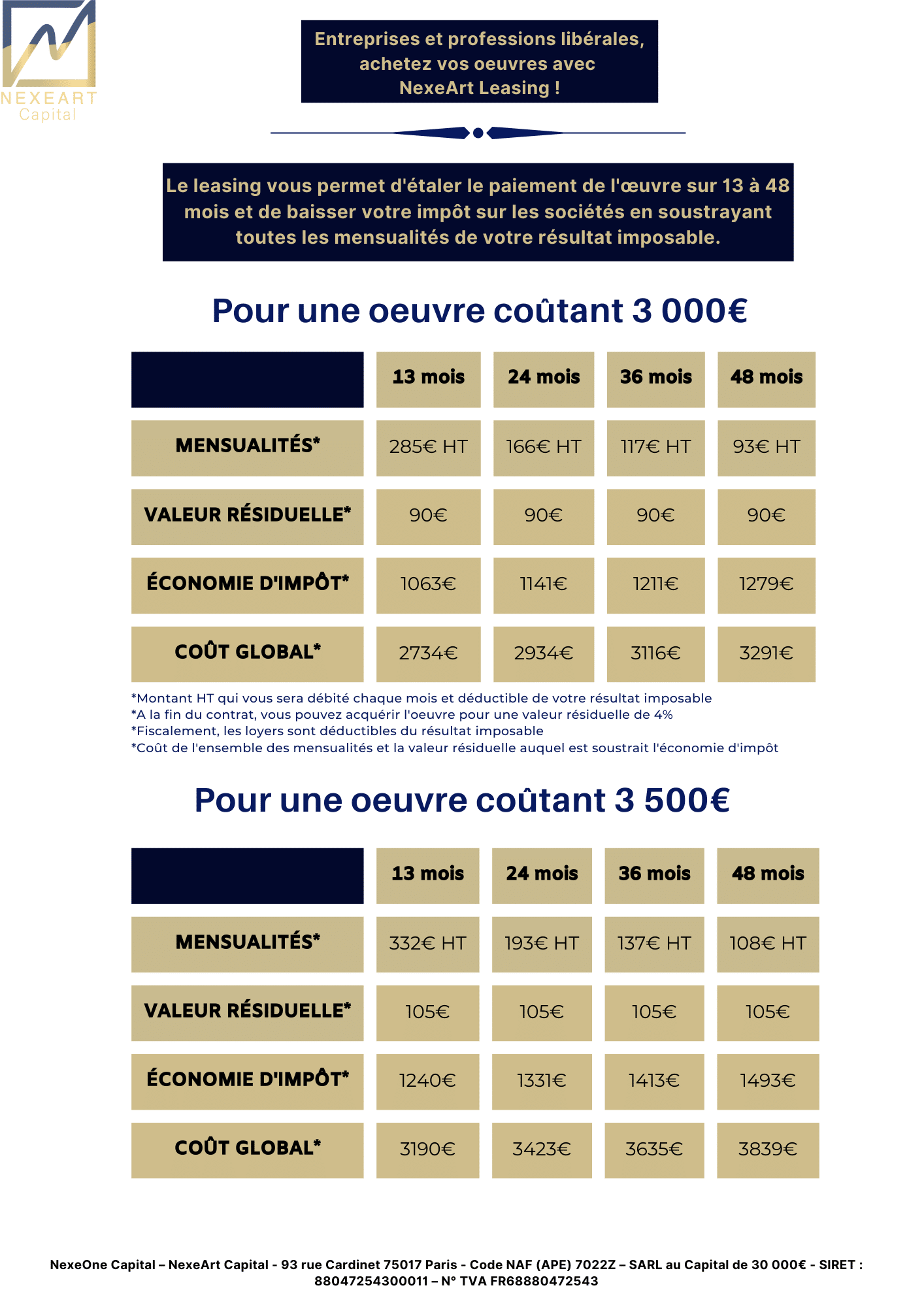

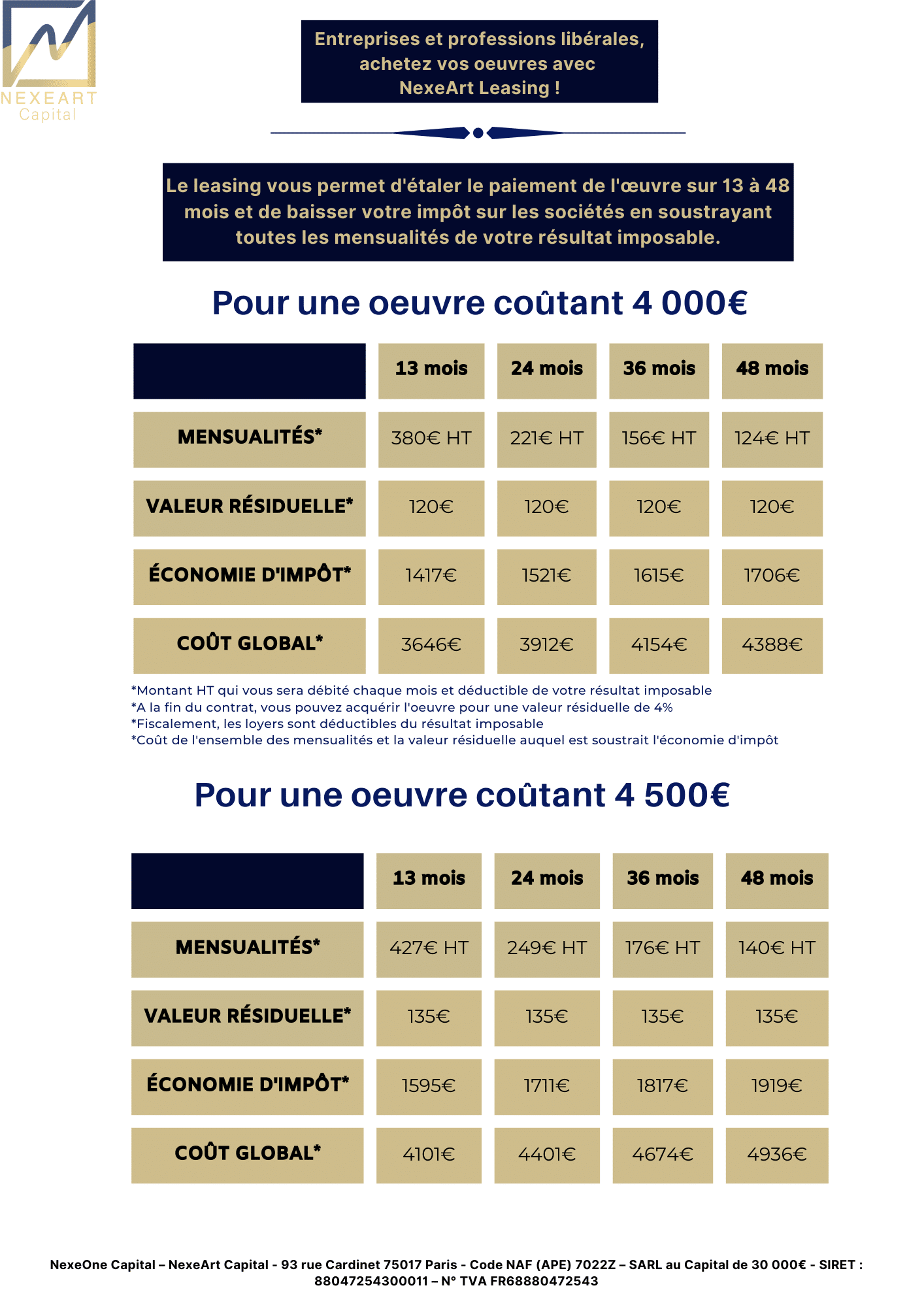

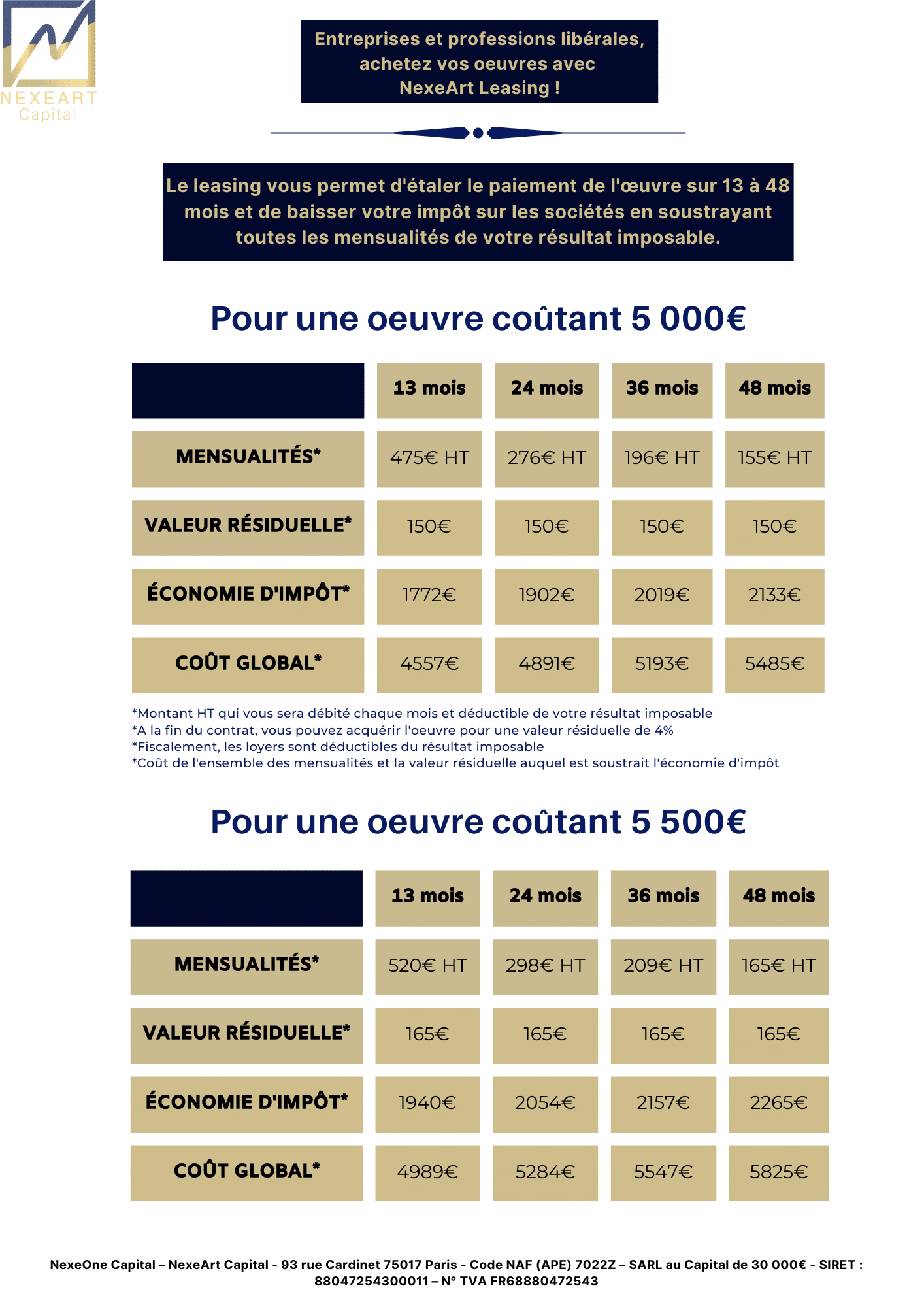

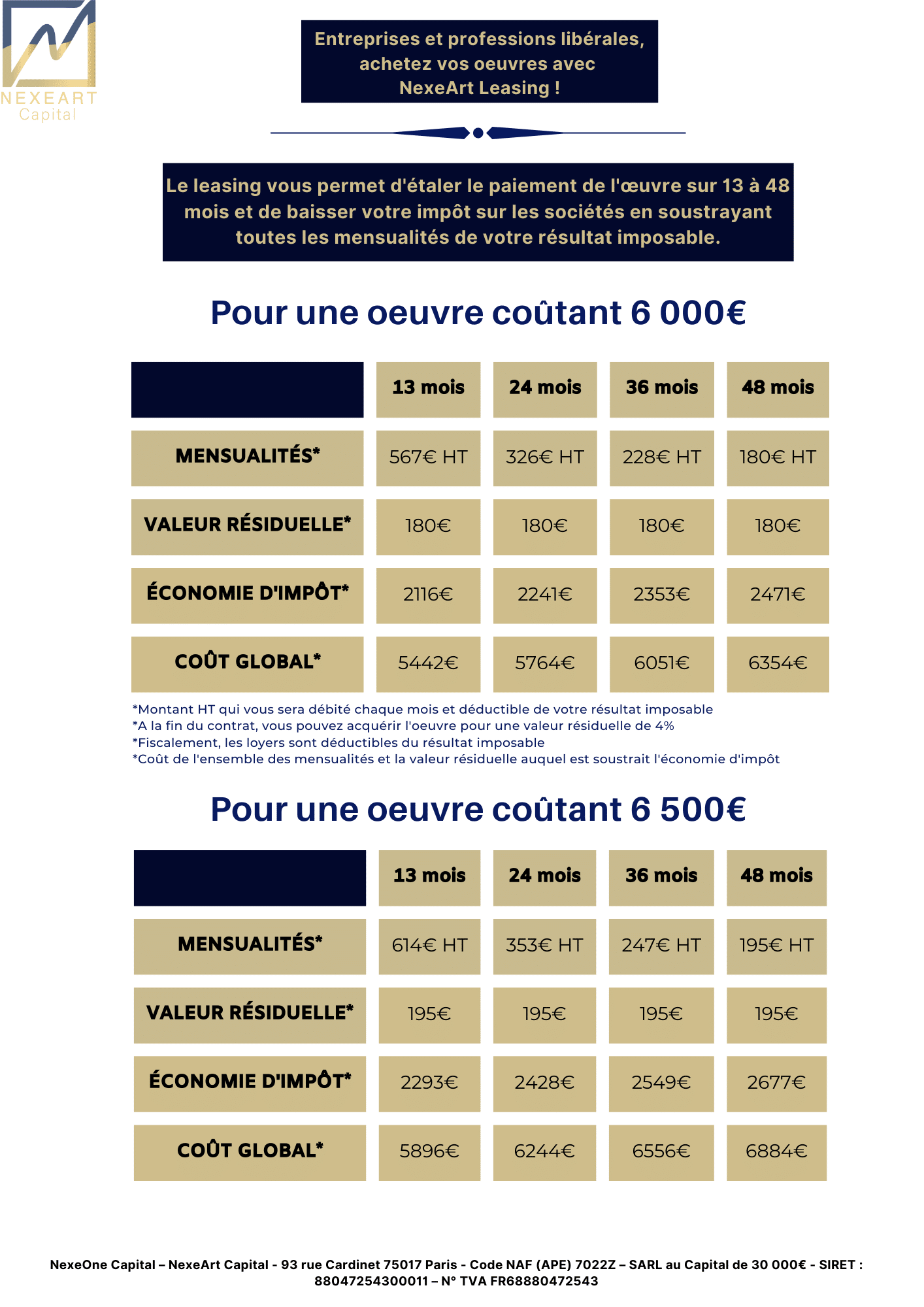

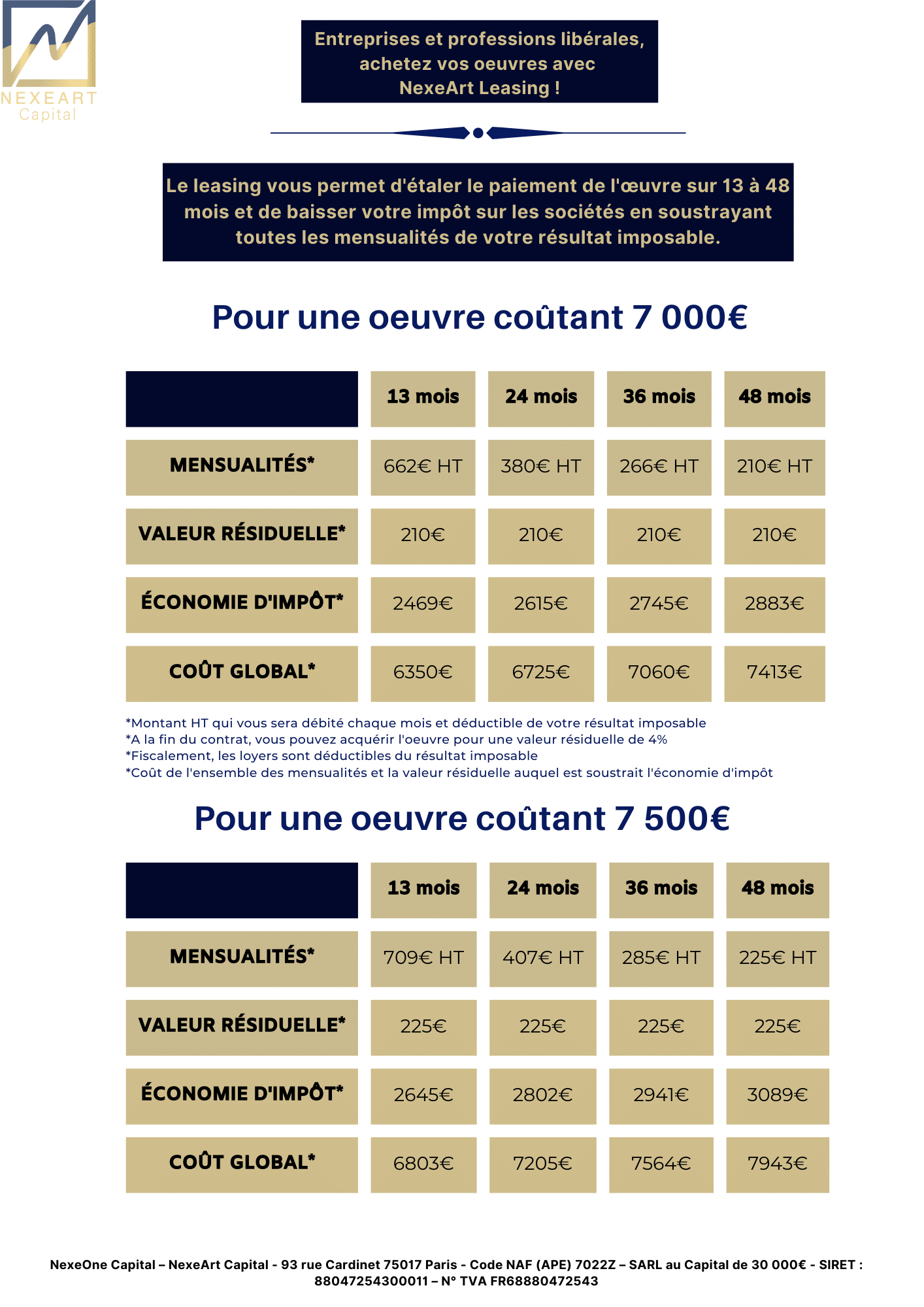

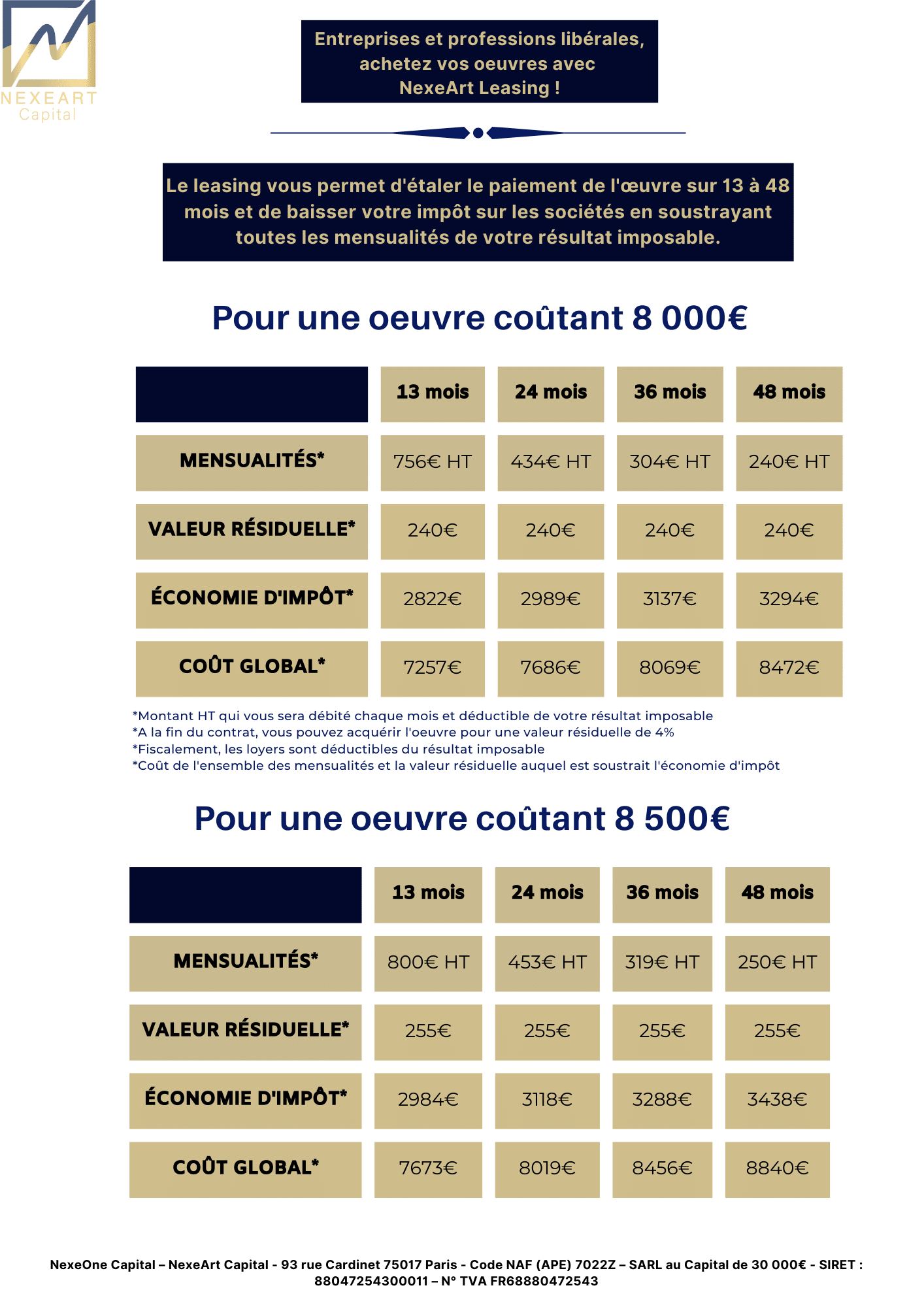

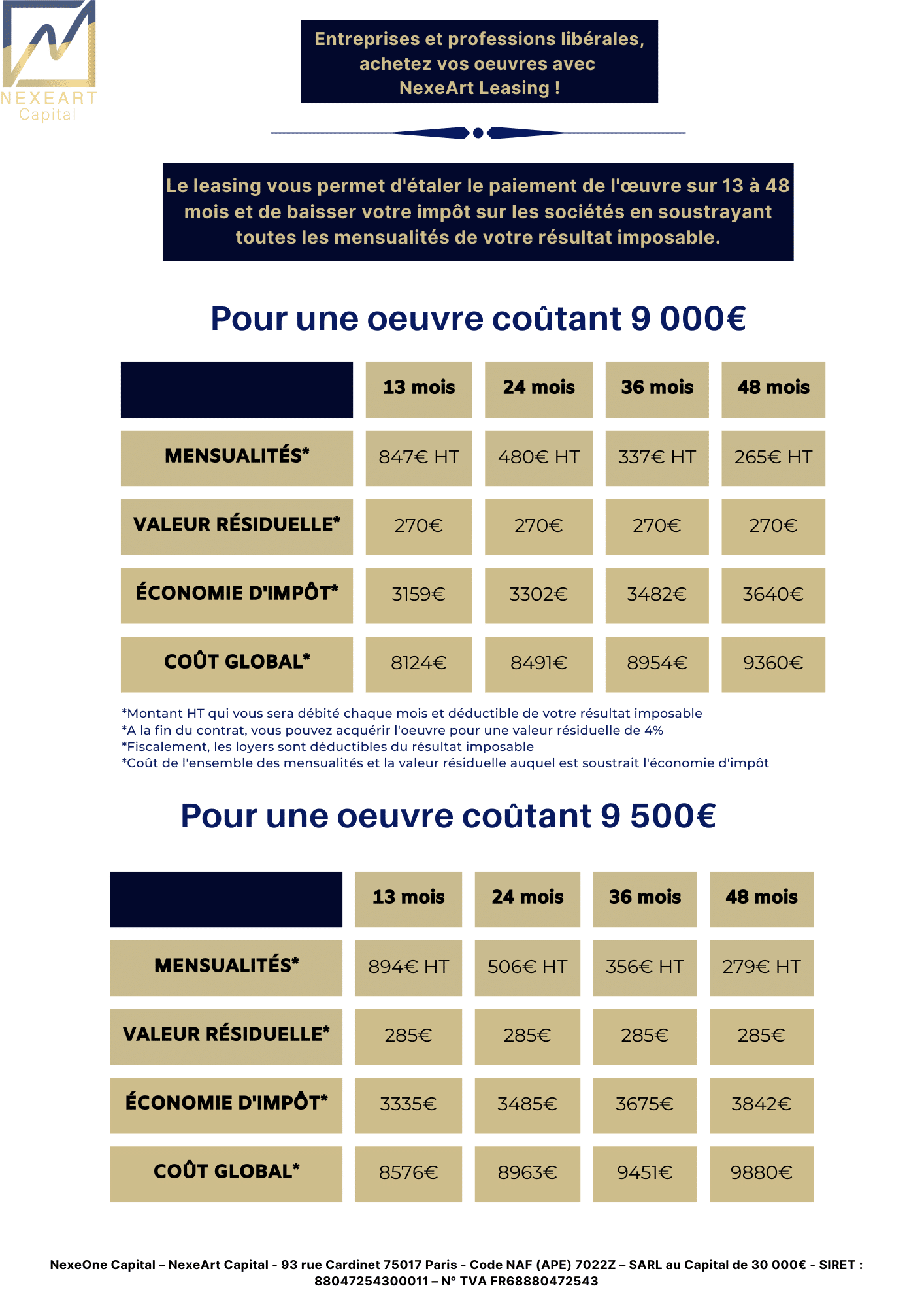

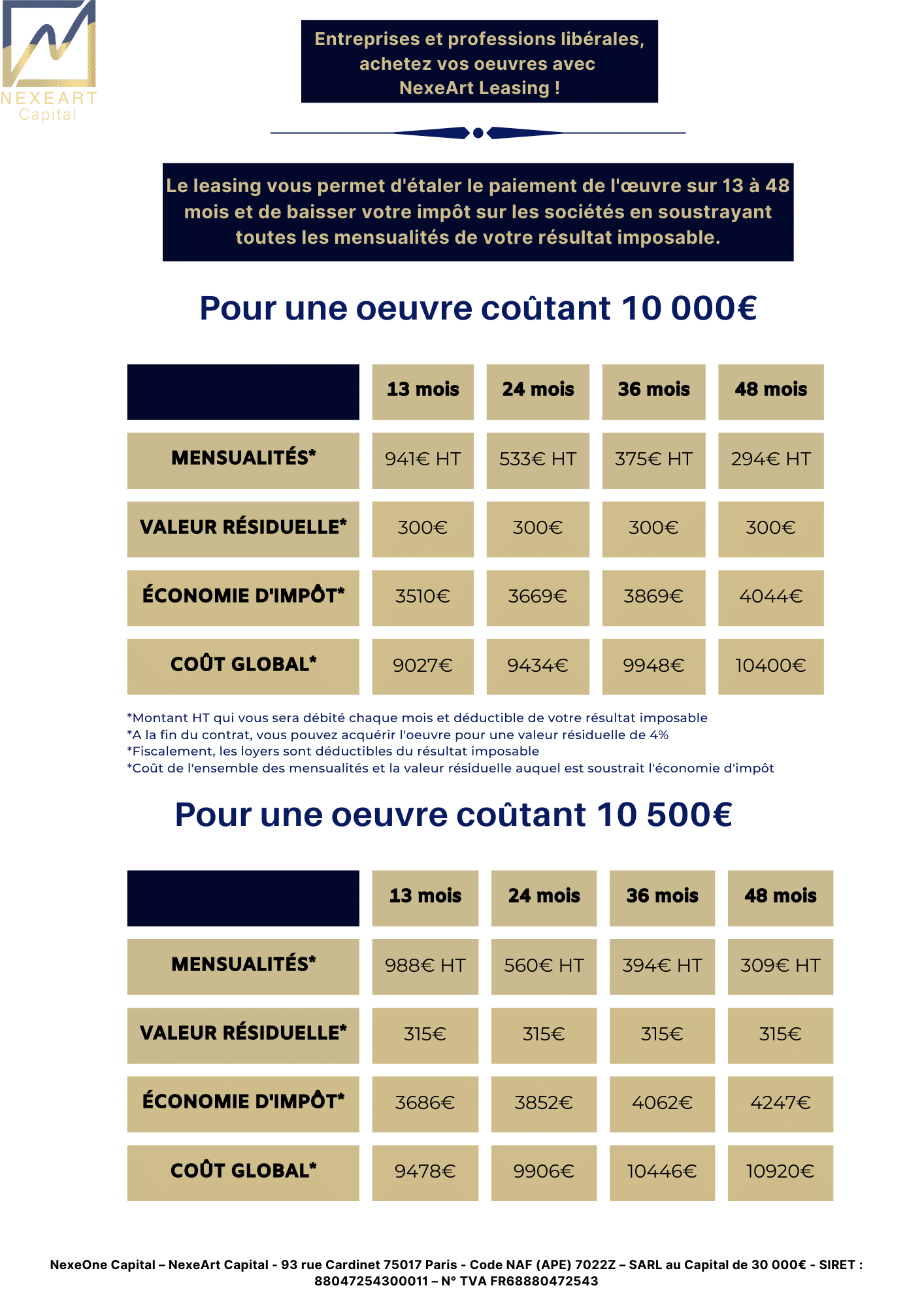

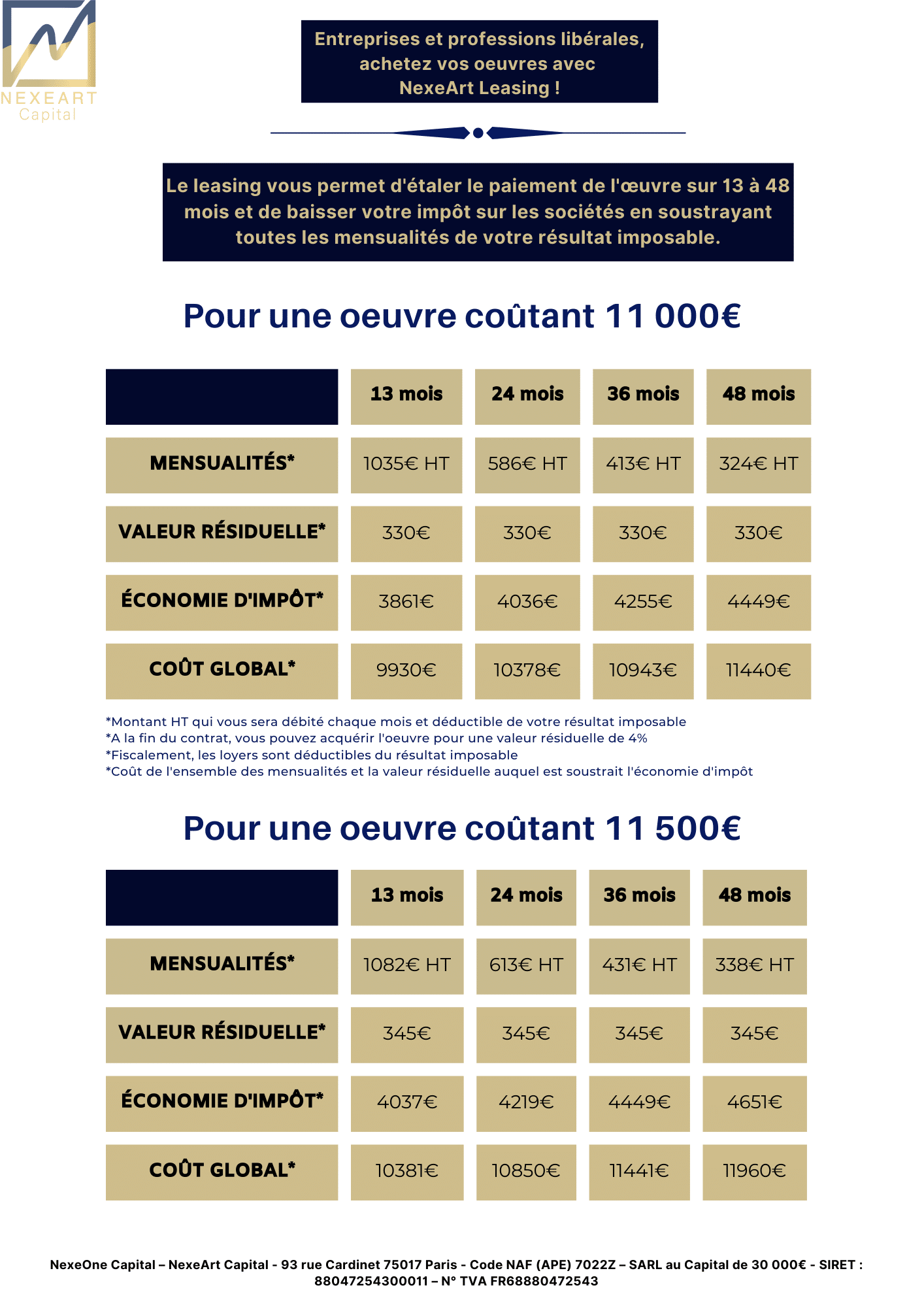

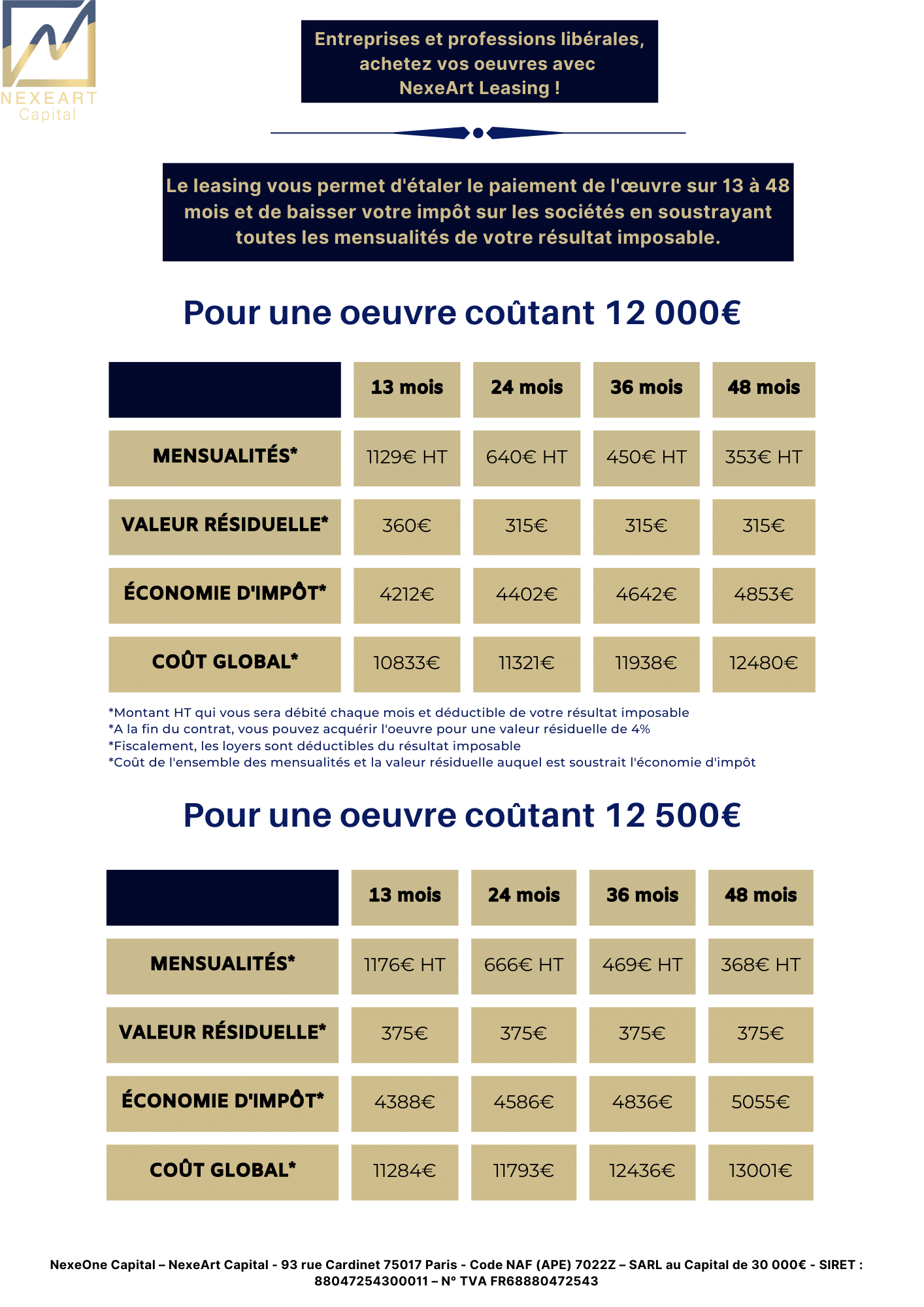

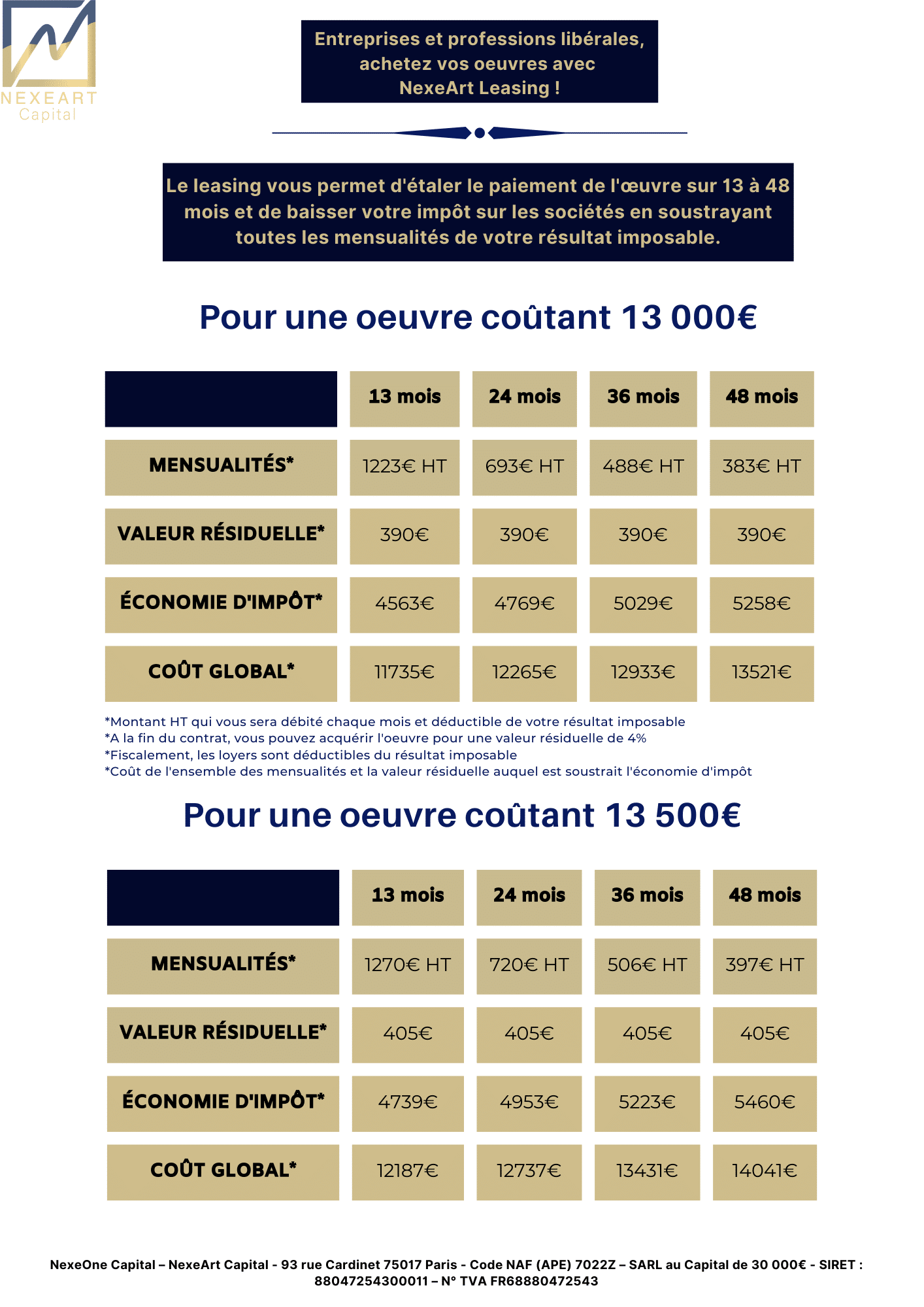

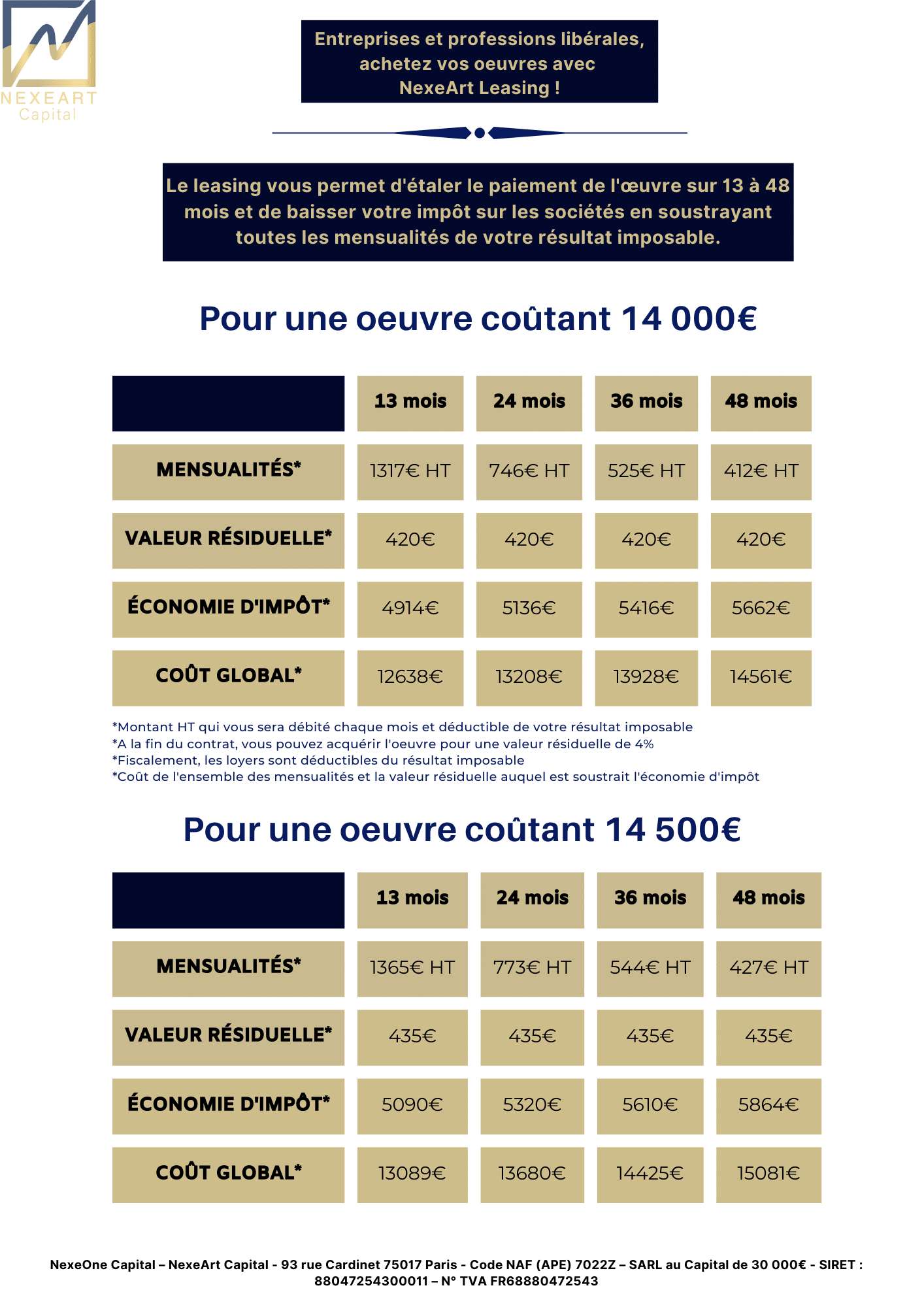

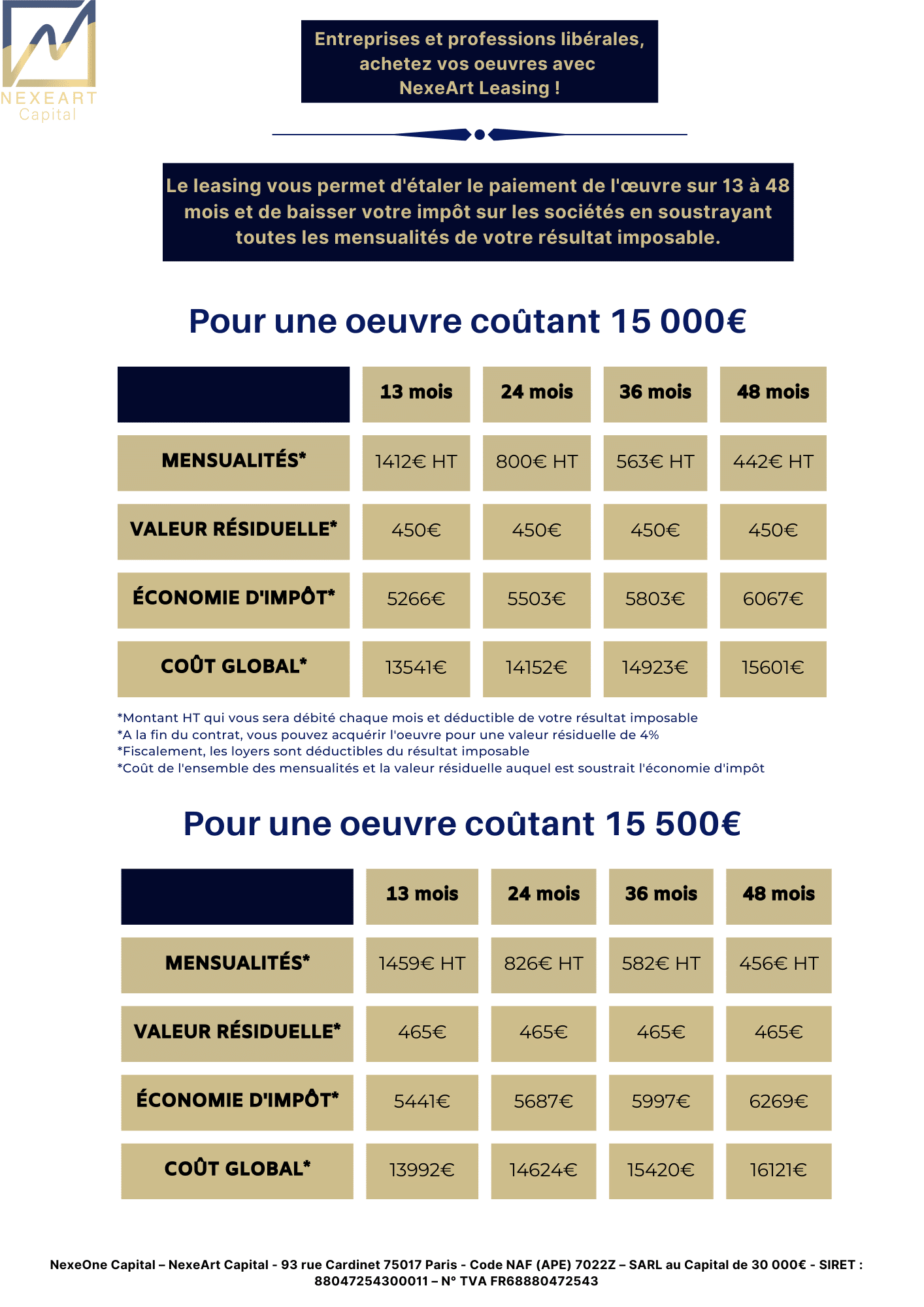

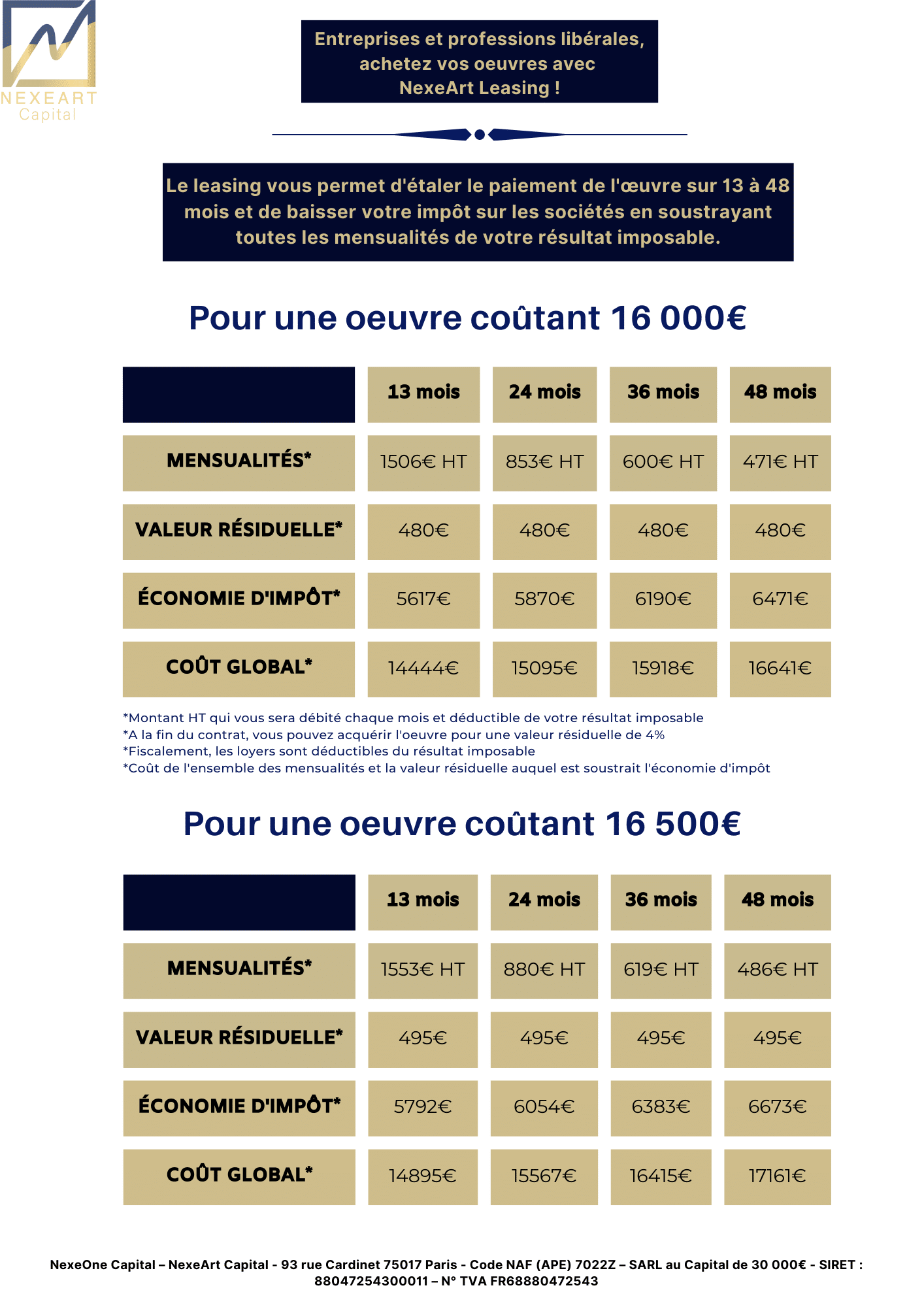

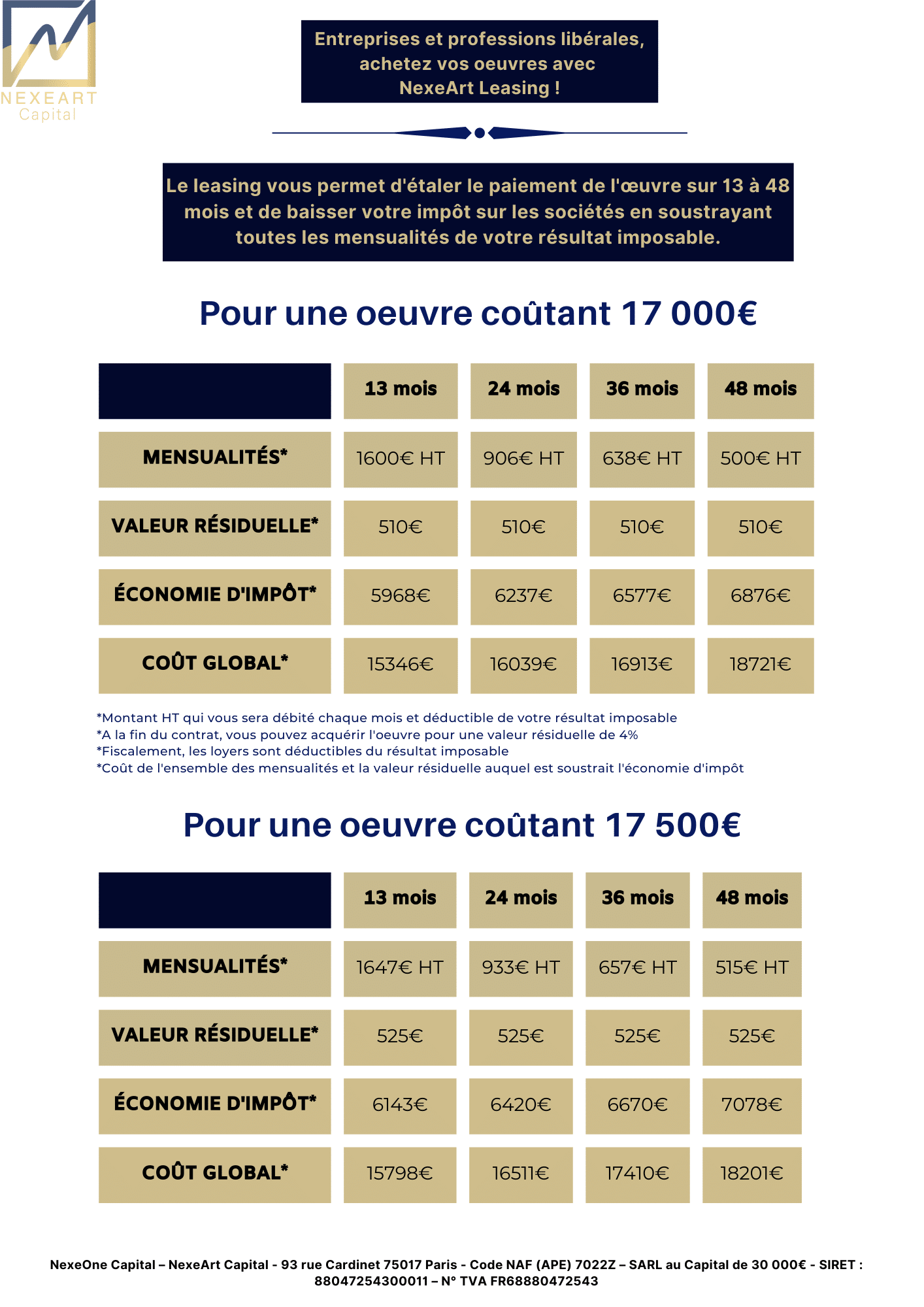

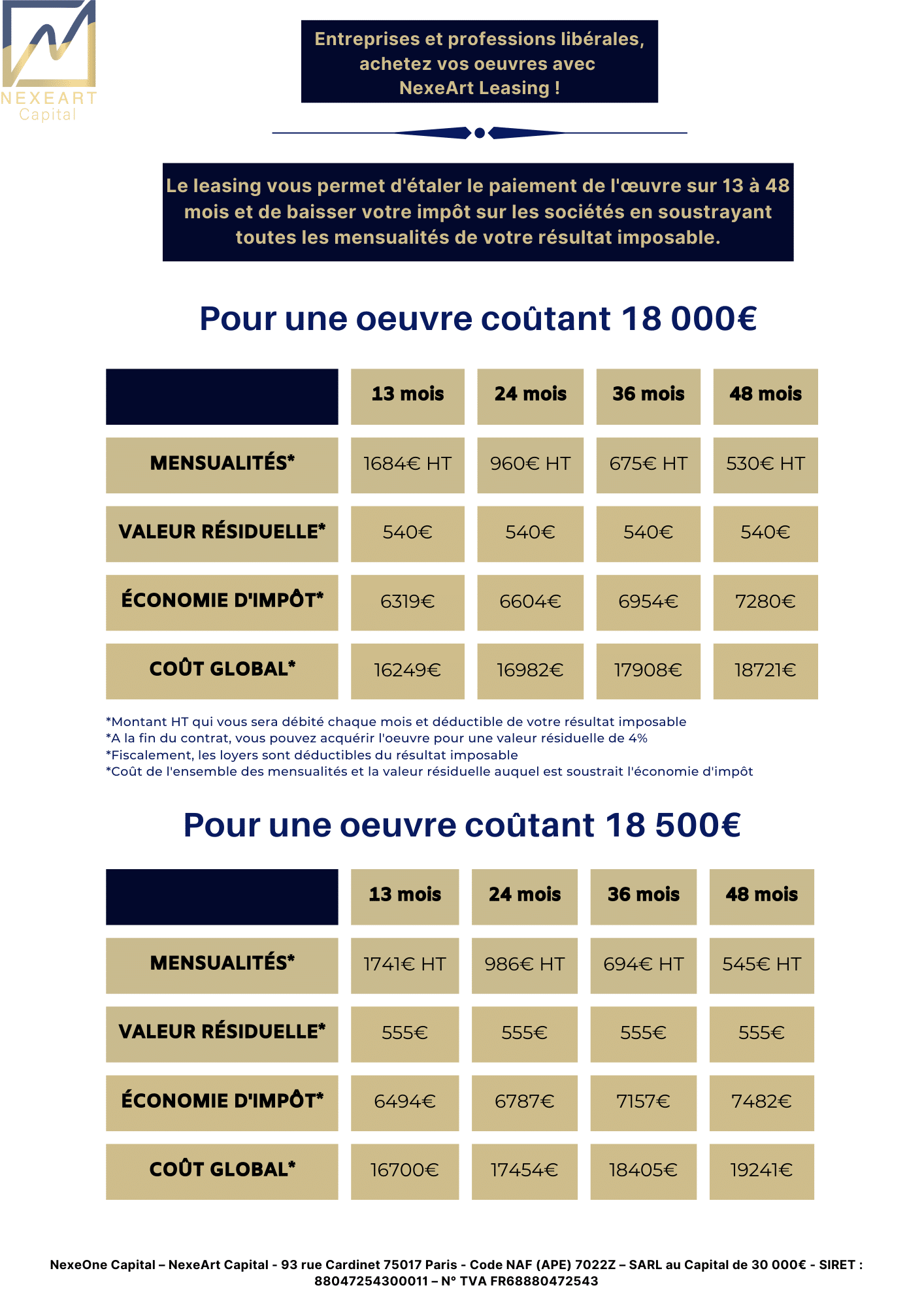

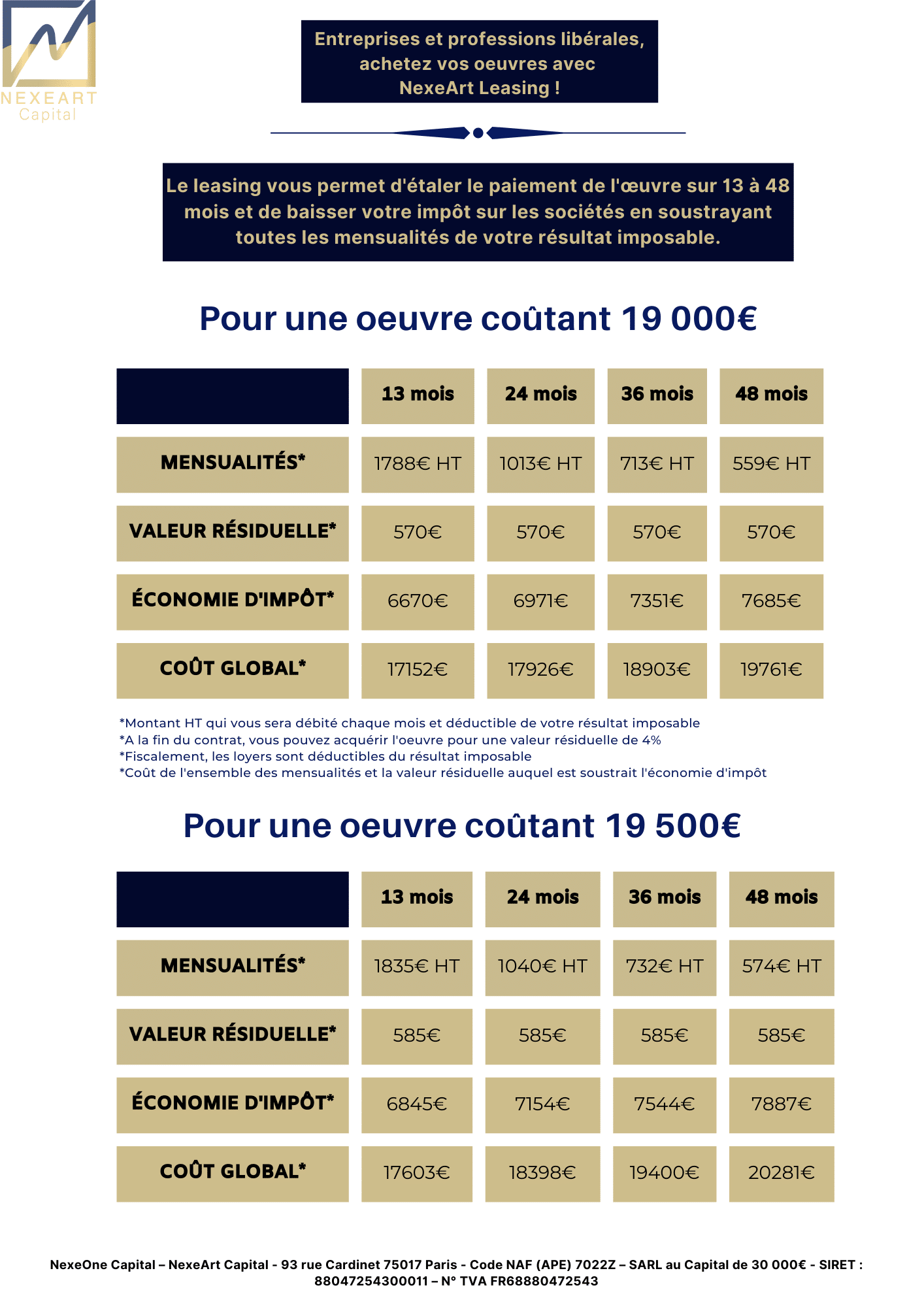

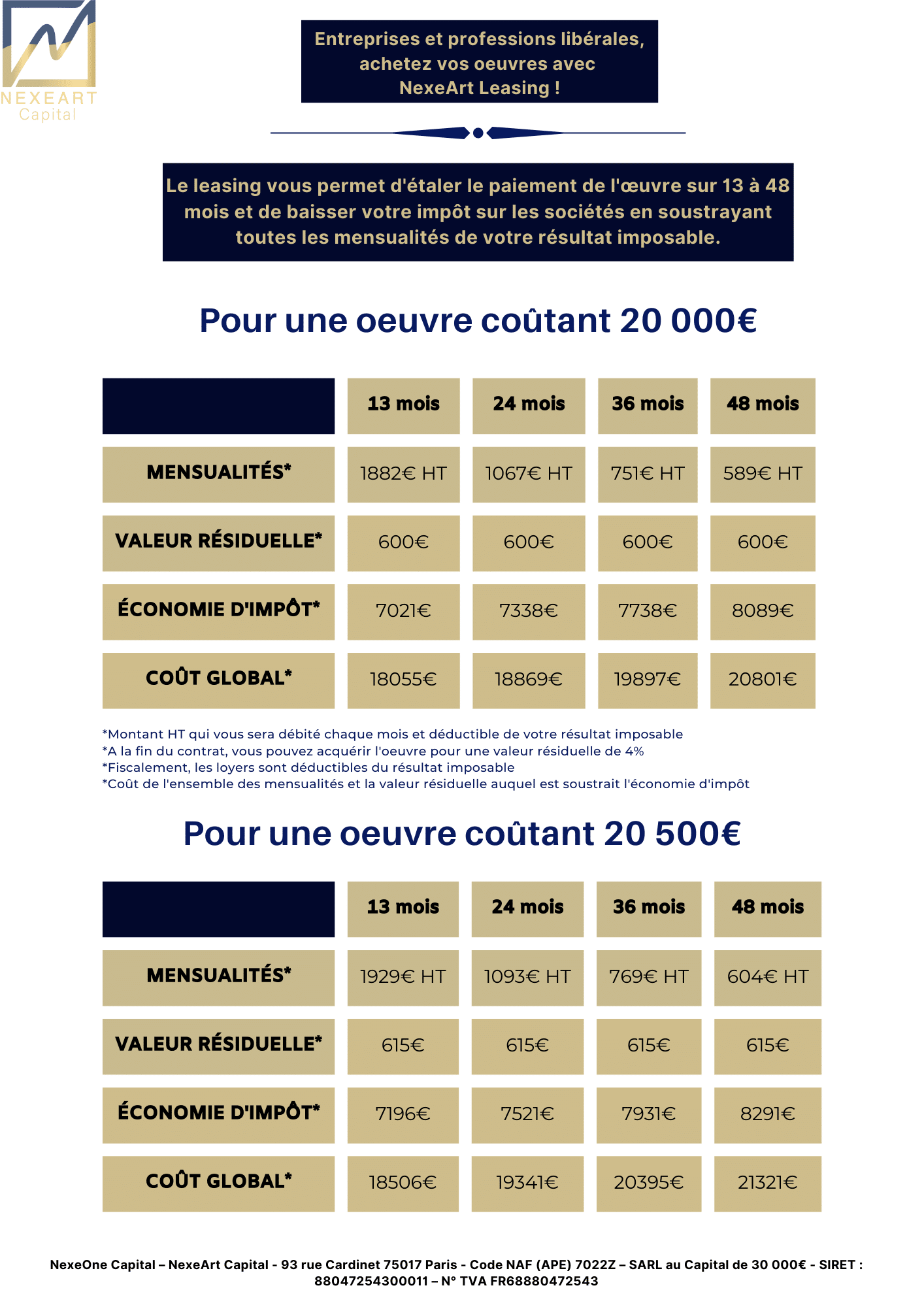

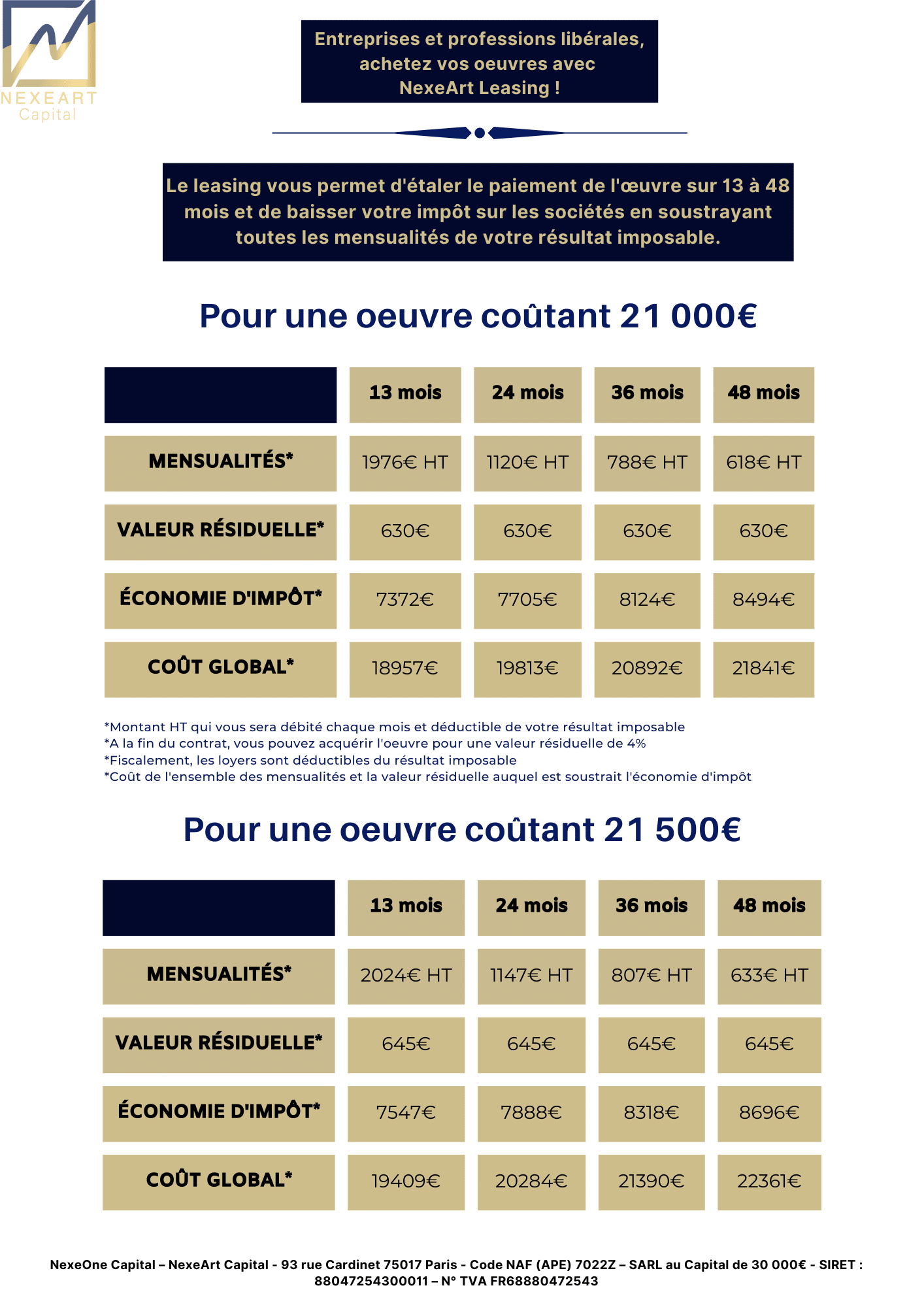

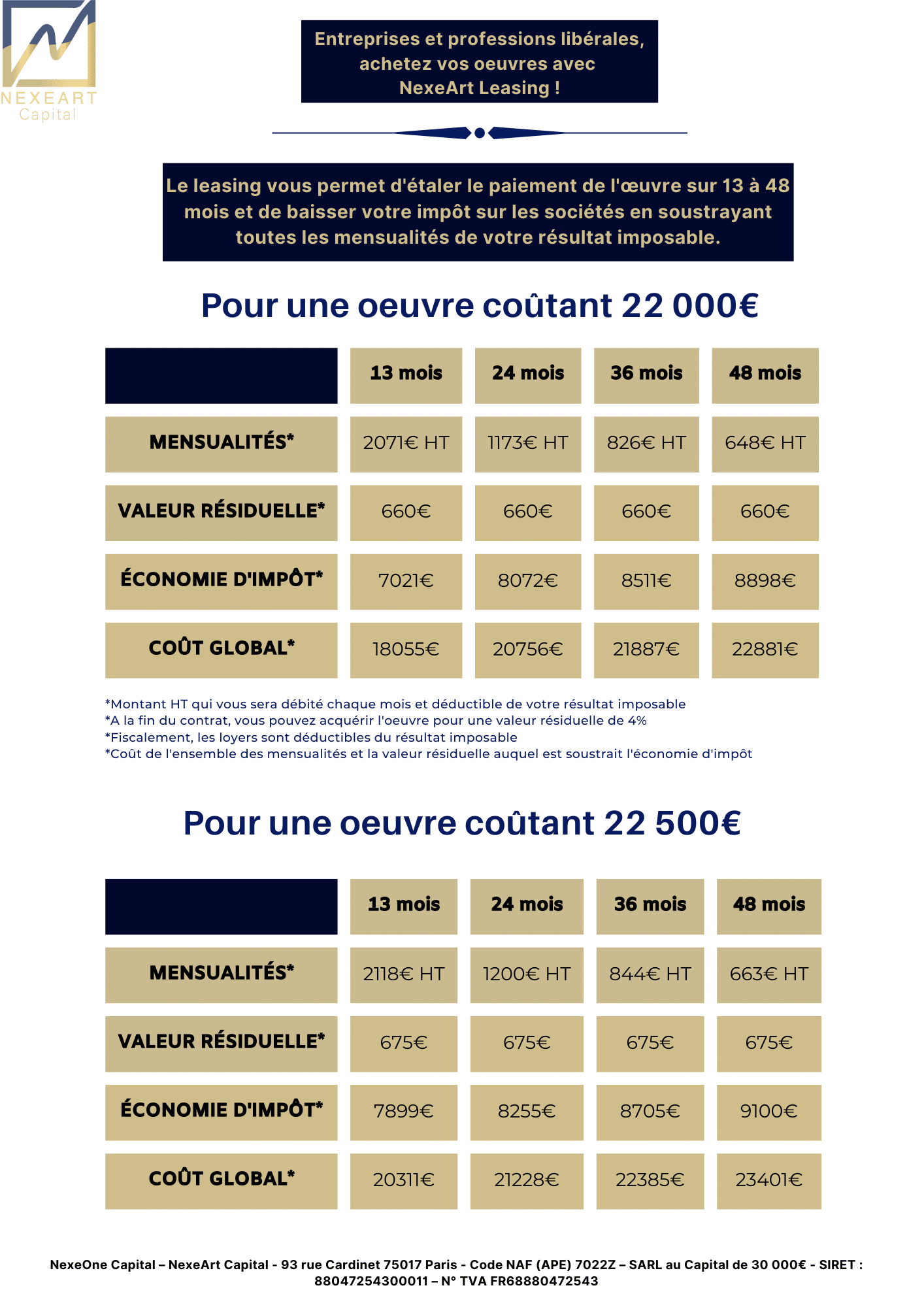

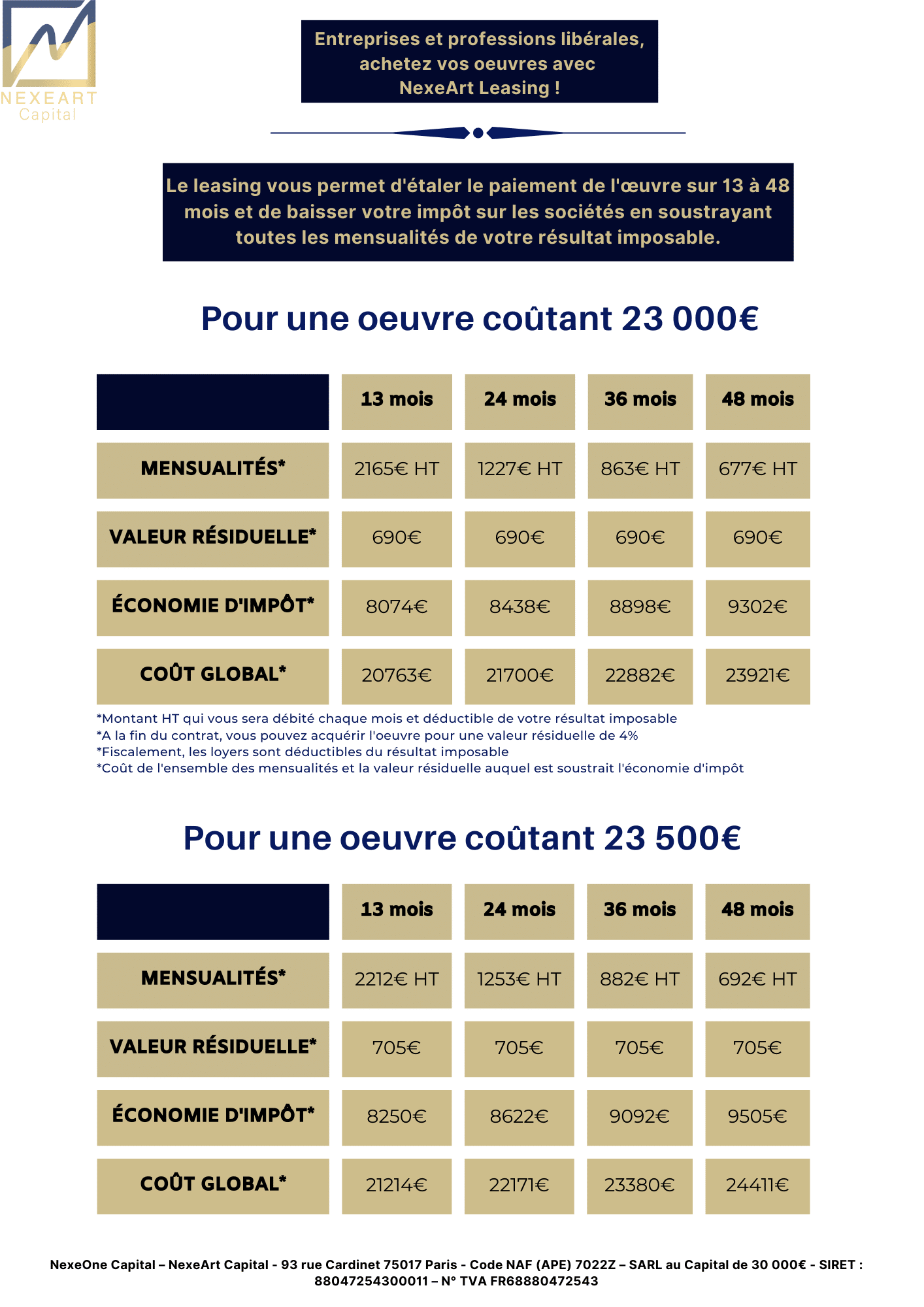

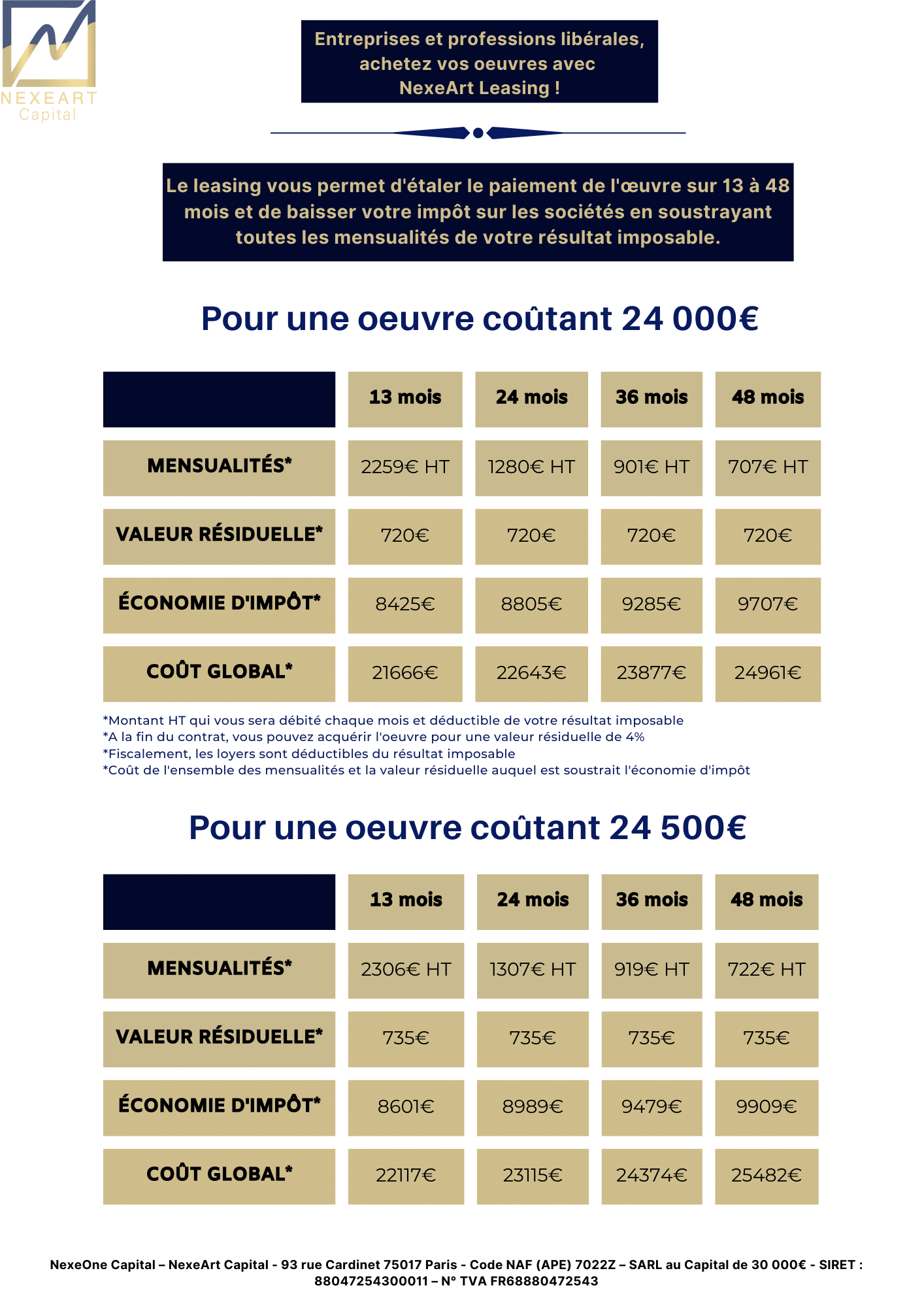

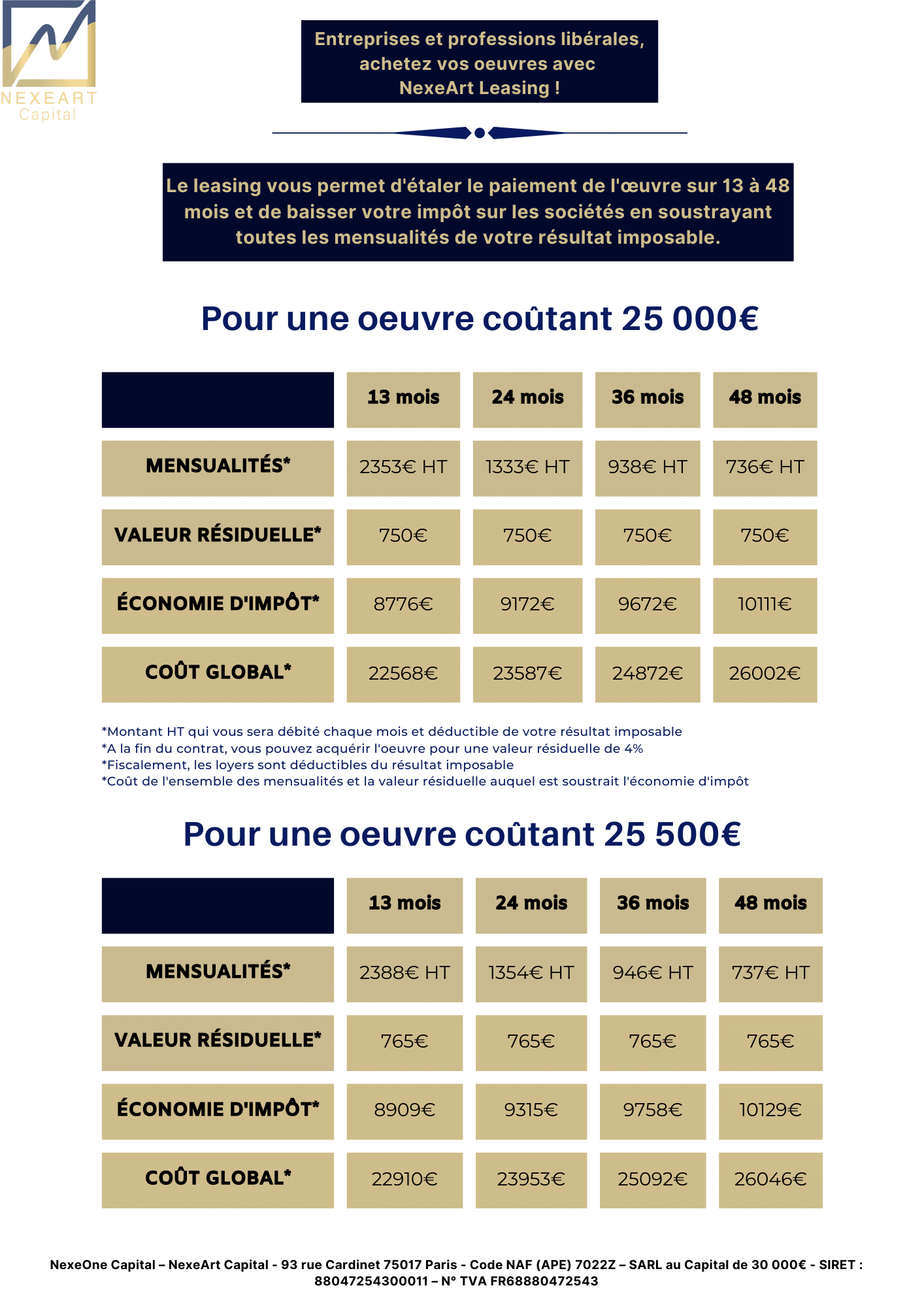

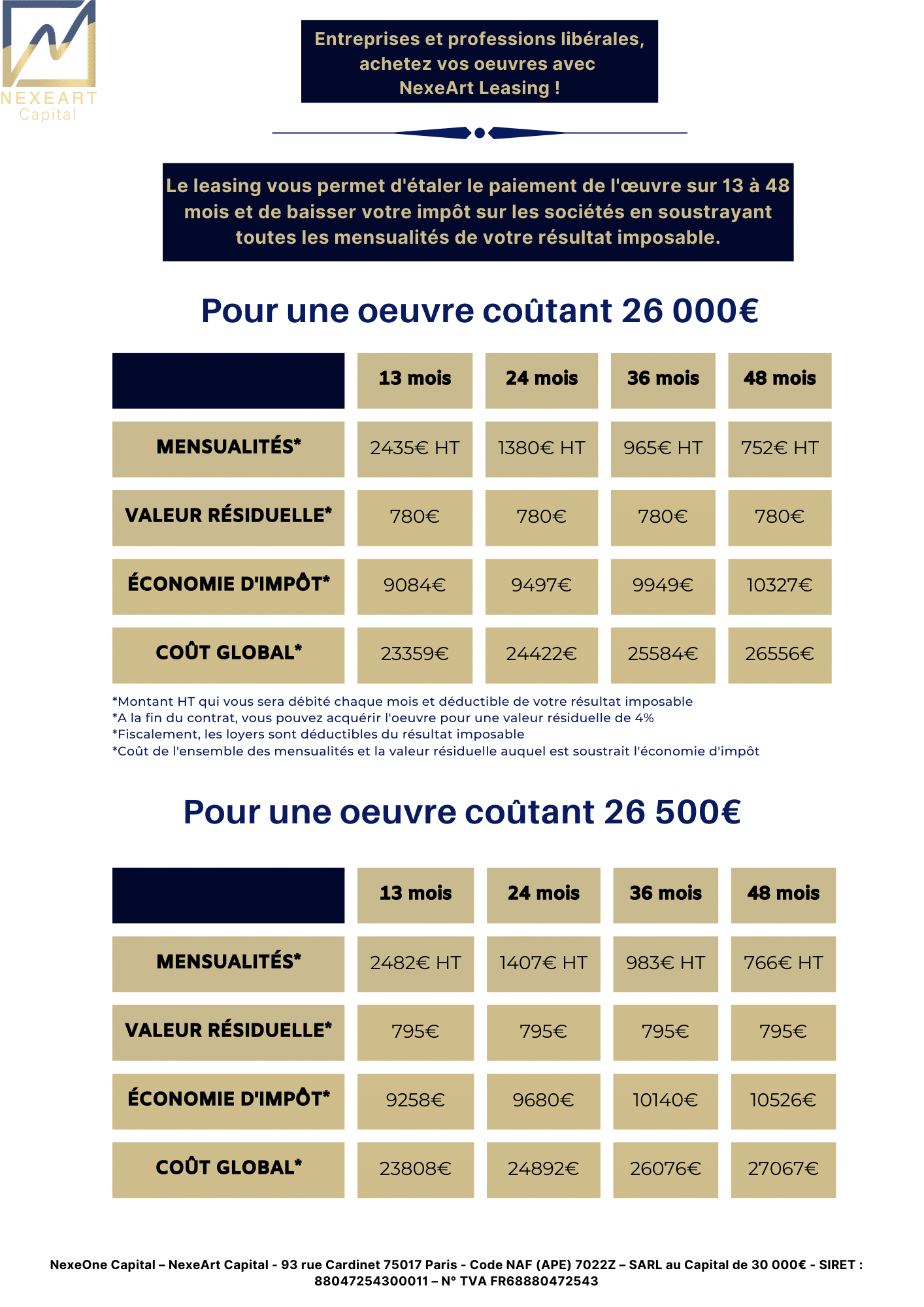

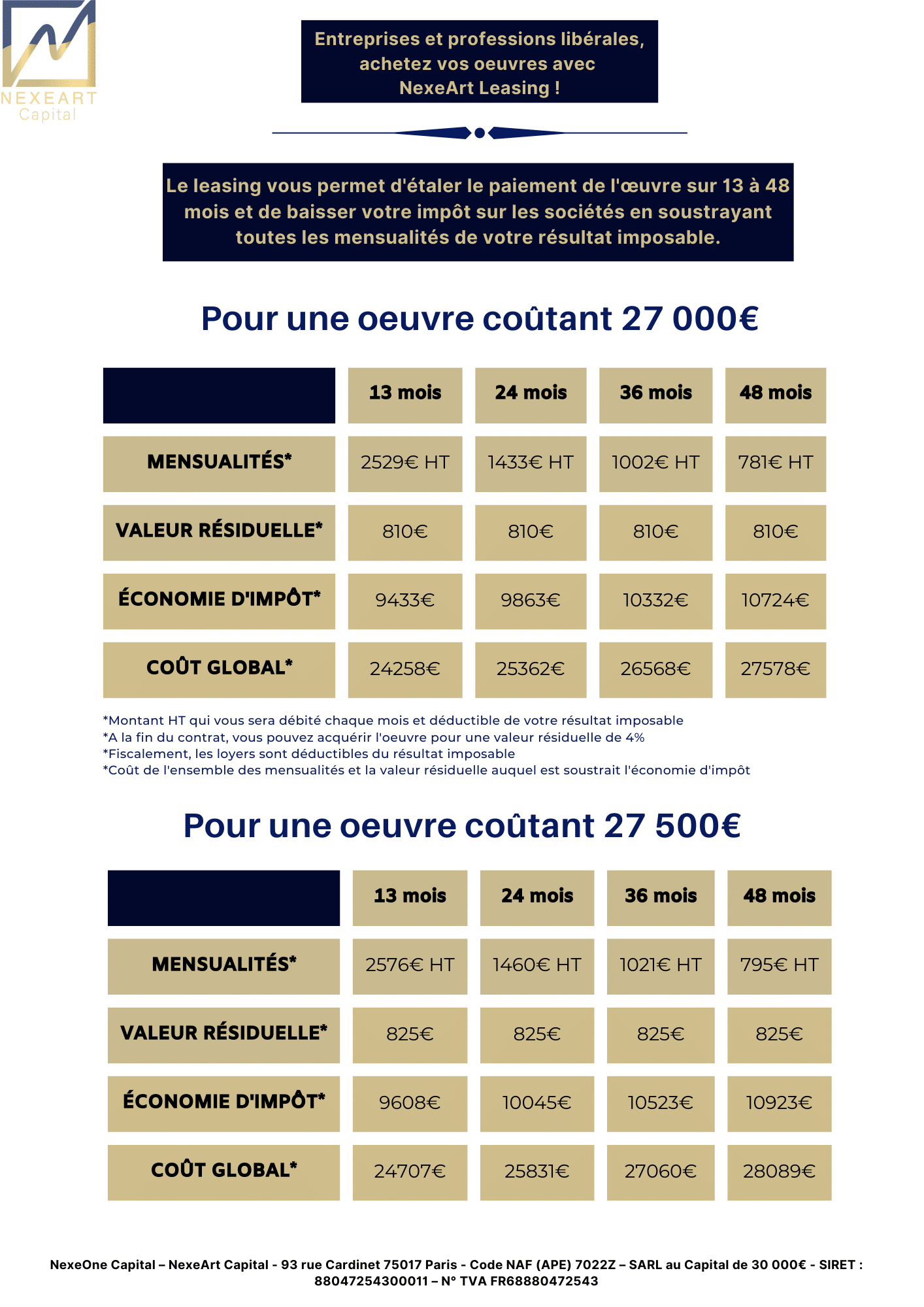

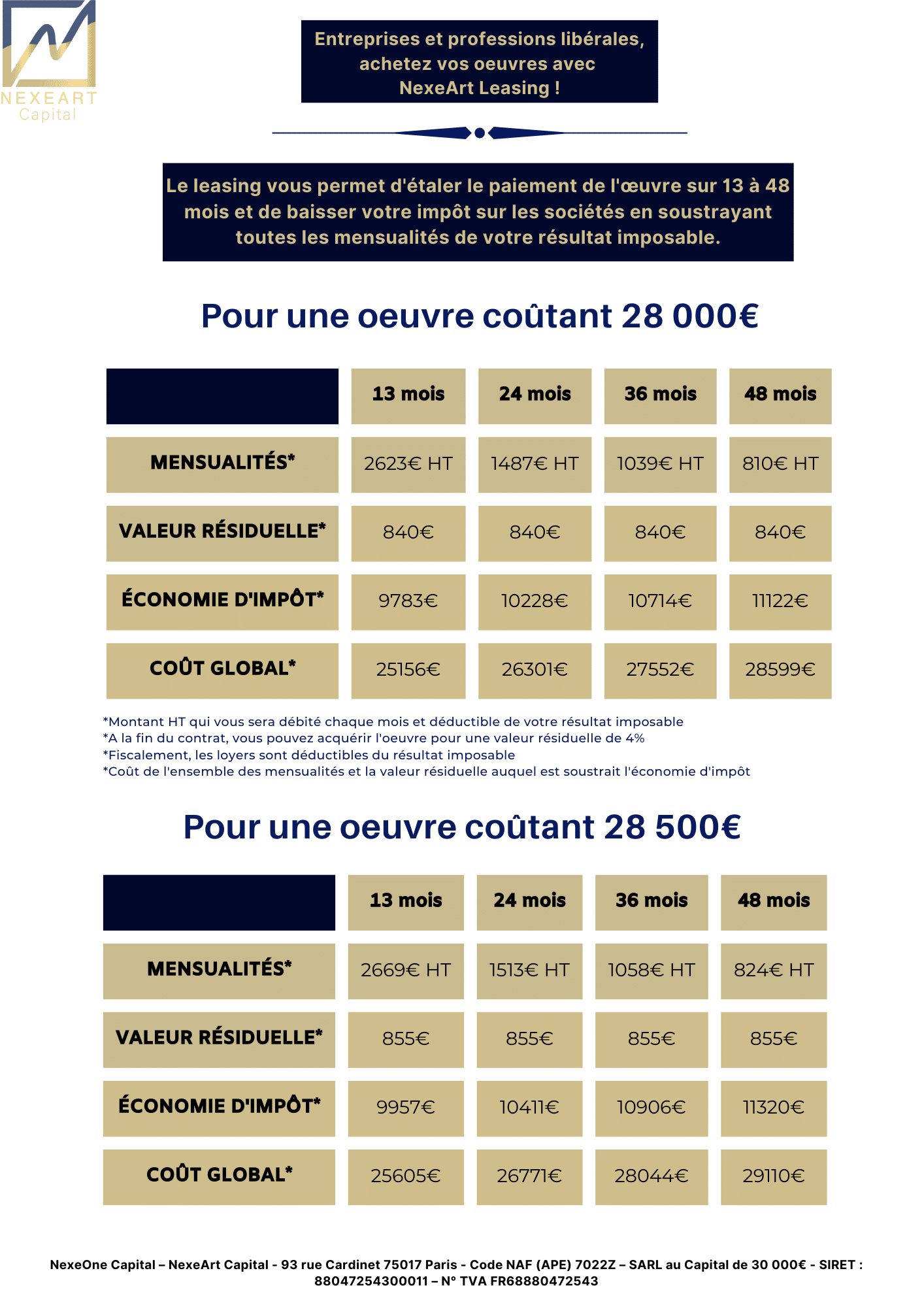

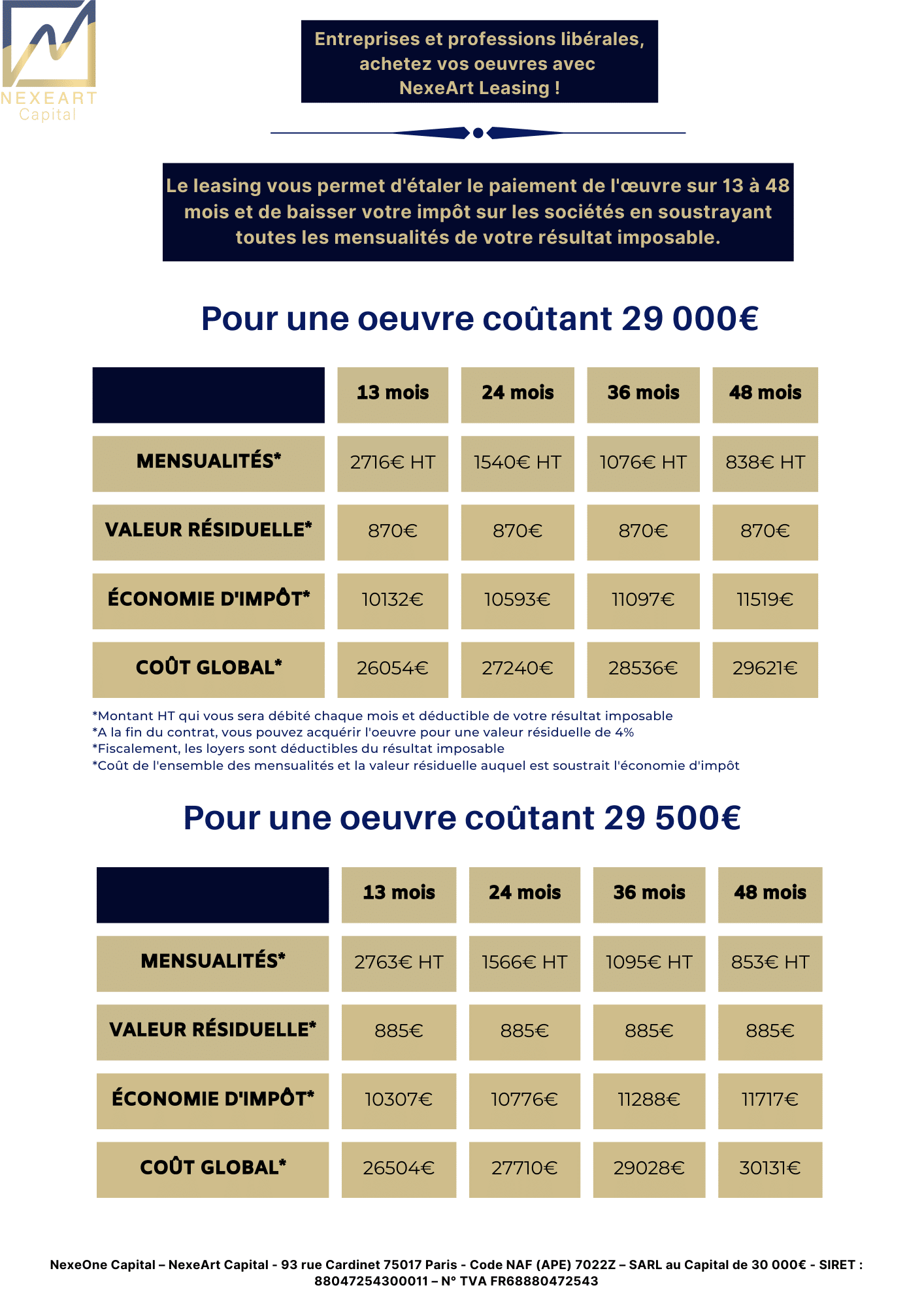

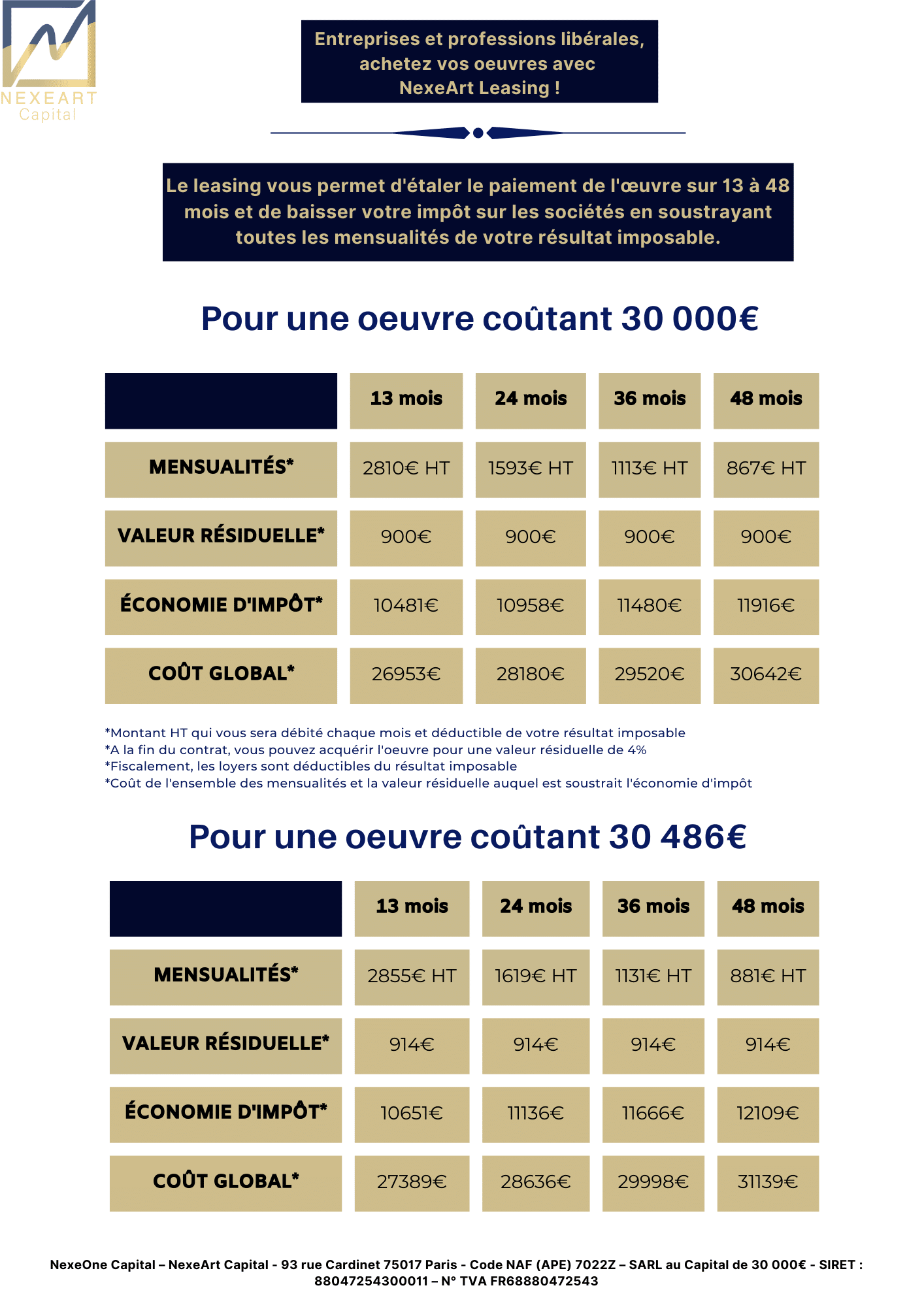

The duration of the contract is variable, ranging from 13 to 48 months.

The work must be visible in a location accessible to employees or customers.

The benefits of NexeArt Capital leasing for companies

For the company, art leasing is a real vector of communication. Displaying works of art in offices and workspaces contributes to :

– embellishing premises and infrastructures

– the development of the organization’s brand image and identity in the eyes of employees, customers and partners;

– employee well-being and the creation of human bonds within the work community,

– access to a diversified culture and the discovery of numerous artists.

While sponsorship imposes conditions on the amounts invested and focuses on living artists, art leasing places no limits or restrictions on the amounts invested.

Tax and art leasing & the law?

The only companies eligible for the art leasing tax deduction scheme must be subject to corporate income tax (SA, EURL, SARL or SAS) or income tax in the industrial and commercial profits

and commercial profits (BIC).

In this way, the cost of leasing works of art is included in office decoration and fitting-out, in account 6068 of the general chart of accounts.

The tax benefits of this arrangement are indisputable, since the leasing is subject to the common law system of expenses deductible from net income (art 39-1 of the CGI), which will reduce income tax contributions.

In addition to this tax reduction (IS or IRPP), among the many other financial and tax advantages of leasing works of art, we can mention:

– the creation of a valuable material asset;

– spreading the cost of purchasing a work over several months or years (13 to 48 months);

– retaining title to the work off-balance sheet;

– smoothing out expenditure and maintaining a high level of cash flow and borrowing capacity.

– Purchase of the work at residual value

Articles 238 bis and 238 bis AB of the French General Tax Code set out the tax exemption conditions available to companies for the acquisition and leasing of original works by living artists.

1. Before renting

The collector chooses his or her work, either freely or with the advice of NexeArt. Our partner galleries can also help you enrich your collection.

2. During the rental

The rental contract can last from 13 to 48 months. Deduct 100% of your monthly payments. VAT is also recoverable.

3. After leasing

The artwork is sold by NexeArt at residual value.

Companies & Professions

DECORATE AND FURNISH YOUR OFFICES WITH ART

Leasing with an option to purchase offers you the chance to bring art into your offices, enhance your business assets and capitalise for the future. It is a financing solution that allows companies to acquire works of art while spreading the payment over a fixed period and benefiting from an attractive financing solution.

- Tax benefits for the company, with 100% tax-deductible rental payments.

- Create a link and a strong image for your company

- Purchase option with residual value acquisition at the end of the lease (LOA)

- Hire of works of art for 13 to 48 months (39-1, PCG 60-68)

- Leasing open to any medium: works of art, photographs, sculptures, etc.

For further information:

In order to benefit from the tax advantages associated with leasing and the deduction of rental payments, the works of art must be exhibited in shared offices and professional lounges that are accessible to the public.

The rental amount must be in line with the company’s turnover.

Consulting

PROFESSIONALISM

CONFIDENTIALITY

As a recognised expert in the art market, Nexeart Capital offers an end-to-end solution for businesses and self-employed professionals, assisting you in all your choices and financing solutions, as well as in the selection and arrangement of works of art, by capitalising on our expertise in consultancy and logistics.

- Artistic expertise and financing of works of art

- First-class financial partner

- Financial advice on investment and acquisition

- Private management of your artistic assets and circularity

- We take care of the transport and logistics of your works of art